Medicare Supplemental Insurance is an insurance product which covers gaps in Medicare Original Medicare coverage, including copayments, coassurance, and deductibles. Most medical insurances offer deductibles of at least $1500.

Medigap plans offer lower deductibles than Standard Plans, but you must pay higher deductibles before your coverage kicks in. The premium for high-deductible plans is dependent largely upon how many premiums the plan offers. Contact us for the details on the high-deductible Medicare plan Plan G.

Medicare enrolling during its annual enrollment period has not always been a simple option. Medicare Supplement participants may modify their insurance coverage for a variety of reasons throughout the year.

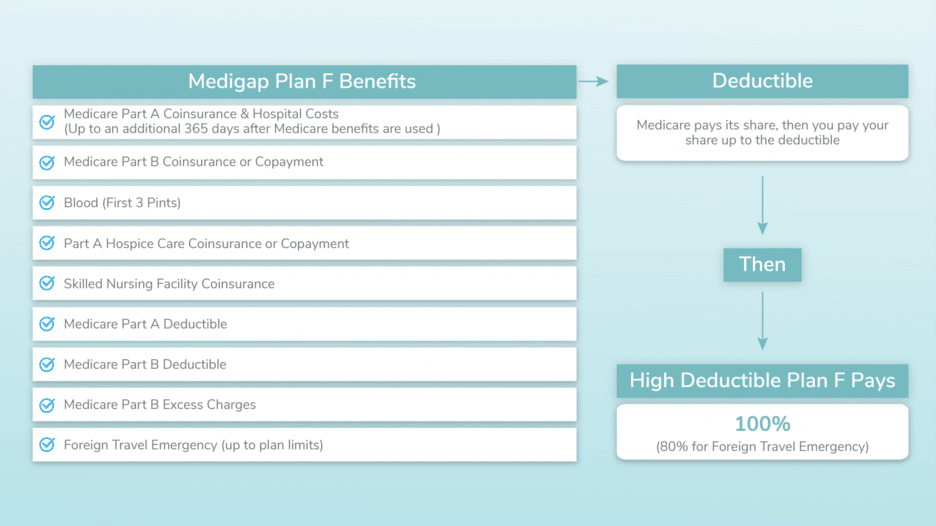

Several of these changes you may suggest to your customers include switching to the high deductable plan, Plan X (Med-Gap). Medigap F provides coverage in the broadest possible range of Medigap Plans currently in existence. With MedigapF, it does not cost more than an additional deductible each year.

Summary: Medicare Supplement plans can help cover health care expenses that were not paid for by Medicare, as well as Part A and Part B. The two Medicare Supplement plans, F and Plan GL, offer a high deductible and sometimes with reduced premiums.

A deductible will cover your medical care before your insurance provider pays their share of your premium. So the higher your tax deductible, the more your benefits will be paid. Find a map of your area quickly!

Medicare Supplements high deduction plan G is the latest standard Medicare Supplements. The Medicare Supplement highdeductible plan g can be an alternative choice for patients wishing to receive Medicare's basic benefits but prefer lowering their monthly premium. Find an affordable Medicare plan today We can assist you in finding your ideal Medicare plan today.

The Medigap plan can have 10 kinds of letter names in all the states. All plans are subject to governmental regulation. Only two kinds have highdeductible variants: plan F and plan G. In Medicare Advantage plans, the Medigap plan cannot be purchased separately.

The Medicare Plan F program does not provide coverage for Medicare enrollees after January 1, 2019 or after this date. Medicare Plan G has the most similar option available for any Medicare beneficiary, but also available as a high-deductible plan. Medigap's standard and deductible versions offer the same benefits - the difference occurs once the coverage kicks in.

Medicare Supplements usually lower your Medicare costs by providing supplemental income to your beneficiaries. These are sometimes called MediGap plans because of coverage gaps left by Medicare. The most common Medicare Supplement plans in the nation come from private providers.

The different types are marked with letters, such as Medicare Supplement Plan A or B. Medicare Supplements help pay the coinsurance or supplemental costs for Medicare Part A or Part B. Certain plan plans will pay Part A/B deductibles, assisted living coinsurance, hospice coinsurance, and many others.

All Medicare Supplement plans require Medicare Part AA and Part B. It is a high deductible plan. Note that when buying Medicare Supplement plans G or X, it will generally occur during the Open Enrollment Period.

The 6-month timeline begins the day after your first month in the Medicare Part B program. After this period ends, you have an option of obtaining Medicare supplement coverage. In some cases, a Medigap insurer will refuse to charge you more for a medical condition. Find out how to access Medicare Supplemental Insurance.

Each health insurance policy must adhere to if a government-funded program is being offered under the Medicare Supplement Act of 1990 or other applicable law. Most insurers only sell you one standard plan that has been identified by letters.

Most policies offer the basic benefits, but some provide extra benefits. Medigap policy differs across Massachusetts, Michigan and Wisconsin. Each insurer decides on Medigap coverages which they wish the company to sell. insurer selling medspap policies:

As of December 30, 2020, Medigap plan sales are not deductible under Medicare for people with Medicare. The ACA will not provide coverage for people who were enrolled in Medicare after January 1, 2020 if they were not previously eligible.

Those that already hold one or both of these 2 plans or the higher deducted variant of plan F are eligible for a new plan after January 1, 2020. Depending on whether or not you qualify for Medicaid and haven't enrolled yet, you could purchase a new plan.

In 2022 the excess fee would reach $662. 3310 in 2022. * Plans A and G also offer a highdeductible plan in a few states. If you are eligible for this program, the cost of a Medicare-approved plan will increase by up to $2,000 by 2022. Plans C & F are not accessible in any case for people newly eligible for Medicare before January 1, 2020. ** During plans K & L a plan will reimburse the Medicare Advantage if your deductible reaches the annual maximum.

This chart illustrates the basics regarding the benefits covered by the medical insurance program. The Medigap policy covers just after you have deposited the amount (if the Medigap policy includes the payment of the premium).

There's a difference between Medicare Supplement High Deductible Plan F and Medicare Supplement Low Deductible Plan G. Because Medicare Part B deductibles apply to the high-deductible of the plans, it is basically similar to this program. Tell me the best? The most affordable health insurance is the one that offers lower monthly premiums. Please note that Medicare Supplements Plans F is now unavailable for all new Medicare patients. Find the best Medicare plan online.

If you get Medicare Supplement insurance, you can select between the different types labeled A to N for the plan types. ) Each health-saving Medicare plan under the same names has its own standard plans. Medicare Supplements Plan G provides similar basic benefits, regardless of what insurance company offers you this plan. Premiums on this plan vary. Standard plans may simplify comparison of Medicare supplement programs. Most Medicare Supplements offer basic benefits.

The premium and the premiums are the main cost for Medigas. The deductible is a legal rule and will be the same for all of us: $2490 in 2030. Part B is deductible and the costs shared with the company apply to high deductibility. Premium rates differ amongst people. Medicare's health care system determined prices based mainly on factors like the number of people a patient can have.

Medicare's annual deductible is $2,000. The deductible helps to maintain a lower premium on these plans. Alternatively, a standard Medicare Supplement Plan GS could provide the most suitable option for your needs.

Medigap plan is cheaper and has higher deductibles than a standard plan unless your premium is lower than a regular plan.

In order to meet your Medigap deductible, in the case of a higher-deductible Medigap policy, you will need to compare prices and decide what is most effective. The lower deductible variant must outweigh the costs associated with meeting the deductible in some cases to be more attractive.

Medigap plan benefit kicks in after the premium is $2,500 in 2020 and is set to rise in 2019. These are split by 12-month period, and the cost is $27.99 / month. A highlydeductible policy should be at least $25.60 per month less than standard plans, so that you can pay a smaller premium total.

Summary: All Medicare Supplemental Plans F and G have high-deductible options. In addition, the Medigap Plan J was available with high deductibles prior to June 2010. Plans f is available only for people enrolled in Medicare before January 1/2020. The high-deductible variant is available. Oct 30th 2022.

What is the most common type of medical coverage? Medicare Part A and Part B cover 90% coverage after you meet the deductible. Medigap Plan F and C pay the rest 80% so it'll be cheaper. 13th of October 2022.

Before June 1, 2010, Medigap Plan J could also be sold with a high deductible. The high deductible version of Plan F is only available to those who are not new to Medicare before 1/1/2020. High deductible G is available to individuals who are new to Medicare on or after 1/1/2020.

Find the right Medicare Supplement Insurance plan Because Medigap plans are standardized, you can get precisely the same Medicare benefits from any company offering the plan. So when you shop, keep these considerations in mind to find the best policy to fit your needs: Is your preferred plan available? Health insurance companies don't always sell every plan, so check who sells the plan you want to buy in your area.

A high-deductible Medigap plan is more reasonable than a normal plan if your deductible is lower and your premium is cheaper than a standard plan. 26 avril 2020 - 2025.

CMS updates the deductible amount for plans G, F and J each year, after release of the August Consumer Price Index for all Urban Consumers (CPI-U) figures by the Bureau of Labor Statistics, which generally occurs in mid-September.

$2490. *Plan F and E also offer statewide deductibles. In 2024, your insurance company will pay your premium up until your deductible is paid; Until then your policy will pay your premium.