Almost 250,000 people in the US depend on Medicare to cover healthcare. Medicare beneficiaries are entitled to receive benefits (Part B) via traditional Medicare or enroll under a Medicare Advantage plan. Parts A and B of Medicare offer the same health benefits, and often provide supplemental benefits like dental and vision and typically provide prescription drugs. Many Medicare patients have also relied on alternative sources for coverage.

Medicare Supplement Insurance is Medicare Supplement insurance that helps cover gaps in Medicare coverage. This policy sells through private firms. Medicare provides most, but not most, coverage for medical costs and supplies. Some Medicare plans cover services the Medicare does not provide such as medical care while traveling outside the United States.

These reductions must be adopted by December 23, 2011, to avoid triggering $1.2 trillion in automatic across-the-board federal program cuts over 10 years. What's The Debate? Policy makers and economists who support limiting supplemental coverage believe that such a step may deter Medicare spending that is of limited value, even though it meets the program's standards for being considered "medically necessary."

Medicare recipients receive no payment for most preventive services provided by a doctor or other provider in Medicare (also called acceptance ad hoc). For preventive services, a Medicare enrolled person pays no fees and may be forced to pay co-insurance for the visit. Medicare provides a physical examination for a new Medicare patient every year after the new Medicare payment date. Welcome to Medicare is a single-time assessment of your health, a comprehensive education and consultation on prevention services and referrals to additional health care services if necessary.

The ability of insurance companies to impose pre-existing condition exclusions has been severely constricted since the enactment of a federal law called “HIPAA.” Under HIPAA, if an individual had health insurance coverage for a period of at least 6 months prior to their initial open enrollment period for Medicare, no pre-existing condition exclusion may be imposed.

Medicare Select is a Medigram type of policy that requires insureds to use specific medical centers or in certain cases, special physicians. Medicare Select policies should meet most conditions of a Medigap plan apart from the restrictions for medical facilities. The Medicare Select policy can lower premiums due to that requirement. The Medicare Select network of hospitals and providers pay their share of the fees approved by Medicare. The insurer has the responsibility of providing all supplementary coverage under Medicare Select policy.

Current or recently enrolled Medicare patients, including people with Original Medicare, can view current coverages for health care and prescription drug coverage and compare plans for their local region. It's the time Medicare eligible persons may sign up to Medicare Part D or Medicare Advantage plans. Medicare users can review and compare their plans against their new Medicare Part B plans. This resource is useful for comparing plans.

The Medicare Advantage Program is supervised through the Centers for Medicare and Medicaid Services. Please visit CMS Medicare' website for details of what plans you can purchase or for information regarding the benefits or yearly premiums.

Medigap plans, they include: Medicare Advantage Plans (like an HMO, PPO, or Private Fee-for-Service Plan) Medicare Prescription Drug Plans Medicaid A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

People enrolled in traditional Medicare programs have incurred significant outgoing costs. Part A of Medicare requires deductible payments for inpatient treatment such as hospitalization. In 2011, a typical hospital deductible is $1132 per incident or occurrence of sickness. For hospital stays exceeding 60 days patients must pay some of these days' costs, this type of coverage is called coinsurance. In Part B of Medicare the beneficiary has to contribute a deductible and a medical treatment plan.

Medicare has remained a part of the US federal budget. As policy makers seek to analyze Medicare spending, policy makers should focus on the impact of additional Medicare coverage, which includes the impact on coverage in the form of supplemental Medicare coverage. This coverage has been known long before. It was called moral hazard.

New York State regulations require that every insurance agent who provides Medigap insurance must accept a Medicaid enrollment application. Insurers may refuse a Medigap plan if it is deemed to have no medical condition or health benefits. But eligibility for policies offered in groups is restricted to persons that were part of the organization to which they were issued.

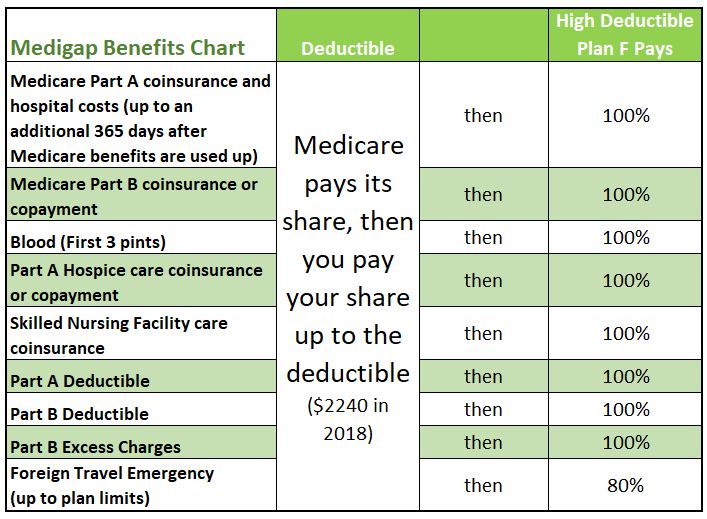

Many Americans who are eligible for Medicare supplemental insurance coverage known as medgap buy it separately. These policies offer financial protection for most of what Medicare doesn't provide - eg paying for a Medicare deductible or other copayments. Most Medigap programs prevent Medicare recipients from paying nearly anything from their account. It's called a first-dollar policy.

Policymakers believe such an approach could deter the government from limiting supplemental insurance, even though the program has the standard criteria for medical necessity. According to these authors, much more of the increased use for Medigap services goes directly into nonmedical services and especially those where doctors and patients have discretion over the provision of care. In such an environment patients are rewarded for providing or receiving more medical attention despite the fact such care is not significant extra.

Medigap policies cover only a single person. When a couple want Medigap coverage they must purchase the other. Medicare is aimed at helping patients with medical expenses, and Medicare Part B is intended for people in need of health care services.

This exam is covered once every 12 months. Medicare Supplement "Medigap" Insurance Medicare Supplement (Medigap) insurance is health insurance sold by private insurance companies to cover some of the "gaps" in expenses not covered by Medicare. For policies sold before June 01, 2010, there are fourteen standardized plans A through L. For policies sold on or after June 01, 2010, there are 11 standardized plans A through N.

Original Medicare provides part or all of the coverage. A Medicare Supplemental Insurance policy is available that helps cover the remaining health care expenses, including copayments. Coinsurance.

People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, if they decide to enroll in Medicare prescription drug coverage later. , and you may pay more if you join a drug plan later. If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments.

Medigap pays for a portion of Medicare - covered costs - and that is all done automatically. Medigap helps you get the most affordable medical care. This process is done automatically – most often without input from you – so the Medigap policy is implemented.

These protections were required nationally for commercial insurance plans under the Affordable Care Act but were not extended to Medigap plans. Additionally, in most states, even if an enrollee with a preexisting condition such as cancer does enroll in Medigap, they might not be able to receive any benefits to cover this condition during the first six months of enrollment.

The Medicare cost-sharing program covers 10 different standard policies in most states and includes a wide assortment. Find out if your medical care is not covered by Medigap coverage.

You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium.