There are currently 12 different Medicare Supplement plan options available to most Medicare recipients in 2019. This simple comparison chart will help simplify your comparisons with these plans faster and more efficiently. How do I search out Medicare plans?

Make sure that Medigap plan A isn't confused with Medicare Part A. Original health insurance - Medicare Part C, the hospital-based health coverage and Medicare - Part B, provides for outpatient physicians. Medicare Part B. MedigAP plan A and plan B provide additional coverage covering the losses that Original Medicare has left behind. No matter what Medigap plan you select, your health insurance coverage is available to anyone who accepts Original Medicare in all states and in all of America. A Medicare-approved doctor won't be turned off by your carrier or Medigap plan if your plan has been selected.

The Medigas program is available for enrollment anywhere during the year. However, it's best if you are starting enrolled in the Supplemental Medicare program at the end of the enrollment period. In some cases, the carriers will not offer coverage. You can enroll in a Medigap program that suits you the best. You may miss a Medicare Supplement enrollment date later on. Medigap enrollments are offered to beneficiaries throughout the year. There is only one requirement: An applicant must answer the medical questions of the insurance company in every one of the states.

Medicare Part D Medicare Part D Costs Medicare Part D Enrollment Periods Medicare Part D Eligibility SilverScript Donut Hole FAQs Top 5 Medicare Part D Plans Best Medicare Supplement Plans Top 10 Medicare Supplement Insurance Medicare Advantage vs Medicare Supplement When to Apply for Medicare Medicare Plan F vs Plan G vs Plan N About Us In the Press Contact Us Get Rates Close Original Medicare Medicare Parts. If you would like to change your Medicare plan, you must first contact the insurance company that provides your current plan. They will be able to provide you with information about what other plans they offer and how to switch. The eligibility age for Medicare is 65.

All Medigam insurance policies follow the same rules and must be clearly labelled "Medicaid Supplement Insurance". The insurer will sell your policy with a standard letter. Each policy offers the same base, but some provide additional benefits, so you can select what fits your needs. In Massachusetts, Minneapolis, and Wisconsin, Medigap policies differ from the others. All insurance companies decide which policies they want to sell but some states can affect what one is offered. Insurers selling Medicap policies:

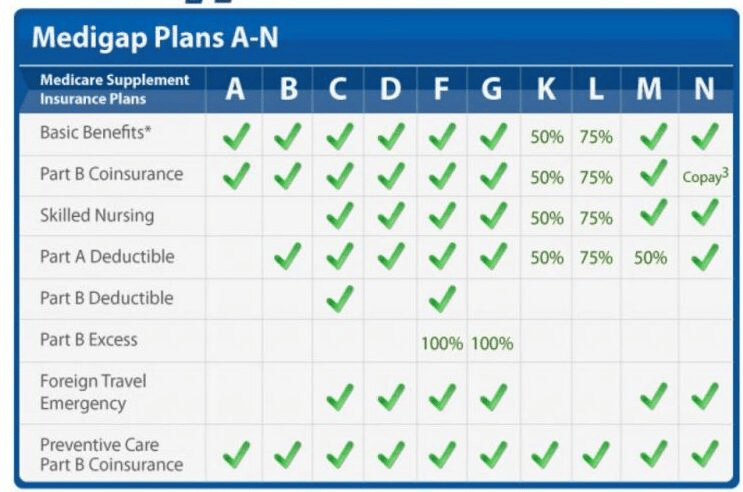

The table below explains some of the main benefits Medigapping provides. The plan covers 100% of this benefit; if the policy does not cover that benefit, the plan is able to provide coverage for this portion of the benefit and will not apply if the Medigap policy is not in effect as of now; if the policy does not cover the Mediga

Upon looking at the Medigap plan comparison, you will see that each offers an additional average monthly premium rate. This will affect beneficiaries in some cases. The costs for the MediGap plan are as follows. Some plan require co-payments and deductions, whereas others require a deductible before coverage is available. Understanding the cost of a specific plan is important before choosing the best one in order to get started.

If you have Medicare Part A or Part B (original Medicare), Medigap may fill gaps in Medicare Part B and Part B. Medigap plans were created by insurance companies for private insurance purposes and were designed to help you cover your medical expenses in an affordable way. Medigap's plans have been designed with common features; however some aren't available in your area.

The First Enrollment period provides limited opportunities to apply for Medicare Part A/Part B if you qualify. After enrolling in Medicare Part A and Part B, you may also have other insurance plans available from licensed private insurers. A Medigap policy is a 6-week period beginning on your 65th birthday and enrolled into Part B. After that period you have no option to acquire Medigap coverage and it may be expensive. The states handle everything differently and sometimes there are more open enrollment periods.

Enrollment in Medicare is a process that individuals aged 65 or older, as well as certain individuals with disabilities, can go through to receive health coverage and benefits from the federal government.

Medigap offers a group of 12 insurance policies with letters A and N. Covering all of the policy benefits of this program. When comparing Medigap plans, the benefits of these policies should match your medical needs. According to your letter plan, your health insurance coverage includes the deductibles & co-payments.

Medigap plans have the most beneficial advantage as there is no provider network. If you enroll into a Medigap plan you can access coverage whenever you want. The foreign travel benefit offered by all Medigap plans can be found here in the case of emergencies travel. Find a Medicare plan in just three simple steps.

In 2022, a Medicare Supplemental Coverage premium amounted to roughly $150 a month or $1800 a year. There are many factors influencing Medigawap costs such as age and location of your residence.

Don't forget, the Medigap plan is not able to change for you in 2024. The majority of medical insurance policies are covered by Medicare Part D to pay for prescriptions for certain medications.

nsurance companies that sell Medigap policies: Don't have to offer every Medigap plan Must offer Medigap Plan A if they offer any Medigap policy Must also offer Plan C or Plan F if they offer any plan Note: As of January 1, 2020, Medigap plans sold to people new to Medicare can no longer cover the Part B deductible.

In the first half of 2022, deductible amounts were capped at $2990. The deductible amount on plans F, J represents an annual expenditure (excluding the premium) that is billed for each individual policy before the policy begins providing benefits for the policy.