Medigap Plan g pays for your medical expenses as a Medicare patient. Currently it provides the largest Medicare Supplement plan in existence and provides coverage for those who have recently become Medicare beneficiaries. Medigap Plan G offers another alternative to Medigap Plan F.

Medicare Supplement Plan G provided by Medicare Blue Cross allows Medicare patients nationwide to access their medical care with no restrictions. The plan consists of additional benefits that will help you increase your income and provide more benefits. This program pays certain Medicare deductibles and copayments. The company primarily provides services covered by Medicare. You may choose to buy Medicare Supplement Plans G by private insurance companies or join the Medicare Supplement Plans G program offered by the PEBB.

Medigrap plans help you pay for health care in the event that you receive Original Medicare. Currently, this program provides Medicare Supplemental benefits to all individuals newly eligible for Medicare. Medigap Plans G and G also provide a substitute for Medigap Plan F, which has never been offered to new subscribers. Terry Turner Terry Turner Senior Financial writer and financial well-being facilitator Terry Turner has over 30 years of journalism experience and covers benefits, expenditures, and federal policy.

Medicare Supplement Plan G provides a complete Medicare Supplement (MegaP) plan for new Medicare beneficiaries. These coverages are getting more popular in these years. Find a Medicare Supplement plan today by using our free online search engine. Medigap Plan G covers the gaps in Medicare's original costs and your own. These programs are geared towards most Medicare patients.

What is the Medigap program cost? Medigap's annual premium in 2022 to 65 is averaging $143.46 per month. For the only benefit not included in Plan G, deductibles for Medicare Part B are about $19/month.

The following pages provide consumers with information regarding health care supplement products from Regence Blue Shield in the state of Washington. Please phone 1-877-282-00510 for information on your plans. This website contains text which has received no approval from Regence BlueShield[2]. This isn't a request for coverage. '

Medigap Plan G is the largest Medicare Supplement Plan currently available to newly qualified Medicare recipients. This plan covers more expenses related to Medicare Part B than other Medicare Supplements. What is the coverage for Supplemental Medicare Plans G - Part A? You cannot purchase Medigap Plans G if you already possess a Medicare ad-hoc plan — e.g. Are there any plans that are available to reduce the Medicare deductible by 2023? Maximise the benefits of your Medicare coverage by purchasing an e-health insurance package. Registrars are eligible to register for the year ending December 7, 2016.

The Medicare G program won't disappear. Some people are confused as to why the Medigap plan has ended and why. Keep an eye on plan G for now. I have an idea.

To participate in Medigap Plan G, you must be enrolled in Part A or Part B. Preexisting conditions may affect your Medicare Supplement Plan G enrollment. Preexisting conditions do not affect the enrollment process based on eligibility for Medicare Supplement G plans. A carrier may refuse insurance in such situations without cause. When a student enrolls again at another time there is the possibility of health insurance issues. Nevertheless, some states allow enrollers to take courses with no need for answers to the above questions, therefore it is essential to find out how your state permit operates.

The federal mandate does not require Medicare supplement plans to be available for people under 60 because of disabilities. However, some states require that Medigap plans must have a minimum choice option available for people younger than 65. Some insurance providers allow you to enroll in Medicare Supplements Plan G. Medicare's most commonly available option is Medicare Supplements Plan A. Medigap plans provide basic health coverage. Nonetheless, many carriers understand the importance of ensuring wide coverage for those who suffer from disabilities. -The Medicare Supplemental Plans. a.

This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services. $214.00 Community Rated Get a Quote Medigap Plan G X If you're turning age 65 this year, Medicare Supplement Plan G is the most comprehensive Medicare supplement you can buy. It's also the most popular. You might be thinking that Medicare Supplement Plan F.

If you are just turning age 65, you have guaranteed issue rights X Guaranteed-issue is a right granted to Medicare beneficiaries and applies to Medicare Supplement insurance (aka, Medigap plans). All states and the federal government enforce this essential right, which protects Medicare beneficiaries from medical underwriting. and cannot be turned down by Regence BlueShield.

Medicare Supplemental Assurance policies must adhere to federal law aimed at protecting the consumer, and should be clearly labeled Medicare Supplement Assurance policies. Insurance companies will only sell your policy in the states indicated in the letter. Each policy is the same basic, but many provide additional benefits. In Massachusetts Minnesota and Wisconsin Medigap Policies differ in their standards. All insurance firms decide which insurance plans they wish to sell and the law may affect the type of plans they are selling. Companies selling medical coverage.

How much do health care subsidies cost? The Medicare Supplement Plan's cost is dependent on several variables including your location, age, smoking history and gender. The monthly cost of Medigap Plan G are still about $100 to $300.

Exceeds Charge: $6620 in 2022 $3310 in 2022 - Plans FR and GR also offer higher-deductible plans in certain states. The Medicare-covered costs (coinsurance and premiums) must be paid up to the deductible amount of $290 by 2020. Plan B and F don' t apply to individuals who had just received coverage on or after January 1, 2020. ** For Plan B and L, once you've met the deductible for Medicare and your part-B deductible the Medigap plan will automatically be added to your plan.

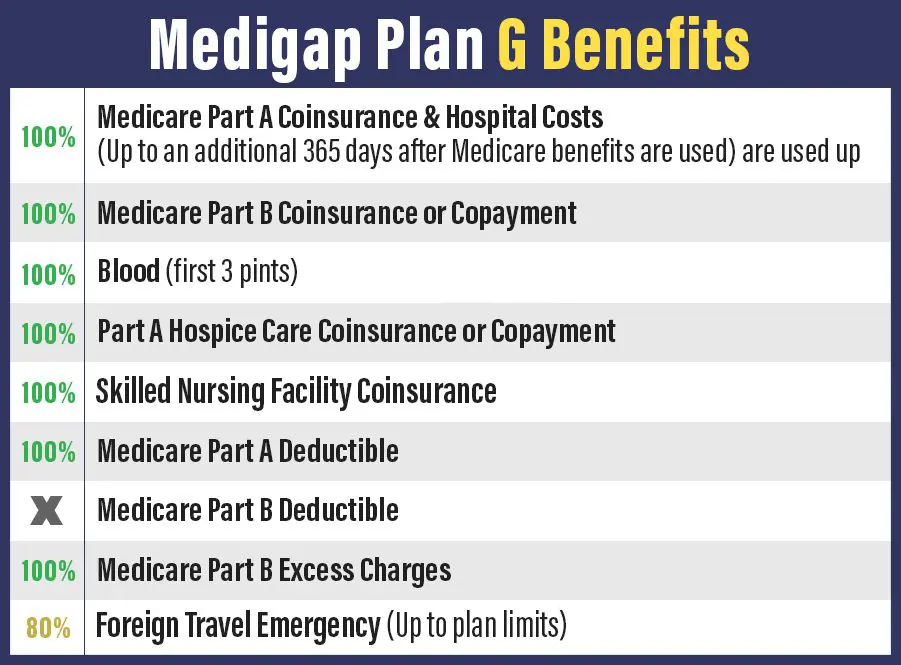

The following diagram provides a general overview of Medigap policies coverage. a plan covers all this benefit. the plan does not cover that benefit.. the policy covers that per percent.

It covers more out-of-pocket costs related to Medicare Part A and Part B than other Medicare Supplement plans. What Medicare Supplement Plan G Covers Medicare Part A coinsurance and hospital costs up to an additional 365 days after Original Medicare benefits are used up Medicare Part A deductible – $1,600 in 2023 (for each benefit period) Medicare Part A hospice care coinsurance or copayment Medicare Part B coinsurance.

Similar to most Medicare supplement plans, Supplement Plan G provides Medicare Supplements Secondary to Original Medicare Parts A & B. Medicare Original provides no full coverage in terms of health care. In addition to paying medical expenses, Medicare Supplement Plans help pay for your expenses. The nation offers ten standard Medicare Supplement plans and two highdeductible versions. The Medicare Supplement plans are marked with letters A – N. Each Medicare Supplement letter covers different coverage and monthly premiums for seniors on Medicare.

Medicare Supplements Plans G vary depending on the location of your home, age, tobacco use, and gender. Medigap Plan G costs range in size from $150 to 300 a month. Let's find out how to find the best health insurance coverage for you. Monthly Medicare premiums are generally more expensive for people living at higher living costs in the USA. If you are unable to pay your monthly premiums, you have another alternative. Medicare Supplement High Deductible Plan G provides a similar service to a higher monthly premium.

Medigamp plan G keeps your expenses down. Medicare Supplement Plan G offers several benefits. Once Medicare Part B is paid off, you can avoid copayment and medical bill surprises. Additionally, since the federal governments standard Medicare Supplement Plan G has the same benefits as the plan regardless of the carrier. Nevertheless, premiums are available monthly depending on the state and carrier. Let us guide you through choosing the right Medicare plan today.

Original Medicare has no deductible on Part B. The cost of obtaining these coverages should begin as soon as your Medigap benefits begin. In addition, Medicare Supplement Plan G does not cover dental and hearing care as routine services. Medicare GP plans cover only Medicare coverage for Medicare. This means the payment will only begin once Medicare is enrolled. In this case, a Medicare Supplement Plan G is no longer paid out. Please see the additional benefit.

Medigap Plan G is a possible solution for people who don't have Medicare Supplement plans. What are the differences between Medigap Plan E vs. Plan X? Find the right health plan for you. Learn about MediGAP Plan G benefits with William Howary, an expert on Medicare insurance.

The following chart provides a summary and comparison between all the insurance benefits available to Medicare supplemental plans offered by Regence BlueShield.

Regence BlueShield rated 5.0 out of 5.0 based on our rating. XMedicare Supplement is an additional Medicare insurance program that a person can purchase to cover a gap in their Original Medicare (Medicare Part A and Medicare Part C) insurance policies. The firm has also earned strong financial ratings. Best, we trust RegenceBlueShield. Aside from that it doesn't require insurance. This is just one reason we strongly recommend this carrier for senior citizens in Washington. Check out the top ten competitions!