InternetMD connects you to healthcare services. If you purchase this service, WebMD can charge you for your visit. WebMD does not support the products or treatments listed here. Medigrap policies add Medicare Original Coverage for Deductive Payment, CoPay and Coinsurance. In some countries, the Medicaid program may be used for lower-risk or non-risk groups. Medicare is a Medicare supplement plan that provides additional Medicare coverage to Medicare users. Continue reading about the Medigap Policy and its Costs. Searching for Medicare Plans in your City?

Medigap plans are sold privately to help pay for the medical costs that original Medicare cannot cover, including co-pays and premiums. Some Medicare Advantage programs also offer coverage for certain medical conditions that Original Medicare does not cover, such as medical expenses for traveling out of the United States. Medicare pays the share for covered medical expenses if you purchase a Medicare Advantage plan. You pay your part of Medigap payments.

Medigap is a Medicare Supplement Insurance plan which fills a gap and is sold by private businesses. Medicare covers a large portion, but not the total cost of coverage. A Medicare Supplement Insurance Policy (Medigap) policy might be helpful when it comes to paying the remaining costs of health care, including medical care.

You pay the private insurance company a monthly premium for your Medigap plan in addition to the monthly Part B premium you pay to Medicare. A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap plan from any insurance company that's licensed in your state to sell one.

Take some time to consider the differences is in the companies, the quality of service and the price. What isn't covered by Medicare Supplement insurance plans? Generally, these plans don't cover long-term care (like care in a nursing home), vision or dental care, hearing aids, private duty nursing or prescription drugs. How do I know if I'm eligible? To buy a Medicare Supplement plan, you must be enrolled in Medicare Parts A & B. Medicare Part B covers emergency room visits for medically necessary services. These services may include doctor's visits, diagnostic tests, and treatments.

Medigap provides a supplemental insurance plan that is sold to private businesses and can be combined with Part A and Part B Medicare Part B. Depending upon your situation you may have to make the payment of your deductibles, premiums, coinsurance, etc. Often a Medigap policy covers medical services that are not covered by Original Medicare. Often a physician's visit takes place during a foreign vacation. Typically, Medigap policies cover a portion of the total cost of healthcare with Medicare approval. The Medigap plan requires Medicare Part A and Part B coverage.

Medicare Supplements are available for people with Medicare Part D or Part D. You have to enroll for six months after the day you turn 65. During the open enrollment period for Medicare Supplement, you may not receive any benefits from Medicare unless you are already in an eligible state. Some states have plans that are not covered by Medicare. With Medicare Supplement coverage, you can visit all the doctors and hospitals accepting Medicare patients. Anthem provides several Medicare Supplement plans which include all of the Part A or Part B co insurance.

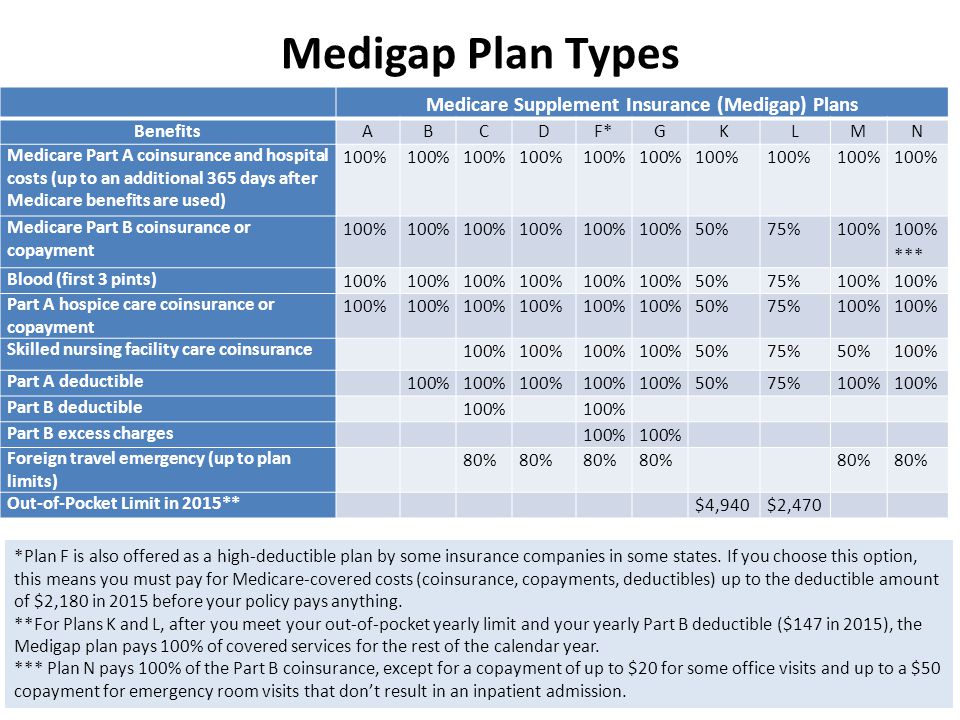

Plans N help cover Medicare Parts A and B deductibles. Then the monthly payments will be lower. Select and Innovative N can be found in certain states.

Medicare supplement plans do not cover prescription drugs and can be purchased through Medicare Part D plans. Medicare Supplement plans also exclude dental and vision coverage, but you may buy Anthem eye care and dental coverage at an additional cost if you're located within a state that has. Nevada, Kentucky and California also offer Medicare Supplements, which provide comprehensive vision and hearing support.

Maybe you wonder if Medigap policies are identical to Medicare Advantage plans. I don't know. Medicare Advantage programs are another option for gaining Medicare benefits when you qualify. Medigap policies are designed to address gaps in Medicare coverage. This is simply an extra supplementary plan.

Medigap is an optional insurance plan. Upon receiving the policy you will pay an annual premium from private coverage. This fee will be a supplement to the monthly premiums paid to Medicare.

Enrollment in Anthem Blue Cross Life and Health Insurance Company depends on contract renewal. Anthem Blue Cross Life and Health Insurance Company (Anthem) has contracted with the Centers for Medicare & Medicaid Services (CMS) to offer the Medicare Prescription Drug Plans (PDPs) noted above or herein. Anthem is the state-licensed, risk-bearing entity offering these plans. Anthem has retained the services of its related companies and authorized agents/brokers/producers to provide administrative services and/or to make the PDPs available in this region.

A Medigap plan sold to private businesses can help cover a portion of the medical expenses that the insurance plan does not cover, such as copays, coinsurance and deductibles.

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year.

What are the advantages of using Medgap? Medigap policies supplement Medicare coverage and cover additional fees. Medigam is more flexible and has greater access to health services than other options offer. In many cases, Medigap is an affordable option.

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company.

Are Health Insurance Plans Good? If there's no hospital expenses for you, Medicare Advantage may offer an affordable and effective option. But for serious health problems requiring expensive treatment and care, Medigap may be better.

Buying a Medigap can be complicated, but using a set of written questions and asking for help when needed can help you stay organized and simplify the process. If you need further assistance navigating Medigap policies and enrollment , contact your State Health Insurance Assistance Program (SHIP) . For additional information on Medigap policies in your state, you can also contact your State Department of Insurance.