The Medicare Supplement or Medigap name are separate from each other, meaning you can use either name to describe one of those plans. Medicare Supplement and Medigap are different names that cover a specific type of health insurance. To explain the concept itself, you can view “Medicigap” as a system designed to fill in gaps in Medicare coverage which the original Part A or Part B does not cover. You may see supplemental health care insurance as an insurance program which adds or supplements original Medicare coverage by reducing or minimizing the cost of supplemental coverage.

Medigap is a Supplemental Medicare insurance program aimed at helping fill gaps in the Original Medicare program. Medicare is reimbursed by Medicare in most cases for covered health care expenses. A health insurance supplement plan may cover some of your health care costs, such as: Some of them include supplemental insurance coverage, or other health benefits that Original Medicare cannot cover.

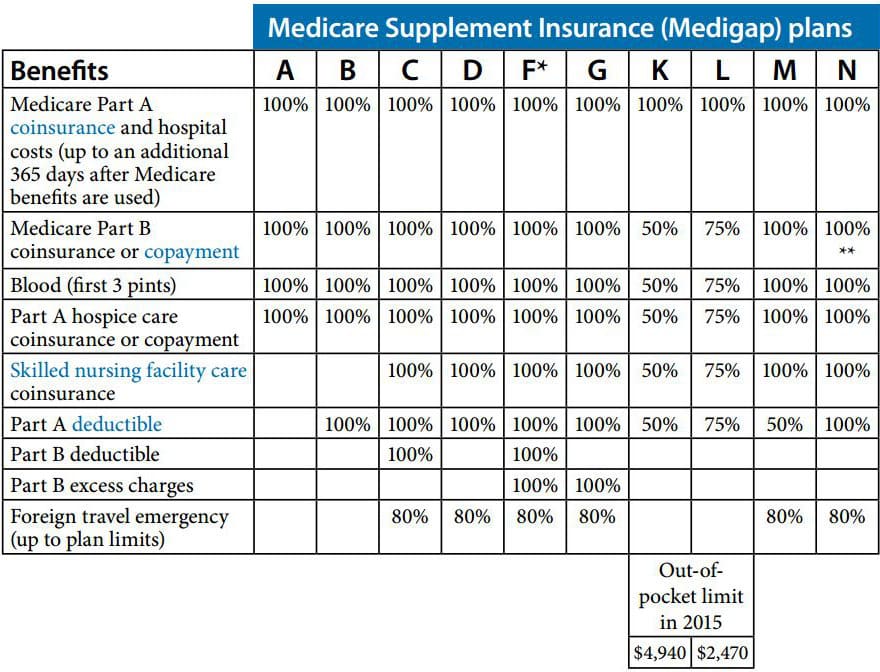

Hospital coverage up to an additional 365 days after Medicare benefits are used up. Part A hospice/respite care coinsurance or copayment. See how Medicare costs may work with these Medicare coverage examples Applying for a Medicare Supplement insurance plan The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you're both age 65 or older and enrolled in Medicare Part B.

If you are currently eligible to join Medicare Part D and Medicare Part B, then you may enroll in a Medicare Supplement. The open enrollment period starts from the month you turn 60. During the Open Enrollment for Medicare Supplement, you cannot lose any coverage due to your medical conditions. Some states offer health insurance for under 60 years of age if they qualify for Medicare. With Medicare supplement insurance you may see a doctor or hospital accepting Medicare patients. Anthem provides a Medicare Supplement plan which includes all Part A and Part B co-insurance.

Plan F covers Medicare Deductible & Coinsurance. According to government regulations Plan F will only work when you become enrolled in Medicare after January 1, 2020. Various e.g., Select or innovation f can be found in certain States.

Plan N provides a payment method for Medicare coinsurance. Those who are covered for the deductible and copayment will pay a lower premium each month. Select and Innovative N are available in some locations.

Plan G will cover costs that cannot be reimbursed by Original Medicare for Medicare-approved services, except for Part B's deductible. Selection / Innovative G may be found at various states.

Plan A is the more basic Medigap plan and has the lower cost. This is the only Medicare Supplement plan with no deductibles for Medicare Advantages.

Medicare Supplement Plans don't provide prescription drug coverage, however you may be eligible for Part D plans for extra payments to help pay for prescription drug costs. Medicare Supplements does not provide dental and vision insurance and is only available to customers living in Illinois, New Jersey and New Mexico. In addition Anthem provides dental coverage for additional premiums for California and Connecticut. Several of the state's Medicare Supplements have vision or hearing benefits.

While shopping don't be confused by the idea that Medigap plans are cheaper to buy than Medicare Supplement plans. There will be similar kind of planning. All insurance companies offering Medicare supplements have to conform to federal and state law and must clearly label Medicare supplements. The term "Medigaps" has been used colloquially since its short nature.

If a health insurance policy is not available under Part A, Part B, or Original Medicare Part B or Part C. Medigap plans can be negotiated through private companies and can be accessed through your own pocket. All Medigap plan types and features may differ from those found elsewhere.

If you have Original Medicare and you buy a Medigap plan, Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then your Medigap plan pays its share. What are the differences between Medigap and Medicare Advantage plans? A Medigap plan is different from a Medicare Advantage (MA) plan (PDF, 107KB) . MA plans are a way to get Medicare benefits, while a Medigap only supplements your Original Medicare benefits.

Medicare Advantage Plans Include dental, vision, and/or hearing coverage, and most also cover prescription drugs. Can change and do not offer guaranteed lifetime coverage once you've enrolled.

The Initial Enrollment Period is a restricted period in which your first Medicare eligibility is capped between Part A and Part B. If you're eligible for Part B or Medicare Part XI, you have other coverage choices such as Medigap insurance from an insurance company approved by the government. It is best for the consumer to buy Medigap insurance in the six-month period beginning the month after you turn 60 if you are 65 or older. After that period the ability to obtain Medigap policies is limited. Different states deal with it differently, but some states have longer open enrollment periods.

What are Medicaid Supplements and Medigap? Espaol: Okay. Medicare Supplemental Insurance is a private insurance program which supplements your Medicare coverage to help you with your share of medical expenses. You can buy Medigap yourself.

Because Medicare Supplement insurance plans differ, you might want to determine which benefits you want and which plan you want before you enroll. Types of insurance that are not Medicare Supplement insurance include Medicare Advantage plans , Medicare Prescription Drug Plans, Medicaid, and veterans' benefits. Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealth's Medicare related content is compliant with CMS regulations, you can rest assured you're getting accurate information so you can make the right decisions.

The Medigap policy is a second insurance program in Medicare. It has primary benefits. Medicare does not cover all of these. Supplementary policies protect against unexpected medical costs.

You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap policy from any insurance company that's licensed in your state to sell one.

There are also disadvantages to Medigape plans such as higher fees for each month. It's a challenge to understand different plans. There's no medical insurance available under Plan D.

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

Yeah. Prescription medications may be incorporated into a company's health care plan. When you join a Medicare drug plan, you lose coverage and you can't receive those benefits from other programs.

Medicare Advantage Plans Include dental, vision, and/or hearing coverage, and most also cover prescription drugs. Can change and do not offer guaranteed lifetime coverage once you've enrolled. Can be a PPO or HMO. Can have a $0 or low premium. Can only move with you if the plan is available in your area.