Medigap insurance is a company that provides coverage in a private company to help reduce costs Medicare does not cover, like coinsurances and deductible payments. Medigap coverage is available to individuals with original Medicare Part A or B coverage.

Both the Medicare Part A and Part B deductible is fully covered by Medigap plans C and F. However, these two supplemental plans are only available to those who were eligible for Medicare before 2020. What is AARP Medicare Supplement Plan F? Medicare Supplement Plan F has the highest enrollment and very strong coverage, but it's only available to those who were eligible for Medicare before 2020.

There are downsides to Medigap plans, including a lower monthly premium. Have to go through different plan options for different peoples. It is not possible to purchase prescriptions through a Plan D program.

If you are unable to buy a Medigap policy right now, or only one that charges you very high premiums, remember that when you turn 65, the clock will be reset. You will then be eligible for Medicare based on age instead of disability, and you will be able to buy any Medigap policy of your choice with full federal protections provided that you buy one within six months of your 65th birthday, unless you happen to live in one of the few states that allow you to buy Medigap at any time.

While Medicare Parts A and B (known as Original Medicare) cover a portion of healthcare costs, the Medicare Part B program does not cover all. The UnitedHealth Care AARP Medicare Supplement insurance plan is the perfect plan for this situation. Supplement insurance plans are also known as "medigaps" by private insurance firms.

AARP Medicare Supplement Insurance Plans AARP endorses the AARP Medicare Supplement Plans insured by UnitedHealthcare. Insured by UnitedHealthcare Insurance Company, Horsham, PA. Policy Form No. GRP 79171. Plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease. Not connected with or endorsed by the U.S. Government or the federal Medicare program.

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease. Not connected with or endorsed by the U.S. Government or the federal Medicare program. This is a solicitation of insurance. A licensed insurance agent/producer may contact you. You must be an AARP member to enroll in an AARP Medicare Supplement Plan.

En espaol | The best time to buy Medicare Supplement policies - also dubbed Medigap - is to have the right to get a Guaranteed Protection Policy at the Best Rate for Someone Your Age. Even though it is a sham, a Guaranteed Policy When you buy Medigap insurance at another time, the insurer may decline you or charge a higher premium for your previous or current condition.

Why AARP Medicare Supplement Insurance Plans from UnitedHealthcare? UnitedHealthcare has been providing coverage and building personal relationships for more than 30 years and offers the only Medicare Supplement plans endorsed by AARP.** The basic benefits provided by Medicare Supplement plans are the same no matter which insurer you choose. But an AARP Medicare Supplement Insurance Plan from UnitedHealthcare has many features that stand out.

Medicare Supplements Insurance is an insurance plan for a large percentage of individuals with high health insurance rates. The average cost is variable, and the plan includes additional benefits such as vision, dental, hearing fitness, and much more.

Most Americans prefer to take Medicare Supplement Insurance (also known as Medigap) plans. Customer support scores are lower than those for the same company. The wide variety and selection of policies can help you pick out the best plans for you, but the endorsements offered by the Association will provide peace of mind. It's among the better Medicare supplements available and is one of the most popular with almost three2% of Medicare supplement members having AARP/United Healthcare Plans. AARP members must be aware of their policies when they submit insurance applications.

Typically AARP provides supplemental coverage to the enrolled patients in Medicare Supplement plans. As part of this business agreement, AARP is sponsoring and promoting selected United Healthcare plans and AARP receives 4.95% fees per plan sold. Medigapp policies offer additional coverage under Medicare Part B. This Supplement Plan reduces deductibles, copayments, or unforeseen medical costs for a patient. It depends how much coverage you choose from the various plans that you choose from. If the medical expenses for an examination were $200, Part B could cover $100. FAQ medicare enrollment.

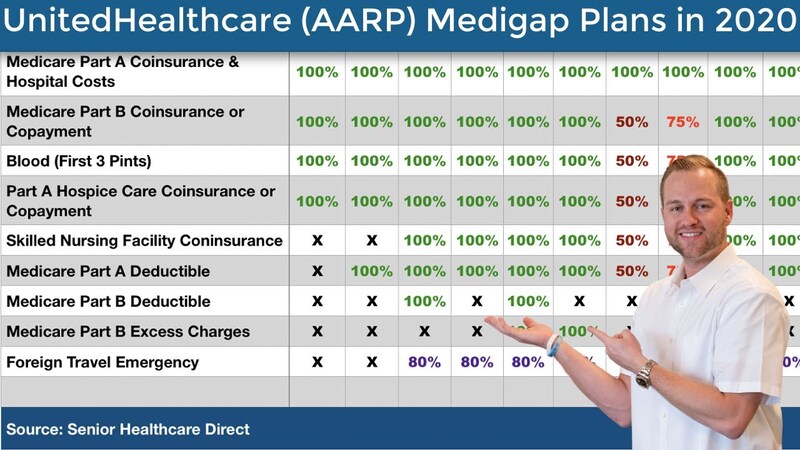

Medicare Supplement coverage is uniform across all companies. A Plan G from AARP provides the same healthcare benefits as a Plan G from another provider. Standardization makes comparison easier and the Medicare.gov Medigap plan cover chart can help you choose the right plan. You may apply for medspap policies as soon as your eligibility becomes active or open enrollment. All available Medicare & Medicaid plans are provided by AARP/USHealthcare. Plans available for Medicare eligibility may differ from place to place.

The main medical benefits offered by AARP plans are similar to the services offered by the other insurance firms, and AARP Medicalgap Plans offer further benefits, adding substantial value.

Because of the variable structure of plans the comparison is hard and most accurate comparisons mainly will take effect using insurance quotes. When a person reaches a certain age, the different rates of price increases may have a significant impact on their overall lifetime costs. In some cases women in their 60's can get a more expensive plan from AARP than from Humana or BlueCrosses. AARP has also had slower prices increase compared to other plans. In age 84, Medigap was cheaper than Humanoid, Cigni and Blue Cross-BlueShield.

Ratings for United Healthcare have a poor customer review with several metrics suggesting a user complaint or frustration. In its division United Health Group has slightly higher complaints rates than a typical insurer of that kind. Across the Utilities and the Financial Services Industry the number of complaints is 2.22. The company has about 22% more complaints than is normal. NAIC estimates that 90% of all complaints relate to claims processing.

Original Medicare Part A and Part B cover some health care costs, but does not cover every part. This is when AARP Medicare supplement plans from UnitedHealthcare can be a good choice. The Medicare supplement plan is called MediGap and offers private coverage. The product is based on your original Medicare plan.

Part D prescription drugs are integrated into Medicare Supplement Programs to provide you with more comprehensive coverage. Coverage guarantees a lifetime if you pay premium as soon as you receive payment and you don't misstate your eligibility. Rate changes will occur as needed. These changes affect any member of the same category covered by your plan in the same country. United Healthcare provides personal and professional care to its clients since 1983 and is the only Medicare Supplement plan approved by AARP. Medicare Supplement coverage is the same regardless of your insurer.

If you qualify for Medicare before age 65 but can't get a Medigap policy in your state, you may be able to sign up for a Medicare Advantage plan after signing up for parts A and B. Until recently, people with end-stage renal disease couldn't enroll in Medicare Advantage plans. But those rules changed in 2021. Disabled beneficiaries have a second chance. If you're younger than 65 and unable to buy a Medigap policy right now or you qualify only for one that charges a very high premium, when you turn 65, the clock will reset.