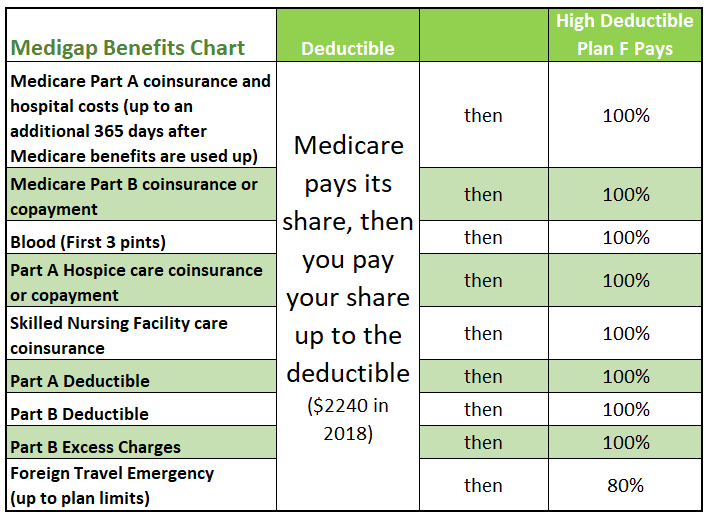

If you have recently enrolled in Medicare, you may have been aware of Medigap. Medigap policy is intended mainly to help cover out-of-pocket expenses related to Medicare. There are many different types of MediGap policies available to choose from. The following articles will explain what the Medigap plan offers and how to enroll. Medigap is a privately-sold Medicare Supplemental Insurance that provides insurance for original Medicare costs. These costs may be covered by a deductible, copayment or coinsurance.

Medigap Plans (also known as a Medicare Supplement) that are offered through private firms will cover some of the medical costs Medicare hasn't paid for ( this may include co-pays or coinsurance. Many medical coverages that Medicare does not cover include ambulatory care for travel overseas. If you have Original Medicare and buy a Medigap plan, it pays its part of the Medicare-administered amount for the coverage. You can take advantage of Medigap plan.

Medigap is a Medicare supplement insurance policy which is available through private companies and is a replacement for the Medicare Part A if the coverage gap is too large. We are able to help pay for deductibles, co-payments, co-insurance or any additional costs. Many Medigap policies cover medical care that is not covered by original Medicare. Examples are doctor or hospital visits involving a trip across the globe. In general, Medigap policies pay the difference between the overall cost and Medicare-approved amounts. Medicare Part A and B are the required documents for Medigap policies.

You may want to consider comparing Medigap and Medicare's Part C program. I'm not sure why. Medicare Advantage plans are another option for getting benefits when a patient has a qualifying Medicare benefit. The Medigap program is designed to fill the gap in Medicare's coverages by providing an alternative plan to the insurance plan. The only option is an extra plan.

What is Medigap vs. Medicare Advantage? You might be wondering if a Medigap policy is the same as a Medicare Advantage (Part C) plan. The answer is no. Medicare Advantage plans are an alternative way to obtain Medicare benefits once you qualify. In contrast, the purpose of a Medigap policy is to bridge the gaps in your Original Medicare coverage. It's purely a supplemental type of plan. What do Medigap plans cost? Medigap is an optional insurance policy.

Medigap policies are only available to people who already have Medicare Part A , which helps pay for hospital services, and Medicare Part B , which covers the cost for doctor services. People who have a Medicare Advantage plan cannot get a Medigap plan. To learn about Medigap plans offered in your area, you can use the online Medicare Plan Finder or contact your state's department of insurance.

You pay the private insurance company a monthly premium for your Medigap plan in addition to the monthly Part B premium you pay to Medicare. A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap plan from any insurance company that's licensed in your state to sell one. Any standardized Medigap plan is guaranteed renewable even if you have health problems.

Medigap offers insurance options. If you want this insurance you must pay a monthly premium to an insurance provider. These fees include a portion of Medicare’s monthly Part B premium.

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the Medicare-Approved Amount for covered health care costs. Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan.

In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium.

You have to decide what sort of plan makes the most sense for you. If you drop your Medigap policy, there is no guarantee you will be able to get it back. Continue Reading Below Continued Some Medigap plans used to cover prescription drugs . Since the introduction of the Medicare Prescription Drug Plan (Part D), you can no longer sign up for these plans. If you already have a Medigap plan that covers prescriptions, however, you can keep it.

A Medicare Supplement plan will cost about $155 monthly by 2023. Costs are determined by two variables: policy and state pricing structures. First of all, different letter plans differ in price as the different insurance plans offer varying levels of coverage.

She has also paid an annual 125 monthly premium because Medigap policies allow for all people to be paid the same rates regardless of the age. This premium is determined by the age when buying a Medigap policy. Premium is lower for those who buy at younger ages.

There are some disadvantages to this plan. Trying to figure out the various plan options. No prescription insurance (that is available in Plan D).

If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap policy from any insurance company that's licensed in your state to sell one. It's important to compare Medigap policies since the costs can vary between plans offered by different companies for exactly the same coverage, and may go up as you get older. Some states limit Medigap premium costs.

Medigap policy sales are done privately and can assist in paying for some expenses which the Medicare program cannot cover. Some Medigap policies may provide coverage for unforeseen medical expenses.

They are sold by private insurance companies. If you have a Medigap , it pays part or all of certain remaining costs after Original Medicare pays first. Medigaps may cover outstanding deductibles, coinsurance , and copayments. Medigaps may also cover health care costs that Medicare does not cover at all, like care received when travelling abroad. Remember, Medigaps only work with Original Medicare.