You can purchase Medicare Supplements or Medicare Medigap if you are under supplemental insurance or subsidize your own medical expenses. Medicare coverage includes copays and coinsurance. It's a government-standardized Medigap plan sold through private insurance providers that decides the premium. It is also possible that the amount you pay varies depending on factors including age, gender, smoking, age and health. How much does Medicare Supplemental Insurance cost?

Medicaid supplement insurers use age as part of the premium calculation process. Your Medigap premiums are the monthly fees paid for joining the plan. Medicare Supplement premiums are usually increased as you get older. As you review Medigap quotes, you should also be aware of how your age can affect your insurance coverage. The average monthly premium for Medigap Plans f & E is broken up by age, 65 and 85. The eligibility age for Medicare is 65.

Medicaid Supplements Insurance (Medicaid Medigap) enables Medicare to cover deductibles, copays, coinsurance and many additional expenses. Medicare Supplement Plan A is expected to cost $143.46 monthly to 65-year-olds. Medicare Supplement plans are able to compare cost online without charge. Get an easy Medicare Supplement comparison tool and find the best plans for your budget.

Below is an overview of all Medigap plans in North Carolina. They offer average prices for a 65 year-old non smoker from the United States. Medigap plans type Monthly Premiums. Medigap plan A - Basic Benefits for every medical plan without extra fees and charges. $75-$429. Medigap Plan B provides basic health care and provides deductible coverage. 1 13-13 - $231. Medigap Plan D is the cheapest option covering most Medigap Benefits. 105-634. Medigap Plan G offers maximum coverage options for new Medicare users. Available as a standard plan or highdeductible option in some regions. 95 - 340$. Medigap Plans with Highdeductibles $25-66.7.

Some Medicare supplement insurance programs have some pricing: community rating. Premiums are not determined by age — everyone pays their premium monthly. It is also possible to describe these pricings as “non-aged”. A-grade issues. Premium is calculated by the age of purchase. In general younger folks pay less for health coverage. It is also possible to describe these pricing models in the context of entering age. Result - Age. Premium is paid according to age, and the price will increase with age. In some states the price of health insurance must be capped and there are no universal pricing methods for each.

Medicare Supplemental Plan standardized benefits mean that the same plan will provide the same benefits across carriers. Medicare Supplement expenses such premiums may differ from person to person. Depending on the type you are living in and where you reside are three major factors. For more information on Medicare Supplements, please see the example Medicare Supplement rates for individuals ages 18+. The corresponding ZIPCodes. Please note that all examples are not geared toward smokers. In tobacco cases your premium will increase 10%.

Plans F and G offer similar perks to Plans A and B, with exception. Normally Medicare Plans G have annual premiums of $1500 - $2000.

Typical costs for Medigap insurance include $150 a month, according to industry experts. These additional insurance plans cover gaps between the Medicare Part A and Part B coverage.

Find Medicare Plans in 3 Easy Steps We can help find the right Medicare plans for you today Medicare Supplement (Medigap) plan costs can range from $50-$400+ in monthly premiums, depending on your plan. Additionally, these Medigap plan costs are different for each beneficiary because they are influenced by several factors. What is the Average Cost of Medicare Supplement Plans? The benefits of a Medicare Supplement plan are standardized, so the same plan has identical benefits across carriers.

This is called an attained-age rated plan. Discounts It's not uncommon for insurance companies to offer discounts on Medicare Supplement Insurance plans. Discounts are often available for non-smokers, married couples and other criteria. Be sure to ask your insurance agent or insurance carrier about any potential discounts that may be available.

Sometimes Medigap pricing can be pretty unintuitive; for example, you might see a high-coverage plan such as Plan G priced below Plan A, which offers only basic coverage. Other Medigap costs Some Medigap plan types have other costs in addition to their premiums [1] Centers for Medicare & Medicaid Services . How to Compare Medigap Policies . Accessed Aug 11, 2022. View all sources : Medigap Plan N has copays for certain office and emergency room visits.

The exact amount can vary by individual policy. Insurance companies can set monthly premiums for their policies in three different ways: Community rated. Everyone that buys the policy pays the same monthly premium regardless of age. Issue-age rated. Monthly premiums are tied to the age at which you first purchase a policy, with younger buyers having lower premiums. Premiums don't increase as you get older.

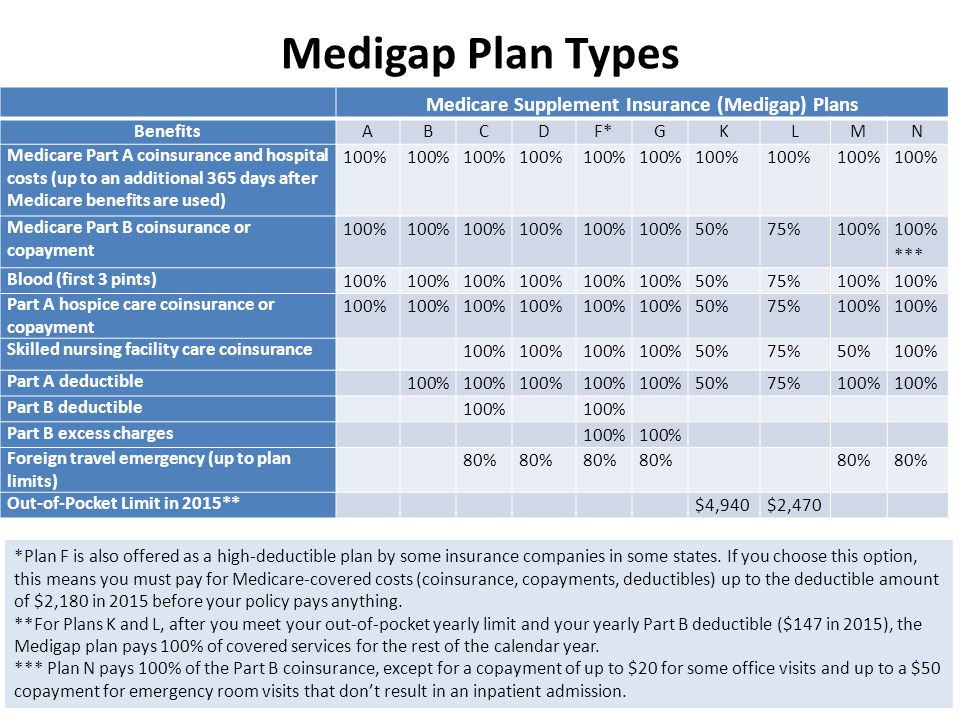

What Medigap Covers Medigap policies offer supplemental insurance that is only available to those enrolled in Original Medicare (Parts A and B) . In general, Medigap covers the following gaps in Original Medicare: Copayments Coinsurance Deductibles Some Medigap policies also cover up to 80% of medically-necessary emergency health care costs incurred while you are traveling outside of the U.S., in accordance with your plan's limits.

While Plan N covers 100% of the cost of the Medicare Part B coinsurance, the plan requires a copayment of up to $20 for certain office visits and up to $50 for emergency room visits that do not result in an inpatient admission. Compare Medicare Supplement Plan Costs Near You The easiest way to collect Medicare Supplement Insurance plan costs is to contact a licensed insurance agent who can gather up price quotes for multiple carriers selling Medigap plans in your location. You can also compare plans for free online.

The following table displays Medicare Supplement Insurance Plan F cost averages by age. Based upon our analyses, there were several significant takeaways. Medigap Plan G premiums for beneficiaries 65 to 85 ($235 a month) will be lower.

As shown below, Medicare Supplement Insurance costs can be quite high. Various factors affect the cost of implementing plans.

What are the costs for health insurance? Medicare plan G will cost about $160 to $268 a month in 2024 for 65 year-olds. In addition the cost of Medicare Supplement Plans is varied as a lot of insurance providers use different pricing methods.

Medicare Supplement Plans cost is generally low. Medicare Supplement plans N include additional costs like copayments, but they also cover Medicare Supplement Plan G's entire benefits except over-expensive costs. However, there will not always be problems when you live in a state that allows no extra charges at first. Find the most appropriate Medicare plan today!