One in four Medicare patients in 2014 had private supplemental insurance known as Medigap to pay for deductible payments or other costs. It offers a comprehensive overview of Medigap enrollment, and analyses consumer rights under federal law or state regulations affecting the beneficiaries' access to Medigap.

In 2024, most Medicare beneficiaries can choose from a variety of Medicare Supplement plan options. Medigap plans comparison chart is incredibly simple. How do I find an effective Medicare plan?

Medigap can be rolled out anytime during the year. The most suitable period for obtaining Medicare supplement insurance is the first year of enrollment. If the carrier is refusing you insurance in this situation, the application process will continue. You are eligible for all Medigap Plans. You may miss the enrollment period for an initial Medicare Supplement plan later on in life. Medigap enrollees can enroll in Medicare all year round. There is only eligibility if an applicant can provide information to underwriters about health issues.

All Medigap plans must comply with federal or statutory laws designed to protect you. Insurance companies can only sell standard policies whose name is often attributed to a letter. Each policy has a basic feature, although others offer more features, so that it will fit your specific requirements better. In Massachusetts, Minnesota, and Wisconsin, Medigap policy is uniform in different ways. Depending on state and federal laws, the insurer can decide what type of coverage he/she wants. Insurance company that sells insurance for Medigap.

When you compare all 12 Medigap Plan options you'll find that every plan includes different monthly costs and varying costs. Cost for Medigap Plans varies from one plan to another depending on your choice. Often plans will include copays and deductibles, while many require a deductible for coverage before 100% coverage is effective unless a policy is purchased. Understanding your own costs and responsibilities in any one plan is crucial when evaluating the plan you want.

Medicare Part B is the primary Medicare program that helps you fill gaps in Medicare Part A. Medigap is offered by private insurance companies that helps you pay a premium. Medigap plan is standard. However, a majority of standard plan options aren't available within your local area.

This initial enrollment period provides you with only a short period to apply for Medicare when you first get eligibility for Part A and Part B. Once you enroll in Part A or Part B, you have the option to select other plans such as Medicare Supplements. The most convenient way for a customer to purchase a Medigap policy is during the six-month period that starts with a birthday on the first day of the month — you are 65 or younger. You can then purchase the Medigap plan at any time. The states have different rules and regulations, but sometimes there may be additional enrollment periods.

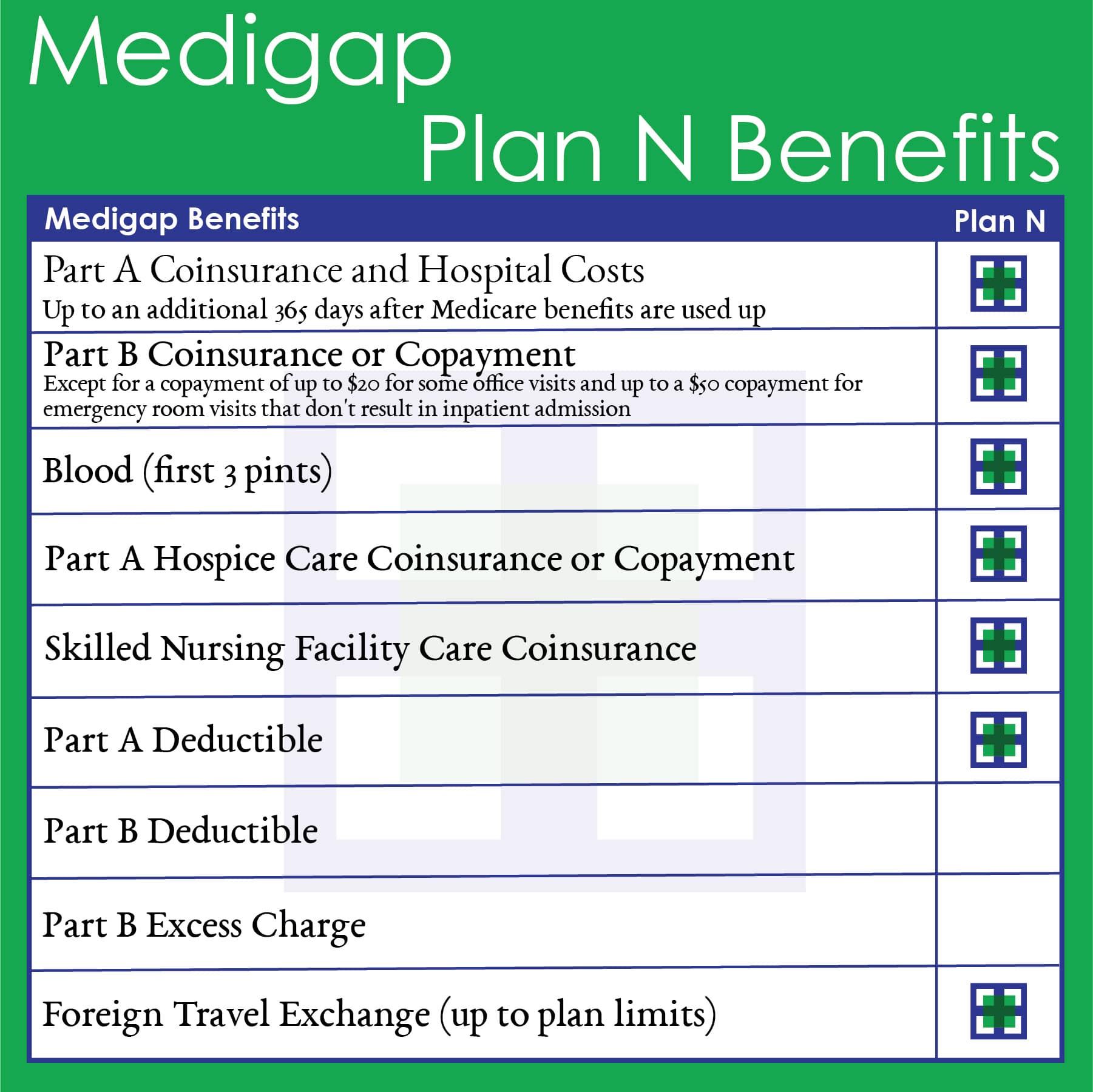

Each different type of Medigap plan has different benefits based on different characteristics and different responsibilities. Most cover all parts deductible.

Insurance firms can offer up to 10 types of Medigap policies in A, B, C, E, D, F. Every letter of policy is standardized. This means all policy labels are identical regardless of whether the insurer has the same price.

These plans are available for people enrolled in Medicare parts A and B, not for those who elect a Medicare Advantage plan. Medigap plans pay for costs such as deductibles and copays and other charges that Medicare doesn't cover. In 2010 the federal government standardized the types of Medigap plans, creating 10 options designated by A, B, C, D, F, G, K, L, M and N.

They are sold by private insurance companies. If you have a Medigap , it pays part or all of certain remaining costs after Original Medicare pays first. Medigaps may cover outstanding deductibles, coinsurance , and copayments. Medigaps may also cover health care costs that Medicare does not cover at all, like care received when travelling abroad.

Medicare beneficiaries also purchase Medigap policies to make health care costs more predictable by spreading costs over the course of the year through monthly premium payments, and to reduce the paperwork burden associated with medical bills.

This website is not connected with the federal government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area.

Medigap plans are standardized; however, all of the standardized plans may not be available in your area. Costs Premium All Medigap plans require that you continue to pay your Part B premium and a separate premium for Medigap coverage. Deductible Some plans have deductibles. Copays A copayment may apply to specific services.

On the other hand, broader guaranteed issue policies could result in some beneficiaries waiting until they have a serious health problem before purchasing Medigap coverage, which would likely increase premiums for all Medigap policyholders. A different approach altogether would be to minimize the need for supplemental coverage in Medicare by adding an out-of-pocket limit to traditional Medicare.

DFS Portal Medicare Advantage Plans are approved and regulated by the federal government's Centers for Medicare and Medicaid Services (CMS). For information about what plans are available, plan benefits and premium rates, contact CMS directly or visit CMS Medicare website.

DFS Portal Medicare Advantage Plans are approved and regulated by the federal government's Centers for Medicare and Medicaid Services (CMS).

Once you've paid that amount, they take care of 100 percent of covered services for the rest of the year. In 2022, the limit for Plan K is $6,620, and the limit for Plan L is $3,310. These limits increase each year, based on inflation. Remember, Medigap does not cover prescription drugs or dental, vision or most other needs that original Medicare doesn't cover.

Medigap is a key source of supplemental coverage for people in traditional Medicare Medicare beneficiaries can choose to get their Medicare benefits (Parts A and B) through the traditional Medicare program or a Medicare Advantage plan, such as a Medicare HMO or PPO. Roughly two-thirds of Medicare beneficiaries are in traditional Medicare, and most have some form of supplemental health insurance coverage. because Medicare's benefit drug plan, or your other insurance begins to pay.

Several Medicare supplement plans can be arranged for patients. The benefits vary by plan type. Plan F offers high-deductible options. Plans N, K, L and M share a cost.

Store your doctor & Rx drug info in one, secure location. Experience a faster application process. Learn how to get the most out of your plan benefits. Favorites Find Medicare Plans Find Medicare Advantage Plans Find Medicare Supplement Plans Find Medicare Part D Plans Learn About Medicare New To Medicare Enrollment Open Enrollment.