A quarter of the people covered by traditional Medicare in 2015 had private supplemental healthcare also called Medigap that covered both Medicare's deductibles and costsharing obligations. The report offers a comprehensive view of the enrollment process for Medigap participants as well as analyzes consumers’ rights under state and federal law, if eligibility is restricted.

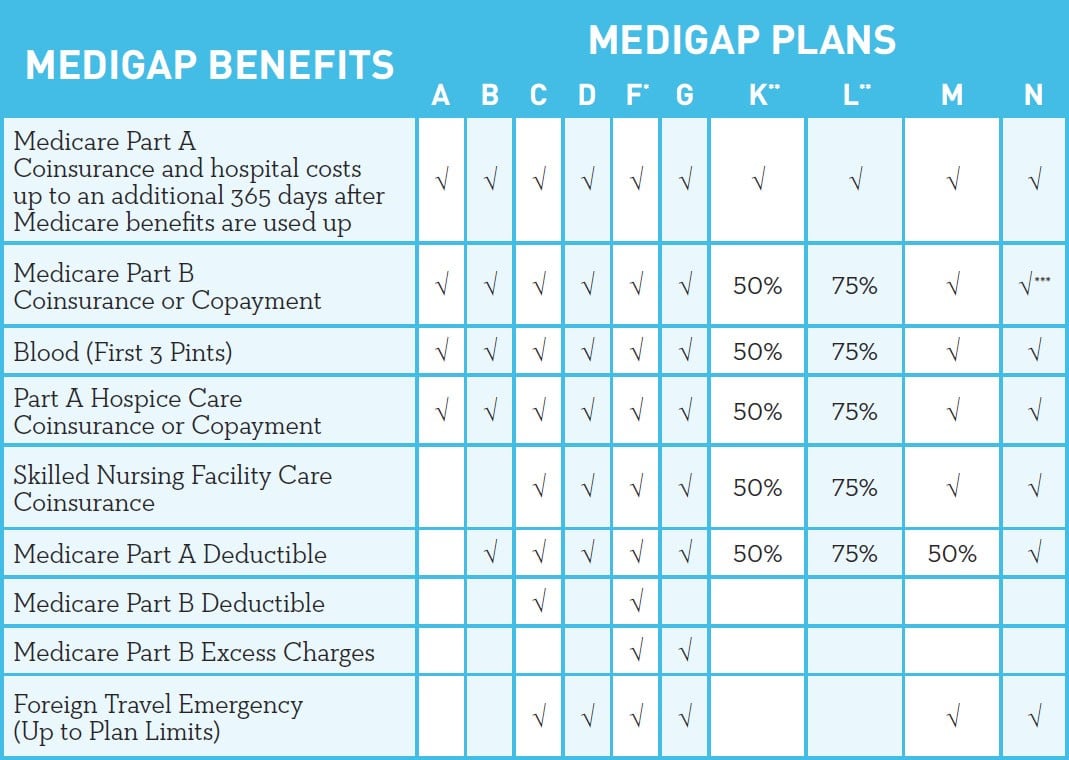

Medicare Supplement (Medigaps) plans are available to all beneficiaries by 2020. The simple-to-follow Medigap Comparison Table makes it easier to compare the plans. Find Medicare Plans for You Today. This table displays each of these 12 Medigap plans. It also shows what the plan covers once the original Medicare pays.

It is impossible to choose the right Medigap program. Depending on how well your plan fits your situation, a specific medical insurance policy will work for you. Medicare plan F is a popular plan for Supplemental Insurance. 41% of Medigas beneficiaries participate in Plan F.2. Plan F covers a much higher standard of Medicare costs in comparison with other Medicare plans. Plan F essentially covers nine Medigap standard benefits offered through a plan. Plan F premiums in 2018 are estimated to be $17.75 p/m. 1. Medigap Plan G has become second most commonly used Medigap plan and the plan grows rapidly. Plan G enrollment increased by 63 percent last year.

Every Medigap policy must comply with federal or state law that protects you. Insurance companies only offer you standard policy identified in the majority of states by the letter. Each policy has an equal basic but some offer additional benefits that you may need to decide what is appropriate for you personally. Medigap policy is based on standardized practices across Massachusetts, Minnesota, and Wisconsin. Companies decide the type of Medigap policy they sell, though certain state laws may impact what type of policy they offer. Insurance Companies that offer Medigap Policy:

In the interim, new Medicare beneficiaries who do not have Medicare coverage may not qualify for Part B deductibles. This plan cannot be offered by anyone new to Medicare until 1 January 2020. You can maintain a plan that covers the same two plan types before 1 January 2020. If you're already enrolled into Medicare and you are still eligible you might get another plan (Plan C or FR).

The above chart provides basic details on what the various Medigap coverages include. the insurance covers 100% of this benefit... the plan does not provide this benefit.

You are able to sign up for any Medigap plan anytime. However, the best time for enrollment is during your enrollment. If your application is accepted during that period carrier coverage will be denied. All of your Medicare and Medicaid coverage is available through Medicap. If your enrollment period is not available for the first two months of your Medicare Supplement Plan, the plan will continue to work. Medigap enrollment can be done throughout the year. All policies require answers to underwriters questions on health insurance in most states.

Don't confuse Medicaid Plan A with Medicare Part A and Part B. Original Medicare covers Medicare Part A hospitalization plan and Medicare Part B medical care plan. Medigap Plan B covers additional coverage provided by Medicare. Whatever your Medigap program, you decide you have a choice from any health care provider who accepts Original Medicare coverage. A Medigap approved physician is unlikely to turn you down because you've chosen a different insurer.

The Medicare Supplements Program is a comprehensive Medicare supplement program that offers the following services. Typically the plans are labeled using alphabetical letters and have a different set of benefits. F plans are available with higher deductible options. Plan N includes a new cost-sharing element.

As on the date of January 31, 2020, Medicare's new plan doesn't include the Part B deductibles anymore. This plan no longer provides coverage for Medicare users who joined on January 1, 2020.

We and the licensed agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program. Medicare has neither reviewed nor endorsed the information contained on this website.

Know Your Rights Provider Rights & Responsibilities Health Insurance Rate Increases Health Insurance Complaint Rankings Medicare and Medigap Insurance Long Term Care Insurance Medigap Plans and Rates SHARE Insurers Offering Medigap Insurance in New York State Medicare Supplement Insurance Carrier and Rate Look-Up Visit our DFS Portal and enter your zip code for a list of Medicare supplement insurance carriers and their current monthly rates.

This makes it easy to compare Medicare Supplement insurance plans because the main difference between plans of the same letter category will be the premium cost. Massachusetts, Minnesota, and Wisconsin standardize their Medicare Supplement insurance plans differently from the rest of the country. In all states, insurance companies that sell Medicare Supplement insurance aren't required to offer all plan types.

Deductible Some plans have deductibles. Copays A copayment may apply to specific services. Coinsurance The percentage of coinsurance varies depending on plan. Limits and Considerations Limits Most of the time, Medigap coverage has no network limitations and is available anywhere that Medicare is accepted. Things to Consider Some Medigap plans cover foreign travel emergency services. Once you are enrolled in a plan, it renews every year as long as you pay your premium and the plan is available.

What Are the Costs for Medicare Supplement Plans? Medicare Supplement Insurance plan premiums are sold by private insurance companies. This means that plan availability and plan premiums may vary. The average premium cost for a Medicare Supplement Insurance plan in 2022 is $128.16 per month. 1 The average cost of each type of Medigap plan can vary quite a bit from one plan type to another.

Medigap either continuously or annually, for all Medicare beneficiaries ages 65 and older Medigap is a key source of supplemental coverage for people in traditional Medicare Medicare beneficiaries can choose to get their Medicare benefits (Parts A and B) through the traditional Medicare program or a Medicare Advantage plan, such as a Medicare HMO or PPO. Roughly two-thirds of Medicare beneficiaries are in traditional Medicare.

The following 2022 Medigap plan chart compares benefits offered by the different plans in each type and provides detailed details about each plan. You can scroll down the chart for detailed information or plan details.

What makes Medigap plans so unique is the low availability of the network. If you enroll in Medigap, you get free health care coverage where you want it. Besides taking advantage of medical benefits and travel costs, you should consider the benefits of a medical emergency. How to choose your Medicare coverage?