You probably know that Medigap plans were updated from 2020 including the Medigap Plan C. Plans C were canceled from January 1, 2020. You might be curious about how this change might affect your insurance coverage, and how much you will be billed for the benefit. What you must understand about Plan C is that Medicare Part C is not the same plan. Part C, also known as Medicare Advantage, is an entirely separate plan from Medicare Part C. Plan C is a widely used Medigap plan because it offers a lower risk.

New enrollment in Medicare Supplement Plan F was closed in 2019. However, if you currently subscribe to Plan F, you can continue that plan or change plan options. Medicare Supplement Plan F is one of 10 standard Medigap plans designed specifically to help reduce deductible expenses not covered by Medicare Part B and A. Standardized means that these plans offer similar services regardless of where you buy, without exceptions.

The original design of Medicare Supplement Plan F was to provide the largest coverage for all 10 standard Medicare supplement plans. Plan F will still be available to individuals that had Medicare eligibility on December 1, 2020. Anyone eligible for Medicare after January 1, 2020, can't apply for Plan F.

Medigap is Medicare Supplement Insurance. This insurance provides a way for patients to fill the gap and sell privately. Medicare provides for many, if not all, health care costs associated with it. Medicare supplemental coverages such as Medicap may pay some of the remaining medical bills.

This Medicare Supplement Plan is the largest and most comprehensive standardized Medicare Supplement program in the country. This is going to end in 2020.

Plan F offers two types of coverage options: the most standard option carries a monthly cost similar to the Medicare supplement. Other choices include higher-deductible plans which have lower monthly premiums. With a higher-deductible Plan F option, the insurance company has the obligation to remit a total deductible amount until it covers reinsurance costs. The annual maximum deductible for the F plan is higher. The federal government is also advising consumers on how much their deductibles should increase according to the Social Security laws governing the program. Between 2020 and 2021 this figure is 2.5% and the 2021 tax deduction is $2490.

Unless you became eligible before December 31, 2018 and you're already in Medicare Supplement Plan F, your plan should remain the same. Once you enroll in an insurance supplement plan, you will be provided with renewable coverage if the insurance premiums continue. If you have not changed plans or have not been paid you can't withdraw the plan. If you were recently eligible to receive Medicare prior to 1 January 2020 and decided to delay coverage, you can still enroll into the Medicare Supplements plan. However, you may incur penalties for Part B and Part C that add extra premium fees to your plan.

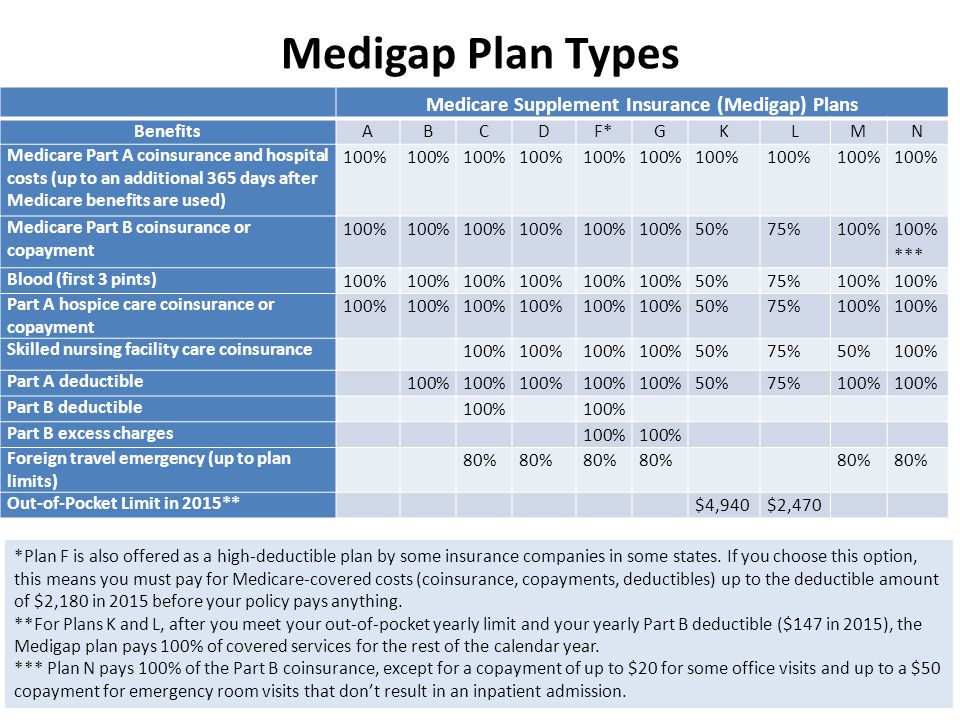

Medicare Supplement Plans F are specific types of the Medicare Supplement Plans. Medicare supplements or Medigap can help cover costs related to Medicare Part A and Part B. These costs can range from the deductible to coinsurance and copayment. Medicare Part B and Part A are the original Medicare Programs of the United States. Medicare supplements have also been referred to by letters like plan A, but are not similar. The plan includes the following: Medicare Supplement Plan F. Each standard plan offers the same basic benefits.

Plan F is among the 10 standardized insurance policies available. It's the largest package and includes all of the available benefits. In 2016, Medicare Supplement plans were discontinued for those that had been in Medicare eligibility after December 1. Plans F are also accessible to anyone who is enrolled on a prior account. If you are eligible to apply for Medicare on or before February 1, 2020 but have decided not to renew, you are still eligible for Plan F.

It'll remain pending for those who have recently entered Medicare. MACRA was a 2015 law that prohibited Medicare Supplements and Part B deductibles. In addition to Medicare Supplement Plan F coverage, Medicare recipients are required to apply for Part A coverage unless a Part A payment period has already expired. However, beneficiaries enrolled under Plan F coverage may continue their coverage or opt-out of the Plan F.

You are not entitled to enroll in a Medicare Plan if you were deemed to be eligible to receive Medicare prior to December 31, 2019. Until that time however you are still eligible for Medicare Supplemental Plan F. You can also retain Plan F if you are currently in the plan as well as pay your daily Premiums.

The following are the benefits available with Medicare Supplement plans. “Yes” means that Plan F covers 100% of this benefit. Medigap Benefits Click to view expanded chart Covered Under Plan F Purpose of Coverage Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits are used up Yes If you're admitted to the hospital for more than 90 days, you pay $742 in coinsurance for each “ lifetime reserve ” coverage day you have.

This period automatically starts the first month you have Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. and you're 65 or older. It can't be changed or repeated.

Medicare Supplement Plan f has been designed as the only plan which provides coverage for Medicare Supplement benefits. These services are offered by Medicare Supplements. Yes. This indicates full plan F cover for all the benefits.

Is that true? From 2020, Medicare Supplement plans paying Part B deductibles will be banned for newly qualified patients. These changes were made under the 2015 Medicare Access and CHIP Reauthorization Act (MACRA).

The Medigap Plan was created by private companies and specializes in helping with out-of-pocket expenses (e.g. copays and coassurances) not outlined in Part A or B. These plans can be bought anywhere in the U.S. The plan is designed for.

Medicare Plan G won't disappear. It is very unclear which Medigap plans were left and which are presently in operation. Please be sure Plan G is not ending. Keep the plan.

After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

Some of which include deductibles, copayments, coinsurance, etc. Medicare Supplement Plan G will be $143.47 monthly for 65-year-olds and the average Medicare Plan F will cost $1184.93 monthly. You can compare the cost of Medicare Supplements with other plans on the Web.

. Medigap pros: nationwide coverage coverage for many medicare costs additional 365 days of hospital coverage some plans offer coverage while traveling abroad some plans cover extras like fitness programs wide range of plans to choose from Medigap cons: premium costs can by high prescription drug coverage is not included dental, vision.

It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you're responsible for the difference. for covered health care costs. Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan.

Unless you bought a Medigap policy before you needed it, you'd miss your open enrollment period entirely. Outside open enrollment If you apply for Medigap coverage after your open enrollment period, there's no guarantee that an insurance company will sell you a Medigap policy if you don't meet the medical underwriting requirements, unless you're eligible due to one of the situations below.

Elledge is a contributor to International Living, supporting Medicare beneficiaries with articles, podcasts, and Q&As. “A licensed seniors market insurance agent in Arizona and New Mexico, Elledge has helped thousands decipher the intricacies of Medicare rules and regulations, enabling them to make educated selections for their health care needs.

These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost.