The age is one of the factors a health care company uses as the basis for the calculation of its premium for a particular plan. Your Medigap premium represents what you pay monthly if you have an active plan. The premium for Supplementary Healthcare Insurance increases with age. If you compare Medigap prices, you may consider how your age affects your health plan premiums. The Medigap Plan G is divided into two segments according to age ranging from 65 years to 85.

When searching for a Medicare Supplement plan, a big question may come up: What is the average cost for Medicare Supplement plans? Unfortunately, there aren't answers to these questions. How should I choose a Medicare Supplement? Additionally, these cost differences in Medigap plans can vary depending on who receives them.

All Medicare Supplement insurance policies must follow federal and state legislation that protects you and must clearly be labelled as "Medicare Supplement Insurance." Insurance providers can sell you standardized policies referred to by letter. All policies offer similar basic benefits, although some have additional benefits, and you have options for which one suits you. In Massachusetts Minnesota

Wisconsin Medigap policies are different from those in Massachusetts. The companies decide which Medigap policies they want to sell, though certain states may have an impact on the policies that they offer. Insurers that offer Medigap coverage:

What is the average price to enroll in Medicare? Medicare plans cost around $120 – $364 a year in 2020 for a 66-year-old. The Medicare Supplement policy offers several options as all of the insurance companies use a unique pricing method for their products.

There are some advantages to Medigap plans. Have to navigate all kinds of plans. No prescription coverage.

Although comparing Plans F and G has been shown to have varying premium rates, the differences are small in the benefits. Generally, Plan F covers each of the nine possible benefits offered under standardized Medicaid plans. It doesn't cover Medicare's deductible, but is available to cover Medicare's entire out-of-pocket costs that are covered in Medigap Plan F. Medigap plan E and plan G were the two best-received Medigap plans. Part B deductions will be averaging $233 annually through 2022. This $233 annual tax is about a little more than $9.00 a month.

Insured motorist insurance rates are determined directly by your insurance provider's premium. Your age doesn't always determine your premium. Other insurers can increase the cost of insurance yearly. Bob Glaze, an insured professional, explained how age affects the cost of Medigap. In the following.

During 2020 Medicare supplemental insurance cost was about $800 annually, according to Senior Market Sales, the leading insurer for health plans.

only after you've paid the deductible The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How to compare Medigap policies Medigap & travel Costs of Medigap policies Each insurance company decides how it will set the price, or premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. , for its Medigap policies.

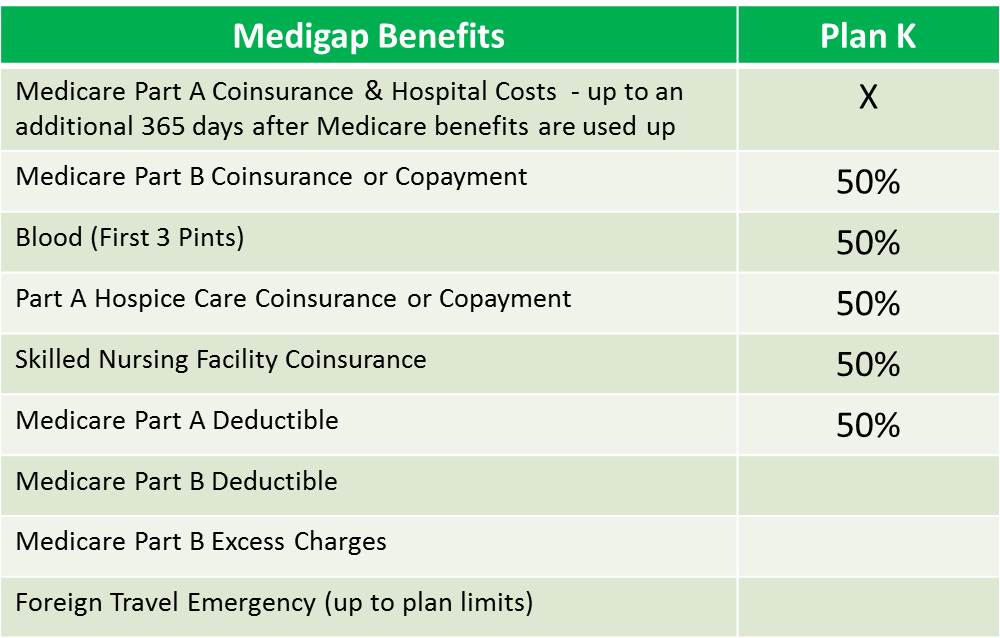

These are subject to change. Call us for your accurate, personalized quotes today. Medicare Supplement Plan K comes with 50% cost-sharing, making the Medicare Supplement plan costs such as premiums lower than most. It also doesn't cover the Part B deductible or excess charges.

What is the Average Cost of Medicare Supplement Plan G? The most popular plan for newly eligible beneficiaries is Medicare Supplement Plan G , as they can no longer enroll in Medicare Supplement Plan F. The second-most comprehensive Medigap plan, Medicare Supplement Plan G covers everything that Plan F does, except for the $233 Medicare Part B deductible.

You can see from the table above that your Medicare Supplement costs may be higher at 75 compared to 65 years old. Medicare Supplement costs, including premiums, are always subject to increase every year, but you will likely start with higher Medicare Supplement premiums the older you are when you enroll.

DFS Portal Medicare Advantage Plans Medicare Advantage Plans are approved and regulated by the federal government's Centers for Medicare and Medicaid Services (CMS). For information about what plans are available, plan benefits and premium rates, contact CMS directly or visit CMS Medicare website.

Community-rated Medigap plans With community-rated Medigap plans, every member of the plan pays the same rate, regardless of age. For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market.

Medigap premiums can increase over time due to inflation and other factors, regardless of the pricing model your insurance company uses. Compare Medigap Plan Costs in Your Area Bear in mind that the premium averages listed above are just that — averages.

Medigap supplemental insurance policies can provide full or partial coverage for: Some out-of-pocket costs not covered under Medicare Part A and Part B. Coinsurance or copayments for Medicare Part B . Part A coinsurance and hospital costs for an additional 365 days after Medicare benefits are used up. Skilled nursing facility care coinsurance.

Some plans charge higher premiums than others. Plans with higher premiums generally provide more comprehensive coverage. Insurance Company Some insurers may offer special discounts to married couples or nonsmokers.

We and the licensed agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program. Medicare has neither reviewed nor endorsed the information contained on this website.