Both Medicare and Medicaid plan options offer additional advantages for patients in the Medicare system. The two forms of plans are different. Medicare Supplement insurance is a medical insurance policy which provides medical treatment to individuals in their first month of hospitalization. The plan is a government funded program, but private insurance that covers the expense of traditional insurance. Medigap plans include 20 per cent Part B coinsurance you'd otherwise pay for medical care and allied medical expenses.

Medicare is an age-specific health insurance policy designed by Medicare. The product is an alphabetical soup of parts containing different types of coverage. Medicare is facing some problems, some of them not being fully covered. If there is a gap, you can enroll in either Medicare Advantage or Medicare Supplement Plans. For your convenience we provide unbiased insight into the costs, availability and selections of these products.

Our selection process is independent and advertisers have no influence. We can compensate you for your visit to our recommended partners. See Advertisement Disclosure for details. All Medicare patients have a choice in mind. What's the best Medicare Advantage plan for supplementing the current Medicare plan?

Medicare Advantage plans look like private healthcare plans. The majority of services are covered with just an extra small cost of a copayment. Plans can provide hMO or PPO networks and each plan limits the total cost of the plan annually to be paid. Depending on the type of program the benefit is different. They generally have prescription drug coverage. Some need to be referred to an expert and the others aren't. Certain will pay a portion of the care outside of network whereas others can be paid for by physicians within an HMO or PPO network. Some of these can be found in Medicare Advantage plans. The choice of plans that offer minimal premiums is important.

List the most important things you want to consider when looking at Medicare Advantage plans / Medigapping Plans. Medicare Advantage plans Doctors and hospitals You may need to use providers from other plans. Referrals: You might be asked to make recommendations and need network experts according to your plan. Coverage for travel. Non-emergency care may be dependent on a service plan. In most cases, emergency treatment can be covered on a domestic flight and often overseas. Registration. Typically, you may be enrolled for a certain period of time during the year or switch to another Medicare Advantage program.

Available by private Medicare insurance companies, the Medicare Advantage (Part C) is sold by such name companies as Aetno, Humana, and the Kaiser Foundations Medicare plans. These policies may have zero insurance compared to other prescription drug plans. Medicare benefits plan covers hospitals and doctors, and may also include prescriptions and services that aren’t covered under the Medicare program. The Medicare Advantage plan is the most popular in the United States in 2019. Most Medicare Advantage plans are managed by health maintenance organizations as well as PPO insurance companies.

Medicare Advantage plans offer a wide variety of health and dental insurance options as well as coverage for items and services not covered by Original Medicare. These include eye, dental and hearing health insurance programs such as fitness clubs and gyms. Plans include transport to doctor appointments and adult daycare services, according to Amanda Baethke, executive director at Aeroflow Healthcare of North Carolina. The plan provides additional benefits for chronically ill persons. The company also offers COVID-19 vaccination transportation to Medicare benefit users.

About 55 million seniors (65 and older) who are covered by Medicare have Medicare Part AA and AB which cover health care, doctors and surgeries.5. About 81% of the Medicare beneficiaries also provide coverage through Medicare Supplemental Insurance, Medicaid or employer-sponsored insurance, whereas over 50 million of them cover Medicare Part D prescriptions.5. Medicare Supplement Insurance or Medicare Supplement plans have no connection with Medicare or other programs or services. While that may seem expensive, it offers many advantages.

Medicare Advantage is a replacement for the Original Medicare plan. They are usually supplied by private insurers and include most of the coverage provided by Original Medicare, but offer extra benefit for things Medicare doesn't. Added benefits may be included in health insurance and hearing, dental, eye and dental services. Medicare Advantage plans are available for people who already have health care insurance under Part A or part B. When enrolling your insurance coverage is replaced by Part A or Part B coverage.

Many Medicare benefits offer no premium. You should always examine their options before signing up. According to Medicare, the Medicare Part B premium is about $165 or more per year for a single person enrolled in a Medicare Advantage program. In the case Medicare Part B coinsurance is $366. The premium under Medicare Advantage is generally 20% of the Medicare-approved amount for many services such as durable healthcare equipment.

Medigap helps bridge gaps in Medicare coinsurance, copayment, and deductibles. Medicare covers 80% of the medical services you receive as part of the program including doctor visits, outpatient services. Medigp plans can pay for 80% of your gap you need out of your pocket. Medigap does not provide Medicare Part B or Medicare Part A coverage. This means you cannot use Medigap for any medications you need.

Typical monthly premiums on health insurance are between $150 and $400 depending on your state and your insurer. As for the Medicare Advantage plan, 65-year-olds are able to save up to $648 a year under a Medicare Supplement plan if the plan is the least expensive option offered. “The private and public plans are able to improve efficiency, effectiveness and fairness,” he says.

Medigap plans offer different benefits based in part upon the individual's medical condition. Medigap plans offer extra coverage to Medicare users who enroll under Medicare, although the plans do not provide for drugs. In contrast, Medicare's supplemental plan also has an additional benefit, including prescription drug treatment, vision, dental, hearing, vision and other health services.

Medicare Supplement plans (commonly referred to as Medicare Supplement plans) are offered by private insurers as an aid to fill in gaps between Medicare and Medicaid. 34% of the people who had original Medicare were covered by Medicare Supplement plans. The program offers a variety of standardized plans including co-insurance and co-pays and includes all letters.

Medicare Advantage is a cost saving and convenient option for people with limited healthcare costs. Medigap can help when you've suffered from serious illnesses that require costly care costs. Talk to the insurance companies and ask for their recommendations. You must select carefully to ensure your specific health insurance coverage.

In addition, the Medicare Original Part A (hospital insurance) includes a Part B (medical insurance). You could combine this coverage with Medicare Part D prescription drugs or Medigap supplements plans. If you enroll for Part A and Part B Medicare requires a separate payment for each supplemental policy.

Find your plan available within your zipcode for an initial look around. Once you're registered with Medicare.gov, you can enter the name of your medications and you can use this handy site to compare plan premiums, deductibles and Medicare stars ratings. If you do not take prescription drugs, check out the prescription drug list. All insurance policies must cover all prescriptions that Medicare customers use as a whole. When compared to a prescription drug, you will find insurance coverage that covers the drugs in this Donut Hole coverage gap, which kicks in after you have paid $4430 for covered drugs in 2022.14.

Medigap is a private plan, available via insurers and brokers, but no longer available on medicare.gov. Each is labelled with a different uniform coverage set. The plan F offers the option for high-deductibles in several states.15. The plan also offers travel medical services for emergencies when traveling abroad. Medigap is standard and does not have any ratings. Consumers are able to easily compare insurer pricing of every type of plan to choose a more affordable plan. In addition, Medicare plan owners who have already purchased a Medigap plan will have no option to cover their Part B deductible.

With a Medigap Plan your doctors can consult with anyone that is accepted by Medicare. By contrast there are less options to choose between doctors with a Medicare-based plan. You can no longer get Medicare benefits through Medigap. You can switch between these options.

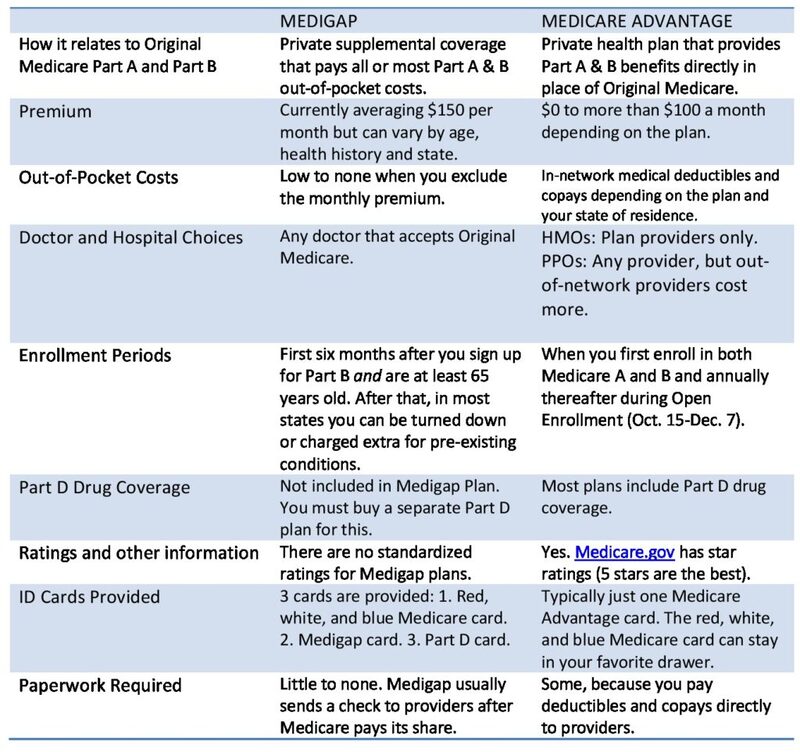

Medicare Advantage and Medigap offer a number of different options depending on what's best for you. You should compare Medicare coverage carefully so as to find a coverage that best reflects your financial situation. Comparisons between Medicare Advantage vs. Medigap. Keep Your Health at your fingertips. Make it a point to take care of yourself. Get free health care assistance for a healthy life.

A Medicare Advantage plan is advisable for people who have deductibles which protect you from huge expenses. Medicare and the Medigap Insurance Program generally allow for more options when receiving services.

Those without are designed for enrollees who have drug coverage from a previous or present employer or another source. You won't have to buy a separate Part D. Keep in mind If you enroll in a Medicare Advantage plan, you cannot use a Medigap policy to cover your out-of-pocket expenses. So you'll have to pay any deductible, copays or coinsurance yourself. It's illegal for an insurance company to sell you a Medigap policy if you're enrolled in a Medicare Advantage plan.

Medicare Advantage has a large disadvantage because it has a network based on closed providers that restricts your ability to choose a physician to use. Medicare benefits cost is also generally determined mainly by how long your needs are for health, and therefore more difficult in budget.

Consumers can confidently compare insurer's prices for each letter plan and simply choose the better deal. As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren't allowed to cover the Part B deductible. Before 2020, most people (66%) who bought Medigap policies chose Plan F , which gave the most comprehensive coverage, including paying for the Medicare Part B deductible ($233 in 2022).

Medicare Supplement or Medicare Advantage plan is a single option that has no monthly premiums. The Medicaid Supplement program adds coverage for Medicare in exchange for lower or no upfront cost.

You also may have to pay a monthly premium to the Medicare Advantage insurer. The average premium for Medicare Advantage enrollees is $19 in 2022, but more than half the plans charge no premium. You can compare the premiums, copayments and coverage for Medicare Advantage plans in your area, including copays for your drugs, by using the Medicare's Plan Finder.