Almost every American is eligible for Medicare Part A but not everyone gets the coverage. A further part of this program may require payment from you out of pocket. In an effort to help you understand the possible cost, the Medicare component explains how much the different cost components should cover you. We will also look at whether you can cover the cost of Medicare through Social Security or other forms of payment.

You will likely receive monthly Social Security payments from the federal government. Can a Social Security premium be deducted? It's true that Medicare premiums will automatically be taken out every month and it will help reduce the hassle of paying the payments manually. Below you can find an overview of all Medicare benefits in relation to Social Security.

Depending on your Social Security retirement benefit, your Medicare benefit may automatically be deducted. The premium amount will go directly to the credit card before the checks are delivered to them. It is usually applied to part B premiums and is available for other parts of a part C and a section d plan.

Benefits and Resources Housing Insurance Taxes and Financial Abuse Employment Health and Wellness Nutrition Chronic Conditions and General Health At-Home Health Caregiving About Us Who We Are Research and Reports Authors and Contributors Home Medicare Can You Have Medicare Premiums Deducted from Your Social Security Check? Can You Have Medicare Premiums Deducted from Your Social Security Check.

You'll get a bill from Medicare every 3 months, which you can pay online or by mail. Medicare Part C and Part D Medicare Part C (Medicare Advantage) and Medicare Part D (prescription drug coverage) plans are sold by private companies that contract with Medicare. Medicare Advantage plans cover everything that Medicare parts A and B do and often include coverage for extra services. Medicare Part D plans cover prescription drugs. Part C and Part D plans are optional.

In some cases, you may not be eligible for premium insurance. You will pay an extra fee in Part B, which is optional. Social Security benefits are automatically deposited into the accounts of the taxpayer who receives benefits from their employer. Medicare pays you directly if you do not collect Social Security. If your plan requires supplemental premiums for part C or part D, please contact us. In some instances, Social Security can be repaid for the premiums a person has paid out of his or her paycheck, although this is not automatic. If no benefits are paid, Medicare pays the payment for the Part D portion and Part C.

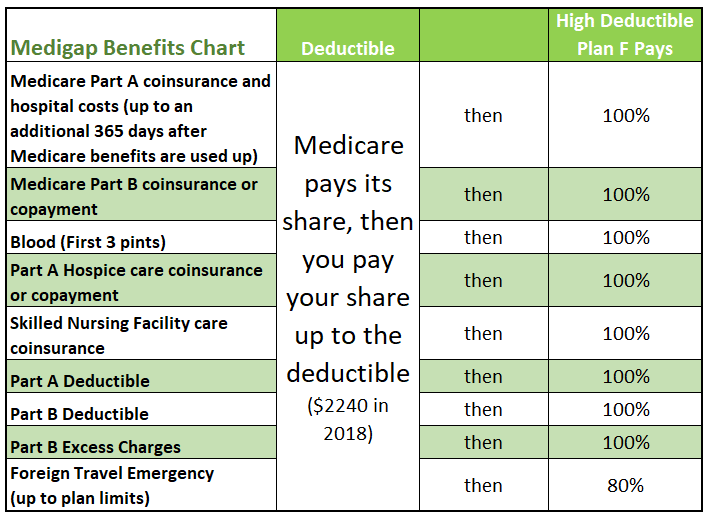

There are many Medigap insurance companies, including Aetna, Anthem Blue Cross Blue Shield, Cigna, Humana, Mutual of Omaha and UnitedHealthcare. There are also regional and local companies that offer Medigap policies.

Those who have Social Security benefits can deduct their Part B payments immediately. Those that aren't eligible for Social Security are given Medicare payments that need to be paid via:11 if your bills have difficulty resolving the problem. Medicare Advantage and Part D premiums do not automatically deduct your benefits and you will usually be billed by the insurance provider directly. You can request this change by calling your insurer.

Almost all those receiving Medicare coverage will automatically be charged. Let me show you how much you can pay in checks.

Filed Under: All About Medicare , Blog Posts Tagged With: Are Medicare Premiums Deducted From Social Security , medicare part b , medicare part b premiums for 2020 , social security deductions for medicare premiums Are You Confused About Medicare and Having Trouble Choosing the Right Plan.

If you don't receive benefits, you'll get a bill from Medicare for Part D and from the insurer for Part C. Medicare Costs You Can Deduct From Social Security Most people who receive Social Security benefits will have their Medicare premiums automatically deducted. Here's a closer look at what costs you can expect to see taken out of your checks. Medicare Part A Medicare Part A covers hospital stays, skilled-nursing-facility care, hospice care, and home health visits.

Medicare Part A will be premium-free for most users, but Medicare Part B has a premium. Throughout the Part C program, many Medicare Advantage plans require no monthly premiums, although some do. Original Medicare or Medicare Advantage Medicare beneficiaries can decide between Original Medicare and Medicare Advantage for health insurance coverage.

Prescription drug plan costs vary depending on the plan, and whether you get the Extra Help , also known as the subsidy, with your portion of the Medicare prescription drug coverage costs. If you're a higher-income beneficiary with Medicare prescription drug coverage, you'll pay monthly premiums plus an additional amount. This amount is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

Medicare-insured Americans receiving Social Security can pay premiums by automatic deduction. Without Social Security income, Medicare sends a bill every 3 months to those enrolled in Part B only. With Part A only, Medicare sends a monthly bill for premiums, if any. For private Part C or D, insurance premiums can be directly paid to the insurance company.

We recommend consulting with your medical provider regarding diagnosis or treatment, including choices about changes to medication, treatments, diets, daily routines, or exercise. This communication's purpose is insurance solicitation. A licensed insurance agent/producer or insurance company will contact you. Medicare Supplement insurance plans are not linked with or sanctioned by the U.S. government or the federal Medicare program.

If preferable to pay from a savings or checking account, Medicare Easy Pay is a free service to help make payments easy and regular. When selected, Easy Pay can also deduct premiums for a Part D policy or Part C Medicare Advantage plan. Comparison shopping is a great way to select a plan from the Medicare Advantage program in order to get a true picture of costs and benefits.

This agency may be the Centers for Medicare & Medicaid Services or the Railroad Retirement Board. How Social Security Determines You Have a Higher Premium We use the most recent federal tax return the IRS provides to us.

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don't have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) to make a correction.

“People often overlook the Medicare Part A and B premiums they pay because they often don't write a check; it just comes out of their Social Security check,” said Steber. “It doesn't exactly pop out at you.” You'll receive an SSA-1099 from the Social Security Administration which will have a summary of the Medicare premiums that were withheld from your Social Security check during the past year.

Yeah. The Social Security Administration automatically deducts your Medicare Part B insurance payment when your benefits exceed $200,000 per month in the first year of your coverage. Part B premiums will be $170.10 each month from 2020.

You can get the Part C or Part D plan premium deductible for Social Security. It is necessary to call the supplier who offers the service for setting up it for free. The automatic payment process could take several months.

Most of the expense is deductible unless you have a personal deduction. These include Medicare premiums, long-term care insurance premiums and other prescriptions and hospital costs.