It is possible you change or convert to the Medicap plan anytime. If you want more money and want to save time, we recommend changing your Medigap plan to one that provides enrollment assurances known as Guarantees. Those factors can help to keep costs low if the doctor has a medical history. Medigap enrollment protection protects your enrollment if you move or lose insurance. Medigap is offered in a number of locations. Currently, California allows for annual changes to Medigap Plans owing to expanded regulations, although others can' t provide as much flexibility.

Find out how to change Medicare supplemental plans. Medicare Part D and the Medicare Advantage plan offer annual Open Enrollments for Medicare recipients between November 15 and December 7, which allows seamless switching from one plan to another. In contrast, Medicare Supplement (Medigap) plans have a no-transfer cycle. It's easy for Medigap to switch providers. However, this is true, here is a complete information guide to switching plans for seniors over 65 who are not currently on Medigap.com.

Before deciding to switch to Medigap plan, there are several important things to learn. How do Medicare plans work together? First, changing Medicare insurance policies is difficult when there are no insurance agents on your side. Agents can help guide you on this journey; they are a valuable resource to any beneficiary. Interested in switching insurance? Call an insurance specialist for more information. You have the option to change your plans. No recipient stays on the program.

Medicare can prove a bit confusing. Many problems are difficult to understand for Medicare. What is causing confusion is whether you can change your Medicare Supplement plan or enroll in Medigap. It's distinctly different from Medicare's rules on the enrollment and change in Medicare Supplements. Tell me a little more about these different things.

In determining Medicare Advantage or Medigap, it is usually important to consider access to a medical provider and the types of costs incurred. The Medigap plan is typically more expensive, but will also cover a greater percentage of your medical bills and is also a decent option for people who want comprehensive medical attention in the long run. Medigap plan offers more options for doctors as you may be going into any doctor accepting the Medicare program. So it's the perfect choice when traveling frequently or if you own a second home. The Medicare Advantage plan provides affordable monthly payments and offers benefits for people with dental and other health care needs.

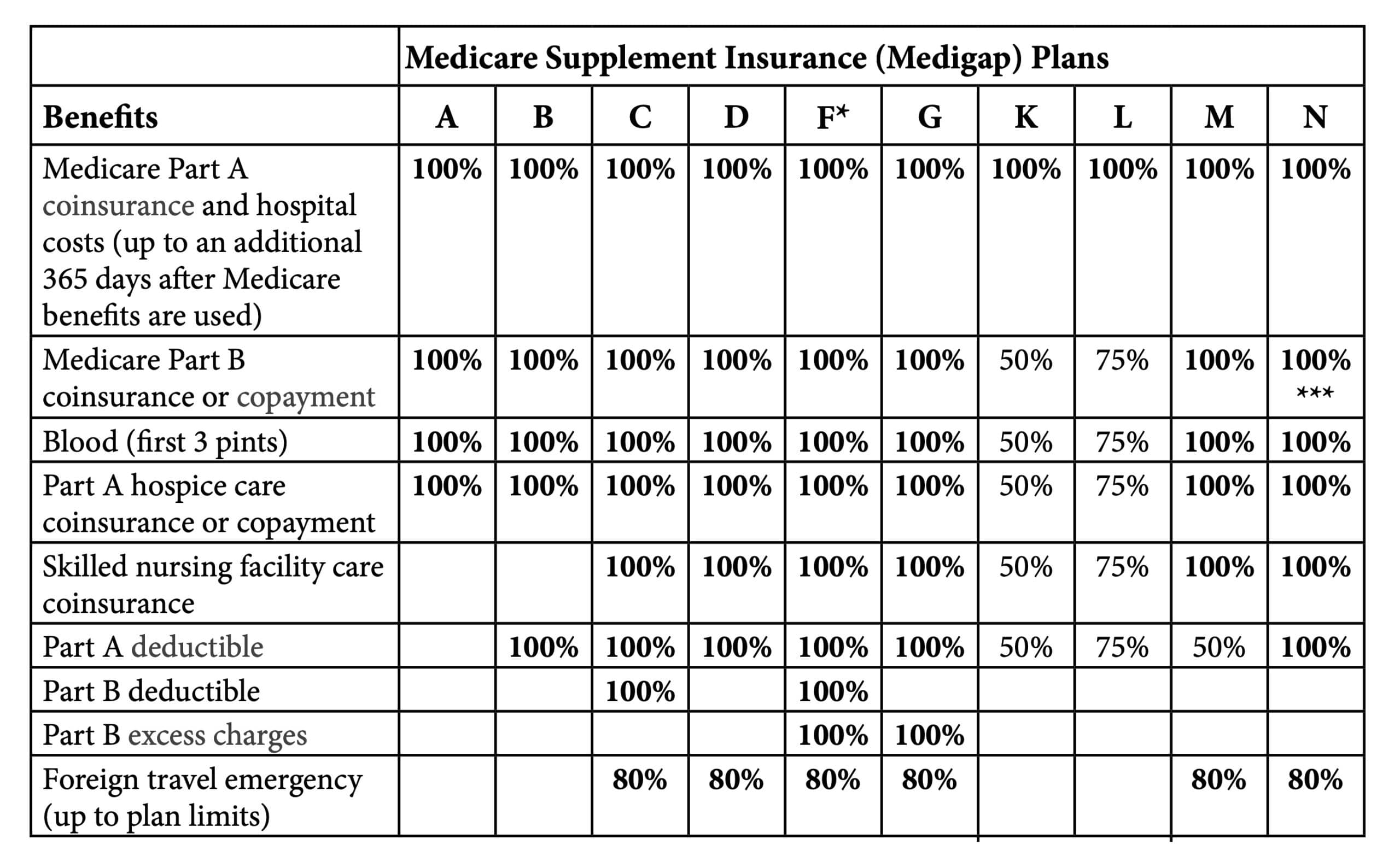

Medicare is an integrated Medicare plan that covers the majority but not all of your medical services. Those that are not covered include Medicare deductibility, co-pay, co-insurance, and other charges. These Medicare Supplement Plans provide a way to cover the cost associated with the Medicare Supplement. Some Medicare Supplement plans reimburse coinsurance for Medicare Part A and Part B. Many medical insurance companies also provide for Part B and Part A deductibles. This chart shows the Medicare out-of-pocket costs for a different type of insurance plan compared. Medicare has been provided to the public.

Those looking to get Medicare Advantage can change their Medigap plans at any time through contacting their health insurance provider and making a payment. In many countries, you have to answer medical questions and it is possible that you are denied treatment by the doctor because you have preexisting conditions. Although some insurers may require a little medical assistance to get their policy approved, some require fewer. If you are not covered by a guaranteed switching period, call the 800-930-7956 number to find an effective option that best suits your situation.

This period begins the month after a beneficiary turns 65 and signed up for Part B. During this time, you can enroll in any one of the 10 standardized plans without going through medical underwriting. This means an insurance company can't turn you down or charge you more if you have a pre-existing health condition. As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period.

The list above shows just a few of these situations. For more information, see this publication from the Centers for Medicare & Medicaid Services. You have an older Medigap policy that's no longer sold You may wish to reconsider switching plans if this is your sole reason for changing plans. You don't have to change plans just because the one you have is no longer offered.

You should be able to keep them once you relocate to Florida but check with your insurance provider first as Massachusetts has some unique rules regarding Medicare Supplemental insurance. If you were not able to keep them for whatever reason, then that would trigger a special enrollment where you could sign up for a plan in Florida without Medical underwriting.

But if you do change it, you could face some restrictions that didn't apply when you originally signed up. Can I Change Medicare Supplement Plans? Policies have a six-month Medigap Open Enrollment Period . This period begins the month after a beneficiary turns 65 and signed up for Part B. During this time, you can enroll in any one of the 10 standardized plans without going through medical underwriting.

What Are Guaranteed-Issue Rights? The main way to avoid medical underwriting is if you have a Medicare Supplement insurance guaranteed-issue right . Some guaranteed-issue rights occur when: Your Medigap insurance company went bankrupt or ended your policy through no fault of your own. Your Medigap insurance company committed fraud and you are canceling your policy.

Related Articles Changing Medicare Supplement Insurance Plans When Can I Cancel My Medicare Supplement Insurance Plan? Medicare Supplement Insurance Enrollment Find Plans in your area instantly! ZIP Code Your ZIP Code allows us to filter for Medicare plans in your area. County See Plans Related Articles Changing Medicare Supplement Insurance Plans When Can I Cancel My Medicare Supplement Insurance Plan.

If you want a new MediGap plan you have the right to have it if it's a new one you need it for. Learn how to switch Medigap plans using an insurance professional's guidance.

If you bought your policy before 1992, your policy: Might not be a guaranteed renewable policy An insurance policy that can't be terminated by the insurance company unless you make untrue statements to the insurance company, commit fraud, or don't pay your premiums. All Medigap policies issued since 1992 are guaranteed renewable. May have a bigger premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

Some of the advantages of Medigp are: Added monthly costs. The difficulty of finding the different type of the plan. Medications are not covered under Plan D.