In a recent TV show Beat the clock the contestants must complete their task as the clock ticks off. It is the same challenge as signing up for the Medicare Supplement without penalty or Medicare Advantage program without inconvenience. Taking out supplemental insurance is easy as is Original Medicare. When you turn 65 in your 60s or older and are a Medicare eligible person, Medicare does not provide you with supplemental health coverage for the following six months. Those periods are known as Medigap Open Enrollment periods. In such time insurance companies will be required to give a plan with an affordable cost regardless of a medical history.

Medicare also covers hospital health insurance as an auxiliary insurance plan for those 65 or over and those under 65 with special disabilities ESRD. The program also offers optional prescription drug coverage. You can get Medicare at any age if you qualify. Medicare is also able to pay some costs but not all. In many cases, they have non-refundable copayments and deductibles and do not cover international medical costs. In order to limit these charges, you can enroll in Medicare Supplements. However, depending upon the date of the request, your insurance can be denied.

Most American people can join Medicare after they reach the age of 62 and meet other requirements, including being disabled Amyotrophic Lateral Sclerosis or Lou Gehrigs disease. One popular form of insurance in Medicare is the Medicare Supplemental plan or Medigap. Medigap plans cover the costs you incur from outpatient medical care like deductible payments, deductible copayments, etc. During any given year you are allowed to apply for Medigap plans.

Depending on their state, Medicare beneficiaries who miss these windows of opportunity may unwittingly forgo the chance to purchase a Medigap policy later in life if their needs or priorities change, or if they choose to switch to traditional Medicare after several years of being in a Medicare Advantage plan. The brief provides new national and state-by-state data on Medigap enrollment, and describes federal and state-level consumer protections that can affect seniors' access to Medigap.

There are many factors that prevent you from receiving Medicare Supplement insurance. Not every carrier imposes similar rules on preexisting conditions. One insurer could refuse to cover a patient if their heart attacks occurred 10 years prior. A third carrier might be willing to accept your heart attack. If you are denied by an airline there's another option available. There are some preexisting health problems that may affect your eligibility for Medicare Supplement plans during Open Enrollment periods. The following is an example of this. Among the conditions cited are the following:

If you have a Medicare Supplement plan, then you will be eligible. Your Medicare Supplement Open Enrollment period offers you an enrollment period of 6 months for Medicare Supplement plans. All new enrollments begin the first day the Medicare Part B is activated. During this time, an insurer will no longer give you coverage. After six months of the Medicare Supplement Open Enrollment period, you can still apply for Medicare Supplement Plans. The application deadline is not specified in which a plan is required when the patient is only eligible to have Medicare in full.

The majority of Medicare supplement policies are guaranteed to be renewed. If you pay your monthly premium, you won't be denied coverage once you enroll. In most circumstances your provider could reduce your insurance coverage after you sign up for a Medicare Supplement plan. You'll have no protection for unused Medicare supplements when your insurance carrier goes bankrupt in any way. In case you fail to make payments or lie to us you won't be eligible for another Medicare Supplement plan.

11 Medigap Guaranteed Issue Rights You may qualify for guaranteed issue in specific situations outside the Medigap open enrollment period by federal law. For example, if: You no longer have coverage because your Medigap insurance company went bankrupt Your employer-sponsored supplemental/retiree coverage is ending Your Medicare Advantage Plan or PACE withdraws from your area, you moved to a new place not covered by your plan, or you chose to withdraw from a plan during the trial period.

When you have a Medicare Supplement (Medigap) plan, you are no longer responsible for all of the costs Original Medicare leaves behind. However, if you do not enroll when you first become eligible, you could be denied Medicare Supplement coverage. Find Medicare Plans in 3 Easy Steps We can help find the right Medicare plans for you today Many health-related pre-existing conditions can result in a denied Medicare Supplement plan.

can I enroll in Medigap Plan N? If you are denied for Medicare Supplement Plan G through one carrier, they will also deny you coverage for any other plan letter. However, you may try applying to another carrier. How do I appeal a Medicare Supplement plan denial? If you believe you were wrongfully denied Medicare Supplement coverage, you can request a copy of your medical records. This will provide a reason for denial from the carrier you applied with. If there is an error on your medical records, you may have it corrected by your physician and apply again.

Unlike other insurers, Medicare for seniors may not provide Medicare coverage after the initial enrollment in Medicare for seniors if the health condition has already been diagnosed or if the health condition does not occur in a prior year.

It is generally not possible to deny your eligibility for Medicare Advantage. If the Medicare Advantage program approves your medical services before the enrollment period, the insurer can no longer deny you coverage because there's no medical requirement.

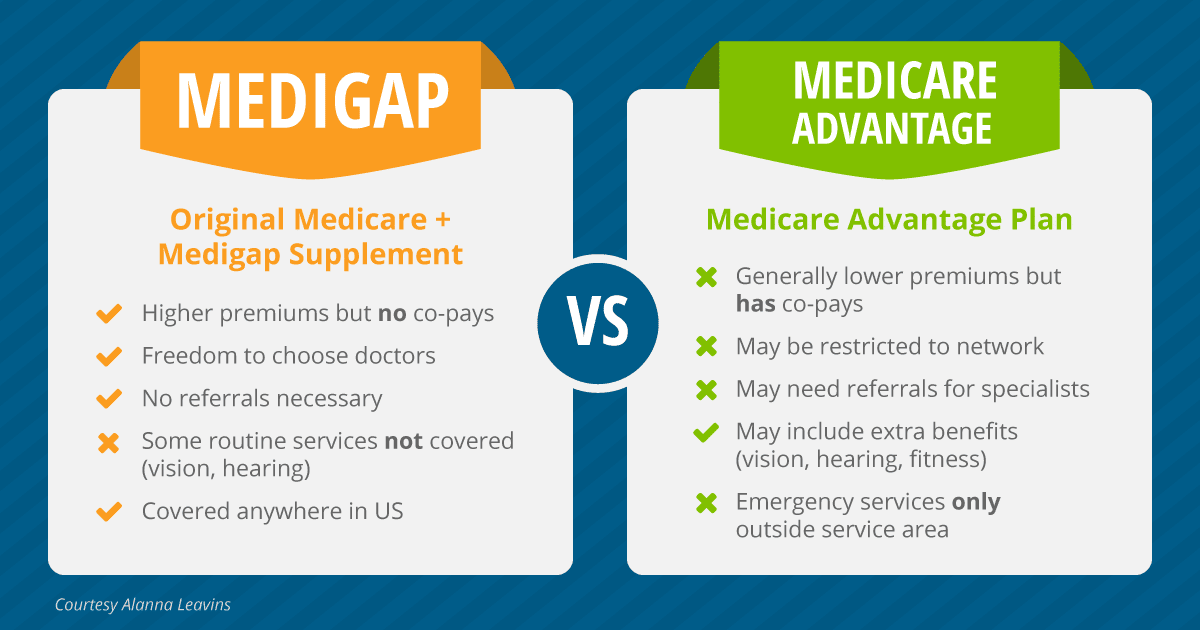

Medigap provides additional health care that is paid for by private insurers for costs not covered by Original Medicare. Medigap policies cover not everything.

In order to get Medicare Supplement Insurance (Medicaid) you must have Medicare Part A and Part B. The Medicare Supplement Insurance plan covers gaps in medical expenses which do not cover Medicare.