The best tips on how to modify an Medicare Supplement (Medicaid) program are found below. Changing your Medigap insurance policy is difficult, especially if you're not having a broker. They can guide you and are very useful resources for people who have Medicare. Can I switch to supplemental health insurance? It's all right? How does one get a plan with a low premium? Below is an overview of how to make changes to a Medicare Supplement plan.

You'll just have to answer health questions if you're outside your 6-month Medigap Open Enrollment Period . As long as you're overall healthy, you should not have any issue switching plans. Now, if you have a Medicare Advantage plan through Blue Cross Blue Shield , then you'll have to wait until one of the next annual enrollment periods to make changes. You can make changes either during the annual Medicare Advantage Open Enrollment Period or the Fall Medicare Annual Enrollment Period.

In the United States, around 10,000 people turn 64 each day an important age signifying eligibility for Medicare[1]. If you want to enroll with Medicare or someone else, it may be a worthwhile idea. Find the information you need regarding a Medicare Supplement plan.

Unless you bought a Medigap policy before you needed it, you'd miss your open enrollment period entirely. Outside open enrollment If you apply for Medigap coverage after your open enrollment period, there's no guarantee that an insurance company will sell you a Medigap policy if you don't meet the medical underwriting requirements, unless you're eligible due to one of the situations below.

Since 2011, the Center has helped millions of Americans understand the health insurance system and the benefits that they need. Let the insurance company know today. I need a new supplement for my medical care. how can i find a better option?

The most important thing to note is, when you're in your Open Enrollment Period, you're guaranteed the right to buy a Medigap policy. Can I enroll in a Medicare Supplement plan if I'm not 65? Federal law does not require insurance companies to sell Medigap policies to people under 65.

In some states the Medigap program is only available in states where it is available for a younger population. However, even in the absence of disabilities you are unlikely to be eligible for Medicare. The company may take in consideration your disabilities or health problems, compare them with the cost of your insurance plan and then decline the application for reimbursement. Certain states offer open enrollment for Medicare Supplement recipients under 55. Medigap insurers must also provide policy options to those younger than 65. However, they can charge a higher price. Get in touch with your insurance department and find out the best way of doing so if necessary.

Original Medicare Medicare Parts Medicare Part A Medicare Part B Medicare Costs Medicare Eligibility Medicare Coverage Medicare Enrollment Periods Original Medicare Videos Medicare Supplement Medigap Plans Medigap Plan F Medigap Plan G Medigap Plan N High Deductible Plan F High Deductible Plan G Medigap Plan A.

In the case when you change your Medicare Supplement Plans, your doctor has the option of making changes for a maximum of 30 days to see how much time you have left. This is often referred to as the free look period, which begins once you start acquiring the next plan. If your decision is that you dislike this plan then you can always change your existing plan without penalty. Remember you must pay for your new insurance plan as well as your previous insurance plan within one month.

Medigap's open enrollment period runs 6 months. This window begins on the first day of your 65th year. This period will allow you to register any of the 12 standardized Medigap plans without undergoing an underwriting medical procedure. Insurance providers may not be willing to accept your application or charge a higher premium to cover your current coverage. Medicare-enrolled patients may change their Medigap plan anytime. Because the application can be rejected by the carrier, it can be difficult for them to find an alternative provider for an existing account.

It does not have a deadline to change plans with Medigap. One limitation of switching to Medicare Supplement Plans is the guaranteed issue rights. It's very important for people who already have conditions. The insurance firm can refuse coverage under the Medicare Supplement, and you can never get it back in your comprehensive coverage. Even though it seems impossible to change a life plan it is not necessarily impossible to change it. All carriers have unique underwriting medical questions. You may also have to travel with one carrier.

Usually buying Medicare Supplement plans during open enrollment periods gives you coverage in a limited period, without any medical underwriting charges or penalties. Medicare beneficiaries generally receive the cheapest rate during the first enrollment period without any adverse effect on the quality of coverage. Check out your personalized Medicare options from a professional adviser You will be able to easily navigate Medicare and see what your benefits require. Start with no obligation.

Medicare Supplements plans are a form of insurance provided by private insurance companies which covers some of your Medicare expenses. It has been dubbed Medigap since it helps fill gaps in Original Medicare. In Part A (hospital coverage) and Part B (medical insurance), your health care services are covered. The government usually pays 80% for these services, though Medicare pays 100% of these costs. The remainder 20% will be your own. Mediga policies help pay these bills.

It may be the easiest time for you to apply for Medicare. It's the six-month period which starts on the first day of each month when your age exceeds 65 and is enrolled in Medicare Part B. Other states have open enrollment periods for people under 65. During the window, the insurer can't deny Medicare Supplement coverage for any reason. The best thing you can tell me about the Medigap plan is you have not many chances that your policy will be issued,” Jacobson adds.

The “open enrollment” period for the insurance is divided into two groups: Annual enrollment describes employer health insurance coverage. This usually takes place between early November and mid December when workers are able to modify their current insurance policies. The change is effective January 1 the following month. In contrast, the term open enrollment covers all people with employer-paid health benefits, excluding Medicare beneficiaries.

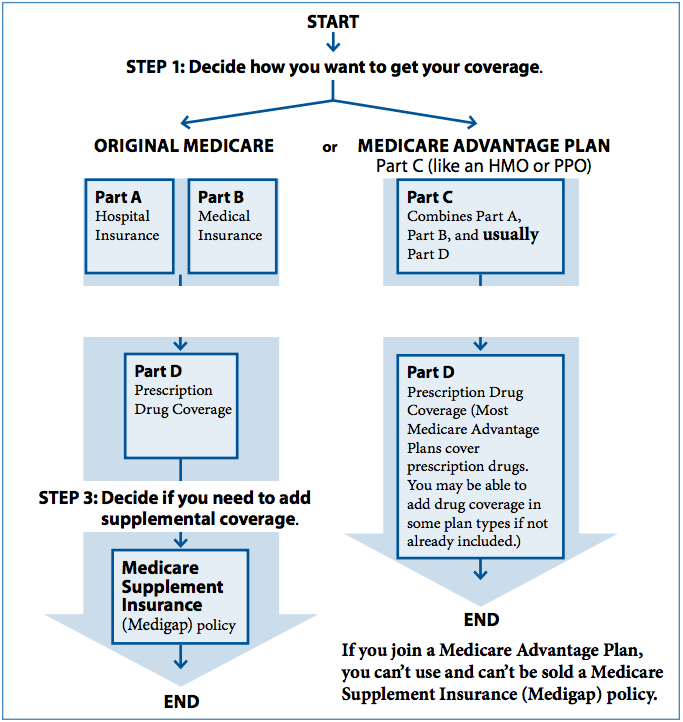

Medicare comprises Part A, which covers healthcare services and hospice fees, and Part B, which covers medical care services. Parts A or B are commonly called Original Medicare. Medicare Supplement (MIGap) plans are offered by private companies and can provide insurance that fills gaps in original Medicare. The plans with letters A and N have the same basic benefit package, although they are slightly different as to how they cover.

The best time to get a Medigap policy is the first few weeks of enrolling on Medicare. It is only during this enrollment period that you are covered from a claim. How are Supplementary Health Insurance Plans Different for Different Countries? Find committed and licensed agents that are working for the best Medicare policy. Find out more about Medicare. Contact us now for a free quote.

Whether you have Medicare Supplement coverage is a measurable difference between a person's budget and health. In general, Medicare supplements provide an added financial protection because they usually cover some co-payments, coinsurance and deductibles that haven't been covered by Medicare. If you experience medical emergencies, this coverage helps reduce the expenses associated with getting treatment.

While there's no cost to enroll for Medigap, the ideal time to enroll is during the Medigap open enrollment period. The six month period automatically starts on the first day after you have both completed Medicare Part B. Depending on whether you are eligible for Medigap, you may have to purchase more expensive insurance because your medical condition is already cured.

This Medicare open enrollment season lasted 15 to 14 months and allowed you to change your health and drug coverage. However, 57% of Medicare enrollees have not taken advantage of comparing Medicare's potential cost to other types of insurance. In addition, 65% of older people don't use an open enrollment program at any time.

While you can purchase Medigap immediately after enrolling, it's important to remember. A few insurers may also refuse to pay out-of-pocket expenses for pre existent health conditions for up to six months. Depending upon the condition you have acquired you may incur additional costs which you must bear.

If you missed your initial open enrollment period, the application will normally take place before the annual Medicare open enrollment period. Regardless of a guaranteed issue as discussed above, the insurance providers can provide you with insurance coverage that meets the requirements of the client.

Medicare Supplement plans have free 30-day lookups. You will then get a refund within 3 days of your first renewal of a current plan. Whenever a new insurance provider decides the new policy doesn't work they will change it back to an earlier policy. Find a good Medicare plan in a few simple steps.

If you want Medigap eligibility, you must first qualify for a Medicare Original plan and have Parts A and B medical coverage. The way to qualify for Medicare is by registering for three different kinds of services:

Unless a patient fails to complete the enrollment period and enrolls in a Medigap Supplement plan at another time, the policy may be denied. Since Medicare Supplement Plans are regulated in different states, it is best to speak to their local offices in order to find more current information about Medicare.

When you sign up during Special Enrollment periods, the policy change will take place. The insurer must offer you a policy and cannot make any charges based on a person's age. Suppose you have issued rights.

Guaranteed issue rights refer to your right to purchase certain Medigap policies outside your Open Availability Period.