For people over 65, you probably have knowledge of Medicaid. You'd probably find that Medicare does not include everything in the plan. Medicare can help cover costs for hospitals and routine health services, but you must pay coinsurance, copays and deductibles along the way. There are several private insurers offering Medicare Supplement insurance. Medicare Supplement Plan Provides a safe alternative to the most expensive medical expenses in your life.

Once you select your insurer and Medigap coverage, the only thing you need to do is apply. Usually it involves an online questionnaire that contains personal info including the health status of your family. If you applied during Open enrollment period, then an insurer cannot claim an unjustified denial of coverage. Your insurance carrier should send an explanation of your plan and its advantages when the claim is approved. Read it carefully if you need help deciding on coverage. Once the insurance company accepts your enrollment your policy will inform you of the payment way. You can usually choose either the checks or money orders, or you can use the cash.

Advantage programs provide Medicare coverage and additional benefits like prescription drug insurance (Part D), which are also provided under Medicare. In some cases, Medicare Supplement or Medigap insurance is offered by private health insurers to those who have Original Medicare. Medigap provides coverage to nearly all beneficiaries nationwide and helps cover things including coinsurance and deductible fees. Because plans cover each other standard, the monthly premiums are not different for each provider. The Medigap policies cover prescription drugs.

It's simple to join Medicare Supplements. Supplements can be bought through agents and directly by the carriers,” Corujo added. Since the annual registration period does not occur, members may apply at any point. To purchase Medigap coverage, you should enroll at the end of your Open Enrollment period of six months. These periods will begin when you are 65 or above on Medicare part B. It is not advisable to purchase Medigap insurance policies sold by a health insurer at this point. You can use the following instructions when purchasing medap plans:

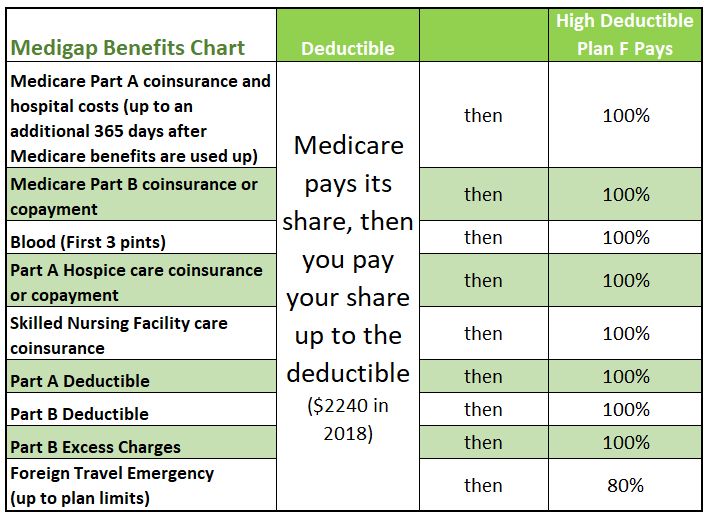

Plan E, and Plan E are the most popular types of Medicare supplementation. Medicare Supplement Plan F provides beneficiaries with 100% of Medicare-covered medical costs after Original Medicare has paid its share. Medicare Supplement Program G allows a beneficiary to only pay the annual Medicare Part B deductible before claiming 100% coverage for all Medicare-required medical costs. Finally Medicare Supplement Plan N can be seen as a payment plan which tend to be cheaper for beneficiaries who have not been able to afford medical care at all regularly but have interest in emergency coverage.

Almost every Medigap plan must follow federal or state laws on labeled products & services. Many states have government agencies to ensure private insurers that offer certain types of plans meet Medicare guidelines by promoting them accurately. The center also conducts a targeted market conduct examination as needed and responds to customer inquiries and complainants to ensure that everyone continues to comply with the standards of Medigap plan regulations.

The most popular Medicare Supplement plan has the highest enrollment rates in the United States. Which one suits your individual needs depends on your beneficiaries. In general Plan F is the largest Medicare Supplement plan because it covers more out-of-pocket costs than all other Medicare plans. Unlike a typical plan, F covers Medicare copayments and deductible payments to help the beneficiaries avoid unnecessary medical and other expenses. Plan F has not been updated and cannot be accessed by a Medicare beneficiary enrolled after January 1, 2020.

How do I know how much money is on Medigap? You can also contact an insurance agent for more information. You will need to know what companies set the prices for. In addition to premium pricing, it's important to determine whether the Medigap providers offer additional discount options for women, non-smokers, and multiple policies if you pay monthly versus year-to-date. A company must be careful if they have medical insurance underwriting — the process of assessing the cost of the service.

Medicare Supplement, also known as Medigap, is a private policy that pays for things not covered under original Medicare. This secondary coverage plan will only apply to Original Medicare and will not apply to any Medicare supplemental coverage or supplemental health plans. In general, Medigap plans do not offer prescription drug coverage so you should consider enrolling into Medicare Part D or Medicare Advantage Plans. Medicare Part C is a program that differs from Medicare Advantage.

If you qualify to receive Medicare Supplement insurance, you must have Medicare Part B or Original Medicare Part A, however you must NOT receive Medicare Advantage plans. If you don't have creditable medical insurance before obtaining Medicare, you may fall into one category. Your Medicare Supplement enrollment period starts with you enrolling in Medicare Part B at 65 years. Medigap insurance plans can be cancelled without requiring the insurance company' s approval.

If you are a student looking to start using Medigap, it is possible for your health care providers in the United States or abroad to sell their Medigap policies. The restitution of health care is prohibited by law. Outside the open enrollment period insurance companies can legal block your application for a higher premium or require longer periods for certain coverages. Insurance providers may charge different prices for the same Medigap policy if they have different plans.

To find out about Medigap policies click on their website. You can enter a zipcode to see what MediGap plans can provide to you within a specific location. The following plans were available when we entered the ZIP code of Nevada. By adding age, gender, and date, they are. Medicare website allows for the comparison of plans. After you determine what plan will suit you the most, you can view the policies from a private policy provider in the region you're looking.

Medicare Advantage and Medigap offer supplementing options that supplement your Medicare plans in a different fashion. Medigap provides insurance for medical and dental expenses as well as hospice costs. In contrast, Medicare Advantage plans may offer additional coverage, including vision insurance and wellness plans or prescription medications. If someone cannot qualify for both Medigap and Medicare Advantage you can find out what you need.

The premium for medical services varies depending on the carrier or option. “Not all carriers offer the best plan,” said Brandy Corujo, Cornerstone insurance partner. Policy rates for Medigagap vary among insurers sold. The price of premium products are determined using a three-way process. In the Medigap program, you buy insurance from private insurers, and you pay your premiums directly from the insurance provider monthly.

Medigap plans are purchased through private insurers. The benefits of these plans are standardized, and premium cost will not vary between insurers. Insurance providers who offer Medigap plans will be able to offer Plan A. In addition to Plan A, Medigap plans may differ depending upon insurers. Depending on who provides the services, the Medigram policies are the following:

Forbes Health ranked all the insurance plans in the nation based on: We provide summary information about the company's reputation. It is important to consider ZIP code and demographics of the person looking for insurance coverage. To achieve the goal, you should either use the plan finding tool on Medicare.gov or contact a nonprofessional insurance agent.

If you need help regarding enrollment in a Medigap plan please contact your local State Health Insurance Assistance Program (SHIP).

Medicare Supplements have many advantages. Any health care provider with high out-of-pocket costs is strongly encouraged to take advantage of their Medigap Plan. Some Medicare Supplement plans also cover services that Original Medicare cannot cover. Medicare participants whose frequent travels are often protected.

Medigap plans don't provide extra health care benefits, they simply help cover the deductibles, copays and other costs that you would otherwise have to pay for your Original Medicare benefits. Medicare Advantage plans are provided by private insurance companies and replace your Original Medicare coverage . This means that they combine all of the benefits of Medicare Part A and Part B into one single plan.