Both Medicare and Medigap is available to Medicare customers as an additional option. However, they are different in that they have different plans. Medicap or the Medicare Supplement insurance is used by those people who have enrolled into original Medicare which includes Part A hospitalization and Part B medical and outpatient care. It doesn't have a government-sponsored program, but a private insurer can cover the costs of traditional Medicare. Medicare plans provide 20 percent Part B coinsurance that a doctor may charge for a medical visit.

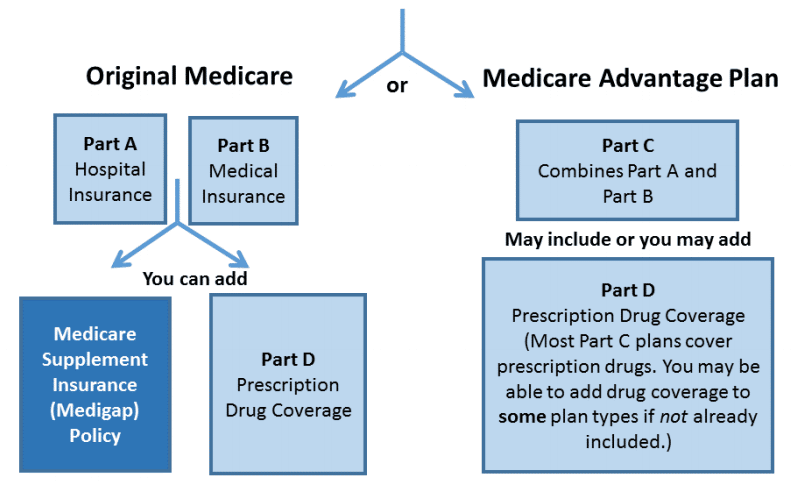

Many traditional Medicare beneficiaries also rely on other sources of coverage to supplement their Medicare benefits. Supplemental insurance coverage typically covers some or all of Medicare Part A and Part B cost-sharing requirements and, in some instances, provides benefits not otherwise covered by Medicare. Beneficiaries can also enroll in a Part D plan for prescription drug coverage.

Medigap - Medicare Supplement Insurance - fills "gaps" and is sold privately. Original Medicare covers the cost of healthcare coverage. Medicare Supplement insurance may help cover a portion of remaining medical expenses such as medical care when a patient is traveling outside the United States. If I have Original Medicare and I purchase a Medicare policy, it may not cover my costs as well as my costs.

Choosing Traditional Medicare Plus a Medigap Plan As noted above, Original Medicare comprises Part A (hospital insurance) and Part B (medical insurance). You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan.

Medicare is a form of insurance that is paid for older people. Here's an alphabet soup of pieces offering diverse coverages and advantages. The program's problems also contain holes that are not completely addressed. If your plan has any gaps, you should look for Medicare Supplements. We have collected unbiased expert insights on the costs, advantages and benefits of each product.

In this case advertisers will not affect our picks. We may receive compensation for visiting a partner we have recommended. Find out more information about our advertising disclosures. Any Medicare enrollee will face many decisions. What is the best option for supplementing Medicare / Medicare Advantage coverage?

You cannot use a different insurance policy. The biggest difference between Medicaid and Medicare Advantage - Medicare Advantage - is that unless you have Medigap coverage your health will have no effect and you're not eligible to receive medical treatment under the Medicaid program. Tell me the truth about this.

The Medicare Advantage plan provides the same level of protection as public health insurance plans. All services, from office visits to laboratory visits to surgical procedures, are covered by a small co-payment. Plans may include HMOs or PPOs and each plan sets annual limitations for expenses. All the plans have their advantages and restrictions. The majority provide prescription medication insurance. Some require referral to the doctor, while others don’t require it. Certain patients may have to pay some part of their care outside the network while some will cover only physicians and clinics in HMOs. Some Medicare-advantage plans exist also. Selecting the best yearly or monthly plan is important.

Once you join the Medicare system, one of the most difficult decisions to make will be whether or not to enroll in Part D Prescription. In the case that you do not get part D coverage before you start Medicare, you might get penalized for enrolling late for the program. You can avoid penalties, however, if you use what is called creditable prescription drug coverage, which is the prescription drug coverage of employers (for example). If you get Medicare coverage and have drug coverage then this is typically allowed.

Aetna, Humana and the Kaiser Foundation. Medicare programs offer Medicare Advantage coverage to the public through Medicare-approved insurance companies. These companies have a lower premium than Medigap policies. Medicare Advantage plan covers hospitals and doctors and usually includes medication coverage and other services not provided under Medicare. By 2020, 42% of Medicare recipients are going to use this program. Medicare Advantage plans operate as health maintenance organization insurances.

About 58% of Medicare beneficiaries choose Original Medicare Parts A and B. This coverage includes hospital, physician and surgical treatment for seniors 65 and older. Almost 82 million Medicare patients pay for Medicare part D prescription drug insurance if they have Medicare Supplement Insurance or Medicaid. Medicare Supplement Insurance, or Medicaid programs, aren’ t associated or approved by any federal government. Certainly, it's cheaper but has several advantages.

If you are still relatively young and healthy you should start to use the Medicare Advantage plans. Currently switching from a Medicare Advantage plan to another form can be done to everyone during this open enrollment period. Usually the elections are held between 15 October and 7 January each year. That is an important thing. When you start taking regular Medicare (Part A and Part B) you will likely be denied the opportunity to enroll in Medicaid.

Medicare supplemental plans are more cost effective for a patient to manage and less expensive. According to Jacobson, the cost-sharing approach is popular among those who do the hospitalization. It's possible you could visit virtually any doctor you like. Similarly, a resident of Arizona can fly to Minnesota to attend Mayo Clinics. Unfortunately Jacobson argues that the benefits of having them are much more important for the person who is sick.

The Commonwealth Fund recently published its latest report. We found only 7% of the health insurance providers provided this benefit. Many people do not know that Medicare Advantage is available and has similar benefits. There are trade-offs between policies that encourage or discourage the offering and non-revenues.

The cost to buy Medicare Supplement is estimated at between $150 to $200 monthly. It will vary by country and your policy. Similar to the Medicare Advantage plans 65 and above are likely to save a total of $648 a year under Plan N. They'll get an average of $800 a year under Plan G for Medicare Supplements in many areas. We look at ways to provide Medicare to people more efficiently, and more effectively.

Medigram Advantage Plans provide different benefit levels based upon the type or condition. Medigap plans include more protection for Medicare users but are not excluded from prescriptions. In addition, Medicare's new plan offers the same coverage as Original Medicare plus additional benefits like prescriptions and vision services.

Plans include the Medigap Medicare Advantage Unlimited network of providers. $0-Premium plans. Special Care - Preauthorizations are needed in HMOs and special requirements plans. Can I change my plans? Maybe as long as the plan allows it. Added benefits such as coverage for health insurance - including dental vision. The Medigapan Plan K and Plan L are limited to one-off expenses. .

Many Medicare Advantage plans have no cost. Please review all options available. If you enroll in a Medicare plan and they charge a premium you have to pay the fee each month. Medicare Part B coinsurance and deductible amounts are $226. Once these are met your copay under Medicare Advantage will typically exceed 20% of the Medicare-approved value for many services and goods.

Medicare Advantage programs include all benefits of original Medicare plus coverage for items or services unavailable through original Medicare. Several plans even offer transportation to doctor visits. Moreover a plan can customize its benefit package for chronic illness. For example, Cigna offered vaccination coverage to Medicare-enrolled Medicare beneficiaries.

In general, Medicare Advantage plans require a Medicare part A health coverage and part B health coverage to reside within the service areas within the health coverage plan. Enrolment occurs for a certain time only but there is a possibility of denying insurance for any preexisting conditions. The following three windows allow the use of the Medicare Advantage plan:

Medicare Supplements are commonly referred to as Medicare coverage and are offered to individuals who need additional coverage. In 2018, 45% of those on Medicare Original Medicare had Medicare supplemental coverage for some of the costs, or about 11 million people. Medigap provides coverage that covers everything from deductibles to co-insurance in the form.

As previously stated, Original Medicare consists of part A (health care coverage) and part B (med. Alternatively, it's possible to supplement your Medicare Part A or Medigap plan by adding a supplemental plan to it. If you are signed up for Medicare Part A and Part B, you must decide whether to purchase a supplemental policy.

MediGap policies are a private plan that is sold by insurance companies or by brokers. The plans include: A, B, C, D, F, K, L, M and N each having an entirely new coverage system. Plans F and G also have higher deductibles. Several plans offer medical services for emergencies in foreign destinations. Since coverage is standardized, it's impossible to rate Medigap insurance policies. Consumers can easily check the cost of a specific insurance company letter and choose a more favorable offer. Beginning 1 January 2020, Medicare plan sales will no longer cover Part B.

To begin, locate your zip code. When you register for an upcoming medical visit to Medicare.gov you will find out how much a drug costs and what deductibles a medical plan will cost to get an accurate quote and how much it costs. If you've been a patient for a long while without prescriptions, you Despite being a Medicare plan, the majority of the medications are covered under the plan. If you have high prescription costs, check with a plan that provides coverage for drugs for a gap period of up to $4430 for your plan.

It is possible you aren't alone when it comes to understanding the difference between Medicap and Medica Insurance. About half of Americans are not satisfied with the effectiveness of their Medicare selections despite having some knowledge of their plans if the program is selected properly. Here are some summary:

Medigap is a form of private insurance company offering insurance that addresses the gaps in Medicare by paying deductibles or copayments. Medicare beneficiaries pay monthly premiums for Medicare Advantage plans which vary greatly according to the age group and location. You pay Part D prescription drug premiums monthly. Unlike the Medigap plan, G policies offer the same benefits. There is a distinction between the prices and the companies'reputations.

In addition, Medicare includes deductibles and coinsurance that you must pay in advance. Some of the costs of original Medicare covered by a Medigap plan may include a deductible for a hospitalization in 2022. The copayments for each hospital day in 2022 are $379 / day or $443 / day in 2023. In 2022, there will be an additional 900 per week copayment for days 21 to 100. A 20% deductible for health insurance coverage in Medicare Part B. A.

When considering whether or not Medicare Advantage is the right solution for your needs, you need to determine whether it is a necessity. Let us consider a few things first.

Some Medicare beneficiaries may have Medicare Advantage plans or Original or fee-for-service programs. Usually the service you receive will cost you out of your own pocket.

Can deciding on Medicare Supplement Plans help a person to manage their own health problems effectively? Consider these factors when comparing advantages.