Medicare Supplement insurance is available through private companies to fill gaps. Original Medicare covers most or all of the coverage costs and supplies to cover the costs. Some Medicare Supplement Insurance policies may be able to pay off some other health costs, such as:

Coinsurance The percentage of coinsurance varies depending on plan. Limits and Considerations Limits Most of the time, Medigap coverage has no network limitations and is available anywhere that Medicare is accepted. Things to Consider Some Medigap plans cover foreign travel emergency services.

For Medicare For Medicare Shop for Plans Member Resources Eligibility & Enrollment Find a Doctor Find a Doctor Log in to myCigna Compare Medicare Supplement Insurance Plans Plans that help pay deductibles, copays, and coinsurance—out-of-pocket costs Original Medicare doesn't cover. Save with Cigna 1 : Up to 25% in discounts available when you apply with us.

Anthem Offers Medicare Supplement Plans A, F, G, and N Medicare Supplement Plan A Plan A is the most basic of Medigap plans, with the lowest premiums. It is the only Medicare Supplement insurance plan that doesn't cover the Part A deductible. Medicare Supplement Plan F Plan F helps cover Medicare deductibles and some copayments and coinsurance.

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy.

You could also enroll in the Medicare Supplement if you had original Medicare Part B coverage. Your enrollment period lasts six months beginning the day of the 65th year. During this Medicare Supplement enrollment period you will not get coverage for any health problem. In most states, not all states allow health insurance coverage and some states also have plans available for people under 60 if the reason for eligibility is other than age. Medicare is a Medicare-sponsored program which allows patients to see doctors and hospitals accepting Medicare patients. Anthem provides a Medicare Supplement plan that covers 100% of Part A and Part B co insurance.

This program pays for Medicare Part B coinsurance. Your copayment is responsible for all deducted taxes, but your monthly premium is lower. Select and innovative N are available at various state locations across the country.

Plan F covers Medicare coinsurance. The plan will become available if you are able to receive Medicare before January 1, 2020. Select or Innovative F is available for a limited period.

Plan C is Medigap's best-known plan and its smallest premium. There are only some of those Medicare supplement insurance programs that do not include Part-A deductibility.

Plan G covers all out-of-pocket expenses that are not paid under the original Medicare. Select and innovative G are offered in some countries.

Medicare supplemental plans have no prescription coverage but you can purchase Part D insurance plans for an additional premium. Your Medicare coverage also lacks dental or vision insurance. You may purchase extra dental coverage from Anthem Dental and Vision Insurance in states such as Georgia, California. California is the largest state in the U.S. where Medicare is offered in its simplest and most effective way.

They also lack the protection of an annual limit on out-of-pocket spending because traditional Medicare does not have an out-of-pocket limit on cost sharing for services covered under Parts A and B. In contrast, since 2011, federal regulation has required Medicare Advantage plans to provide an out-of-pocket limit for services covered under Parts A and B.

Anthem Blue Cross Life and Health Insurance Company (Anthem) has contracted with the Centers for Medicare & Medicaid Services (CMS) to offer the Medicare Prescription Drug Plans (PDPs) noted above or herein. Anthem is the state-licensed, risk-bearing entity offering these plans.

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium.

Copayments do not count toward the annual Part B deductible. The following plans include Part A hospice care coinsurance or copayment: Plan A Plan B Plan D Plan G* Plan N Plan C Plan F High-deductible Plan F and Plan G are also available; same benefits apply once calendar-year deductible is paid.

Make a good savings on shopping on ecommerce. In addition to our website prices you can enjoy a 6% discount on your monthly premiums when registering through our website. The offer isn't available in California, Connecticut or Ohio.

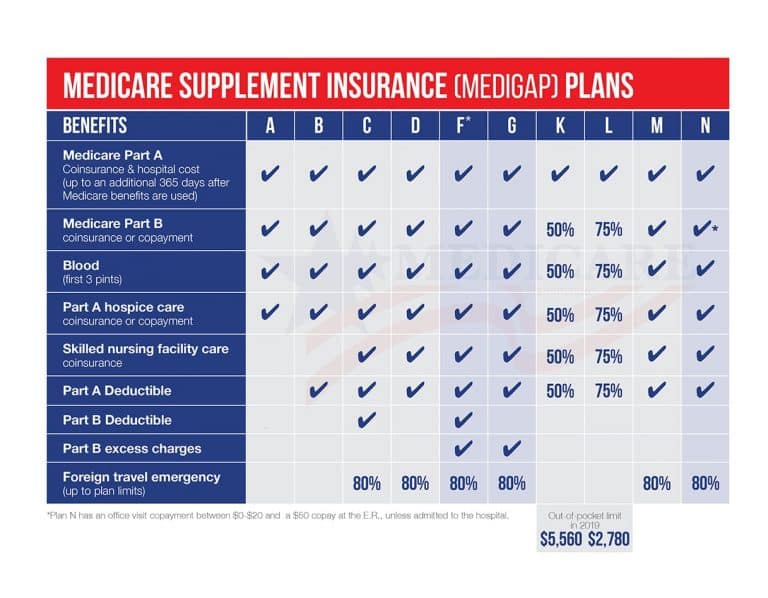

Unlike Medicare Supplemental, Medicare Supplemental is not covered through the network. Plans are available to anyone who accepts the Medicare program. Secondly, the basic benefits offered in plan A, B, C & F are the same for every insurer. (See Diagram above). Nonetheless, many organizations, such as Humana, provide more services. Invest time in evaluating the differences between the companies, the services offered and the prices.

The Open Enrollment Period begins on January 1 for Medicare Part B residents over the age of 65. In most states, you will have to buy plans on the 1st day after you join. If you have a medical history and have been denied eligibility by claiming a guaranteed issue, your eligibility cannot be analyzed. Depending on the country, rules are sometimes different.

You may be covered by a Medicare Supplement and Medicare Advantage plan but you may not have both. Let's see some major differences for your choices.

Is Medicare supplement insurance similar? Espaol | Yeah. Medigap is private medical insurance that helps pay the full cost of your healthcare. Medigap is your responsibility to get it.

In 2022, the typical premium for Medigap plans was $122 each month. Some Medigap plans had significantly less enrollees compared with some plans. The enrollment difference affects the annual premium paid to Medigap recipients.

MediGAP has a few advantages, including the higher premium. Having to manage varying plans. There is no prescription coverage.