Medigram Plans or Medicare Supplements, which are available from private businesses, can help cover health insurance expenses that Medicare does not cover such as co-pays, coinsurance or deductibles. Some Medigap plans offer coverage in certain circumstances; these services are not covered by Original Medicare such as health care while traveling outside. If you have Original Medicare and are buying a Medigap plan, Medicare will cover a portion of this. You get a Medigram plan and you pay it off too.

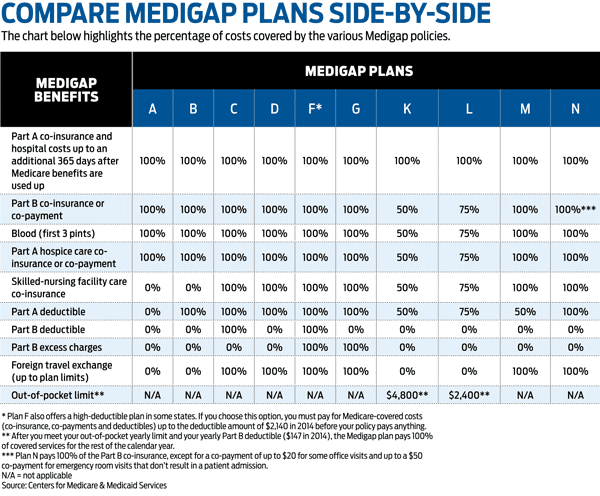

When registering for the Medigap program, you may already have heard about them or have questions. Medigap policies can help cover some of the outsourced costs incurred by your Medicare plan. There are multiple kinds of Medigap plans available, therefore making an informed decision is important. We will describe what Medigap can help you enroll in and how it can help your situation. Medigap provides Medicare supplemental coverage that combines deductible and copayment benefits with co-insurance.

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare.

When you're 65 years old or older, Medicare can be confusing, but it is much simpler than you thought. Medicare Original Part A contains Part B and Part B. Part A covers medical expenses, nursing home and hospice costs, and most cases, premium-free. Medicare Part B covers medical and prevention services and equipment. There are monthly premiums, typically paid by Social Security.

The exception to this rule is if you buy a Medigap policy during your open enrollment period and have had continuous "creditable coverage," or a health insurance policy for the six months before buying a Medigap policy. The Medigap insurance company cannot withhold coverage for a pre-existing condition in that case. Find a Medicare Plan that Fits Your Needs Get a Free Medicare Plan Review Get Started Insurance companies set their own prices and rules about eligibility, so it's important to shop around.

It is a Medicare Supplement Insurance policy which fills gaps and is sold through a private company. Medicare is paid in large part, but doesn't pay for every covered service. Some medical coverages are available to cover medical expenses if you're traveling abroad without Medicare.

It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you're responsible for the difference. for covered health care costs. Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan.

In some states, Medicare Supplement plans are cheaper, but they can also be more complex. Typically, cost is determined in a number of ways: Locations and Ages. Make note the cost of insurance at 65 could be higher at 85, so contact the Insurance Companies to see how premiums are calculated. Policies are determined using a number of methods: Not all businesses offer Medigap plans. Rates can vary by firm, and certain plans have higher-deductible options. How can I obtain Medicare Supplement Insurance coverage? Find committed licensed agents who will help you understand and find your ideal Medicare coverage.

Medicare Part a and Part b Supplement plans are also called Medigas. They cover gaps left in Medicare Part A and Medicare Part B policies. If you have purchased Medicare Supplement plans, you have to enroll for Part C or B in Medicare. Most Medigap plans cover the 20% which isn't included in parts. Private insurance companies provide Medicare supplement plans. Every Medicare plan must provide the same coverage nationwide, but premiums can differ between providers.

When can a Medicare supplement plan be accessed in a free enrollment period of six months? Open enrollment starts the first month you are 65. You can't buy Medigap plans if you have an open enrollment period of one month or pay a lot. If you or your spouse have health insurance and have not enrolled in Part B then your Part B enrollment may be eligible for an exemption. Contact CMMS to get a detailed report on a possible Medicare - Medicaid plan if possible.

Upon receiving Medicare Supplement coverage you can enroll as part of the first month of the program and must be over age 65. Occasionally younger people qualify based upon disability. The opening enrollment period stretches to six months and includes purchases from Medicare Supplement plans of your choice. After the initial Medicare supplement enrollment has ended, you may not have access to the Medicare Supplement plan. Is there a benefit to having supplemental insurance with a disability plan? Get professional licensed agents with a proven track record of understanding your coverage needs.

Medicare Advantage is a private insurance product which includes vision, hearing and dental insurance. Most Medicare Advantage plans also provide drug-recovery coverage. Medicare Supplement plan or Medigap programs are available to fill specific gaps in Medicare coverage. Typically, these plans cover long-term care, eyeglasses or dental care. This product is marketed by private insurers, but it is controlled by the same standards across providers.

People over 65 can buy Medicare Supplements or Medicare-approved Supplements plans from Medicare.com. Medicap may provide a plan for patients under age 65 with qualifying disabilities.

All people concerned with the deductibles from Medicare should consider buying a Medicare supplement program. “Medicare provides deductible and co-insurance. It provides 20% co-insurance for any Medicare approved services with no limit of expenses incurred.” Please consider these items when buying Medicare Supplements Plan.

Medicare Supplement Plan F is a comprehensive Medicare Supplement Plan and has been recognized as an outstanding option by Medicare. It provides 100% coverage after Original Medicare. Medicap Plan F includes Part A, Part B deductibles, and coinsurance.

Medigap policies do not cover everything. Supports and services are provided at home and in a nursing facility. The individual needs support and assistance for a lifetime. In most health insurers, Medicare does not cover health care.

The Medicare supplement, referred to as Medigap, covers the areas Medicare left out. These policies provide coverage for most of the benefits paid under Medicare and pay the deductible and deductibles in addition to providing for certain medical care not included in Medicare.