The Medicare Supplement or Medigap Plan is an insurance program offered by private companies. Some Medigap policies offer coverage for services which Original Medicare does not cover, such as healthcare, if you travel abroad. If you buy Mediga Preferred Medicare coverage and have Medicare coverage, Medicare can pay the portion of Medicare-approved amounts for covered benefits. Then you pay for the benefit of meds.

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium.

Medigap consists of Medicare Supplemental Insurance that fills gaps in Original Medicare. In addition Medicare covers a lot of health care expenses but doesn't cover all of those costs. Several Medicare Supplement insurance plans cover services that Original Medicap cannot provide.

Left navigation How Medicare works with other insurance Retiree insurance What's Medicare Supplement Insurance (Medigap)? Find a Medigap policy When can I buy Medigap? How to compare Medigap policies Medigap in Massachusetts Medigap in Minnesota Medigap in Wisconsin Medigap & travel How to compare Medigap policies Find out which insurance companies sell Medigap policies in your area.

What's Medicare Supplement Insurance (Medigap)? Medigap & Medicare Advantage Plans Search Search Print this page. Left navigation How Medicare works with other insurance Retiree insurance What's Medicare Supplement Insurance (Medigap)? Medigap costs Medigap & Medicare Advantage Plans Medigap & Medicare drug coverage (Part D) Illegal Medigap practices Find a Medigap policy When can I buy Medigap? How to compare Medigap policies Medigap & travel Medigap.

There's a disadvantage to Medigap plans: More monthly premiums. It takes navigating the various plans. The plan does not provide any coverage for prescription medication.

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company.

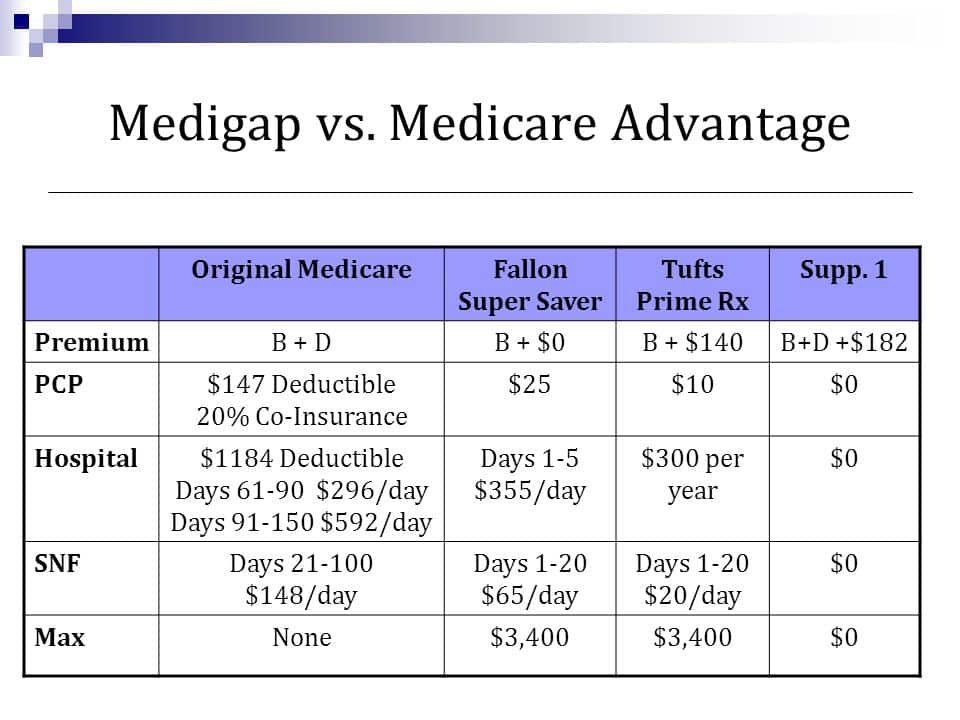

Medigap policies differ from Medicare Advantage Plans. These programs offer a means of gaining Medicare benefits while a Medicare supplemental plan provides supplemental insurance to all your Medicare benefits. The private insurance companies are charged monthly premiums for their Medigap policies.

Viewing this Medicare overview does not require you to enroll in any Blue Cross Blue Shield plans. Plans are insured and offered through separate Blue Cross and Blue Shield companies. Medicare Advantage and Prescription Drug Plans are offered by a Medicare Advantage organization and/or Part D plan sponsor with a Medicare contract. Enrollment in these plans depends on the plan's contract renewal with Medicare. To find out about premiums and terms for these and other insurance options, how to apply for coverage, and for much more information.

Depending on the type of Special Enrollment Period, you may or may not have the right to buy a Medigap policy. For more information Find a Medigap policy. Call your State Health Insurance Assistance Program (SHIP) . Call your State Insurance Department. Site Menu Sign up/change plans About Us What Medicare covers Drug coverage (Part D) Supplements & other insurance Claims & appeals Manage your health Site map Take Action Find health & drug plans Find care providers Find medical equipment & suppliers Find a Medicare Supplement Insurance.

It is not possible to get both Medicare Advantage and Medicare Medigap benefits simultaneously. You can change these plans as your medical bills change.

If you have a Medicare Advantage (MA) plan, you can apply for a Medigap policy, but make sure you leave the MA plan before your Medigap plan starts. You pay the private insurance company a monthly premium for your Medigap plan in addition to the monthly Part B premium you pay to Medicare. A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

A Medicare Advantage plan may provide a more flexible option to pay your insurance premiums. Medicare, plus Medigap coverage, gives you more choice of how and what you receive care.

Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. You pay the private insurance company a monthly premium for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.