Medicare supplement coverage can help offset some of the expenses that are covered under the Medicare program. Several types of standard plans are offered, all with different lettering on the label. All plans have varying coverage levels based upon their original Part A - B coverage. Medigap Plan D is considered the halfway point for coverage amongst the 10 types offered. Plans D offer more coverage than plan A and B but don't offer benefits similar to those offered by Plan E and B. Certain benefits in another plan such as the Medicare Part B deductibles and Part B excessive fees cannot be provided under Plan D.

Are you interested in Medigap Supplement Plans? Are there drugs in Medicare Part D plans? There's a lot of confusion among them. Healthcare Markets outlines the different plans available as a Medicare Supplement and the benefits they may provide to your situation. Medicare Plan DD is a Medicare Supplement plan also referred to by the name the Medicalgap Program. Plan D is a standard Medicare Supplement plan that is offered in all 50 states. A. Medicare Supplement Plan D and Medicare Plan D are a combination of plans.

For many people, Medicare is a welcome change. Despite Medicare eligibility being universal, the Medicare's coverage varies significantly from person to person. Medicaid Supplements have several different benefits for individuals who have opted out of supplemental Medicare plans that offer different coverage. Does Medicare reimburse prescriptions? Medicare has a policy not covering prescription drug purchases.

It is a Medicare Supplemental Insurance Program which provides assistance in filling gaps and is sold privately. Original Medicare covers some, but not all, costs associated with health care coverage. Medicare Supplement Insurance (Megigalap), for example, provides insurance coverage to some health insurance companies for their own employees who have a Medicare policy.

The Medicare Supplement Plan D program is designed for people with low income who have lower co-payment rates. The deductibles are deductible under Part B and are based on Part B. The amount is $222 in 20202. If you pay medical bills in excess of $2,000, you would have a deductible of $40,000. The more you charge, the bigger your coinsurance is, and it is not limited to what is allowed under the Original Medicare program. With Part B coinsurance, your Part B copayment is 100% of the plan's total cost to your employer. 2. Can you tell me a reason for using Medigap D?

While Medicare plan D (Medicaid Supplement) and Medicare Part D (Medicaid coverage) are both utilized for filling coverage gaps in Original Medicare Part a and Medicare Part b, this type of coverage serves different purposes. How do Medicare Supplement Plan D differ? Note that the original Medicare plan, an independent Medicare Supplement Plan D, and a Supplement Plan D may also be combined. You cannot enroll in Medicare Advantage or Medicare Supplement Plans.

Medigap insurance is offered exclusively by private insurance carriers. When you are getting a Medigap Supplement plan, you are going through the Medigap Open Enrollment Period (OEP), but you don't need medical underwriting. Find information about Medicare Supplement Plans.

You may choose to join a separate Medicare Prescription Drug Plan (Part D). because most Medigap drug coverage isn't creditable prescription drug coverage Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage.

People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, if they decide to enroll in Medicare prescription drug coverage later.

n most cases, that means having prescription coverage via a current or former employer or union plan or joining a privately-run Medicare Part D plan (Part D coverage is included in most Medicare Advantage plans , but it's also available nationwide as a stand-alone purchase). 1 Jacobson, Gretchen, Anthony Damico and Tricia Neuman. “ Medicare Advantage 2019 Spotlight: First Look .” Kaiser Family Foundation, October 2018 (accessed February 2020).

It is important to note that not all insurance companies may sell this plan, and availability may depend on your location. Insurance companies are required to offer Medigap Plan A; if they want to offer additional Medigap plans, they must also offer either Plan C or Plan F. Do you have any questions about Plan D or other Medicare Supplement options? An eHealth licensed insurance agent can help you figure out coverage solutions that may work for your specific needs.

In that case, you can join a Medicare drug plan when you lose your Medigap policy. Medigap policy without creditable drug coverage You'll probably have to pay a late enrollment penalty if you have a Medigap policy that doesn't include creditable prescription drug coverage and you decide to join a Medicare Prescription Drug Plan later.

Plan D doesn't cover excess charges, but Plans F and G do cover these costs. See plans in your area instantly! ZIP Code Your ZIP Code allows us to filter for Medicare plans in your area. County See Plans Comparing Medigap Plan D with other Medicare Supplement insurance plans Would you like to compare Medigap plan benefits side-by-side? Our Medigap plan finder makes it easy to compare the benefits of Medigap Plan D against other Medigap plans.

Even if you've selected one of the most comprehensive Medigap plans (Plan F or Plan G), your medical coverage isn't exactly complete if you don't also enroll in a Part D plan, assuming you don't have other creditable drug coverage. How Will Part D Coverage Complement Your Medicare Supplement? Once you enroll in a Medicare Supplement and a Part D plan, you'll have a solid level of coverage.

Plan D is supplementary insurance that fills some coverage gaps in Original Medicare, while Part D is the Medicare prescription drug benefit, available through Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans. Medigap plans do not include prescription drug benefits; if you're enrolled in Original Medicare and want coverage for your medications, you should enroll in a stand-alone Medicare Prescription Drug Plan.

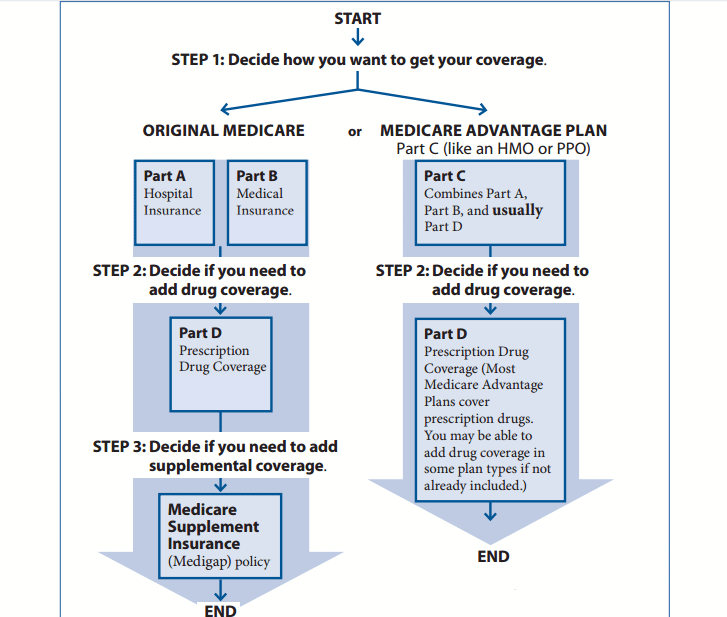

Medicare Advantage plans are "all in one" plans that are offered by private insurance companies. With Medicare Advantage plans, you still enroll in Part A and Part B through the federal government, but then you will enroll in a Part C plan with a private insurance company. Once you do that, you will get your Part A and Part B benefits through your Medicare Advantage plan. Most Medicare Advantage plans also include Part D prescription drug coverage, as well as other benefits such dental, vision, hearing and fitness.

No Medicap prescription plan covers Medicap. Whether the Medigap policy covers prescriptions or not, the drug you are taking must be informed by your health insurer about your coverage with Medigap.

Medicare Plan D is a Medicare Supplemental Plan, also called Medicare-sponsored plans. Plans D are the ten most widely accepted plans for Medicare Supplement in many states: D F K D - D - D - C D - D. The terms "Medicare Plan D", "Medicare Plan Supplement D", or "Medicare plan D".

During open enrollment, you can switch to a different Part D plan that will cover drugs you need, regardless of your health status or medication needs (note that this is not the same as the rules for Medigap coverage. In most states, if you want to switch to a different Medigap plan after your initial enrollment window ends, you'll be subject to medical underwriting).

Costs for Medicare Supplement Plans D Medicare Supplement Plan D averages approximately 129 to 220 dollars a month. The costs of Medigap plan D are often the same as Plan G.

After you reach that limit, you will pay only a small share of your prescription costs for the remainder of the year. Limits and Considerations Limits Most Part D plans have “formularies,” which are lists of covered prescription drugs. Part D plans also have networks of approved pharmacies in your area.

In 2023, the median basic monthly premiums on Medicare Part D are forecast to be roughly $31.50 for a single year. The estimated amount of revenue decreased by 2.8% to $22.08 in 2020.

You can buy a Medigap policy from any insurance company that's licensed in your state to sell one. It's important to compare Medigap policies since the costs can vary between plans offered by different companies for exactly the same coverage, and may go up as you get older. Some states limit Medigap premium costs.