About 10,000 American adults are turning 65 each year an important birthday indicating Medicare eligibility. If your family or friend has enrolled in Medicare, you might consider Medicare supplement insurance or Medigap. Learn about your health insurance plans.

In contrast to most Medicare-related Open Enrollment Periods, Medicare Supplements (MEDAGAPs) open enrollment periods are specific to each patient. It allows you to enroll with Medigap plans without asking health questions. Find your best Medicare plan in three quick steps. So now is the most convenient time to enroll into a Medicare Supplement. Although you can enroll in Medigap anytime, your Medicare Supplement Open enrollment period prohibits carriers from delaying your coverage due to your preexisting health conditions.

Medicare Supplement Open Enroll is different from Medicare annual elections in the fall. The former relates to Medicare Advantage and Medicare Part D, with the date being the same each year. Medigap Open Enrollment happens only once every two weeks and only affects the choice of Medicare Supplement.

Many beneficiaries are considering signing onto the Medigap plan to avoid health issues during this Annual Enrollment Period. But the opposite happens. This is a major misinterpretation which causes a lot of problems. This is another important reason for understanding Medicare enrollment times.

All eligible individuals with a Medicare eligibility card who have been approved by Medicare or are enrolled at least 3 months earlier in a 65-day period will also need an identification card. Once a Medicare card has been purchased, you may get insurance through Medigaps. Medicare Supplement companies will allow you to send a Medicare Part B application within six weeks of your Medicare Part C enrollment deadline. The carrier processes your claim like a patient who has already entered their Medigap Open enrollment period with no medical questions for your claim.

The chances of getting second Medigap Open Entries are very small in this situation. Listed here are some examples from this list. If a person has been diagnosed as having a medical condition and is not eligible for Medicaid for the program, it is possible to enroll without any other benefits in the Medicare program. Some states require Medigap coverage from insurance firms to be provided to those who are over 65. How to Find Medicare Plans for Your Family? Therefore, people who qualify as disabled may not be able to apply for benefits.

Timing affects how much the policy covers, ease of obtaining insurance, and available options. Medicare supplement open enrollment is the only time a majority of people can enroll in the Medigap letter plans. A health insurer must approve a medical insurance policy if there is no health condition.

In Medicare Supplement open enrollment periods there are no medical conditions that can prevent you from being enrolled in Medicare. Our goal is to educate customers on the benefits of Medicare Supplement enrollment.

Sometimes you have options to buy Medigap insurance. However, your insurance company may deny your coverage for health issues. My condition exists. A health problem before your new health insurance was introduced.

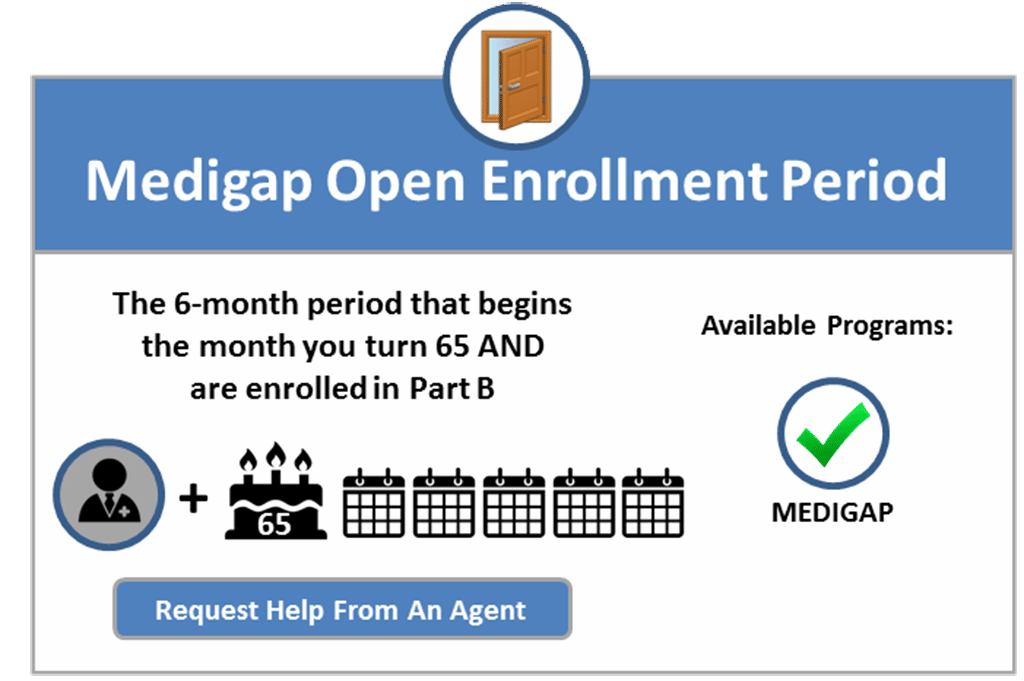

In addition to a six-month open enrollment program under federal law, Medicare Part B. During the open enrollment period, Medigapp providers must offer you a policy that is at the most reasonable price irrespective of your health status.

You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period If you have a guaranteed issue right You may also buy a Medigap policy at other times, but the insurance company can deny you a Medigap policy based on your health. I have a pre-existing condition.

The carrier will process your application as if you are already in your Medigap Open Enrollment Period, with no health questions. Once you apply for Medicare or know your Medicare Part B effective date, you will not need to wait to enroll in a Medigap plan until you turn 65.

If you're past the initial open enrollment period and are interested in a Medigap plan, Jacobson provides a warning: “Medigap insurers don't have to sell you a plan that you want and can charge you higher premiums if they do choose to sell you a plan depending upon where you live, your health status and your age.”

Medicare beneficiaries may apply for Medigap at any time of the year, but may be charged more or denied a policy outside the Medigap Open Enrollment Period (MOEP). The MOEP, based on federal law, requires insurance companies to sell Medigap policies at preferred rates (lowest price).

As required under federal law, the MOEP is a one-time, six-month period in which a Medigap company cannot refuse Medigap coverage when the applicant meets both these requirements: Is aged 65 or older, and Enrolled in Medicare Part B This fact sheet explains when the best time for you to buy a Medigap policy is from June to November.

The Medigap or Medicare Advantage plan you're on leaves Medicare or stops offering coverage in your area, or you leave the plan because they didn't follow Medicare's rules. You enrolled in a Medicare Advantage plan when you first became eligible for Medicare, and are utilizing your “trial right” to switch to Original Medicare within 12 months of purchasing the Medicare Advantage plan (this only applies the first time you join Medicare Advantage).

In a recent report, they note that many health equity gaps arise because of people not fully understanding their coverage options during the short open enrollment period, calling on Congress to make improvements. Who Is Eligible to Enroll in a Medicare Supplement Plan? To be eligible for Medigap, you must first be eligible for Original Medicare and enrolled in Part A (hospital insurance) and Part B (medical insurance).

The rules can be confusing, so don't hesitate to talk to a representative of the Medigap insurance company for clarification. Can I buy a Medigap plan after my enrollment initial window closes? After your six-month open enrollment window, Medigap plans are medically underwritten in nearly every state, meaning that if you apply for coverage outside of your open enrollment window, you can be declined.

The Medigap insurance company can refuse to cover your out-of-pocket costs Out-of-pocket costs Health or prescription drug costs that you must pay on your own because they aren't covered by Medicare or other insurance.

What Is Open Enrollment for Medicare Supplement? Open enrollment is a designated time period within which a person can enroll in a variety of Medicare coverage options without risking penalty fees, medical underwriting, denial of coverage and more.

In most states, if your initial enrollment window has ended, Medigap insurers are going to use medical underwriting if you submit an application for a new plan, regardless of what time of year you apply. So for example, if you want to use the annual open enrollment period to switch from Medicare Advantage to Original Medicare, you can do that.

She is a nationally recognized Medicare expert, a registered nurse, serial entrepreneur, and has served as a technical expert for the Centers for Medicare and Medicaid Services (the organization that runs the Medicare program). She is a frequent speaker on Medicare-related issues.

This lets you enroll in Medicare Part D prescription drug coverage and Medigap. However, you may need to go through the underwriting process and face denial due to pre-existing conditions.

Plans Considering a Medicare Plan? Get online quotes for affordable health insurance I'm Looking for: Health Insurance Medicare Provide a Valid ZipCode See Plans Medicare Advantage plans provide Part A and Part B, and often include Part D prescription drug coverage.

It's impossible to get a Medicare plan anytime. Almost everyone in the Medicare plan, including the Medicare supplement, must be enrolled during an enrollment period. All other type of Medicare plan plans have open admission periods each year.

When purchasing Medicare Supplements/Medicaregaps, it is most convenient to do so during the opening enrollment period of six months. During this period, insurance companies will not refuse coverage because of health conditions. In the first two months of this plan, the Medigap policy may be refunded or your policy is cancelled because it is not covered.