When it comes time for Medicare coverage you have to factor in income taxes to determine your plan's cost of health care annually. It has established a minimum amount of tax relief on income that may be remitted to a single person if it is not redeemed on the same income. The limit helps to adjust the Medicare Part B premium. The adjusted income amount can vary according to how much you earn and the Medicare income limits may also vary annually.

How does Medigap affect you and how much is deductible? Last updated: 16 September 2020 10:13. Medigap provides supplemental medical coverage that helps seniors pay out-of-pocket costs. Original Medicare coverage for older people. How does Medigap affect senior citizens' finances?

It also requires adjustments to your Medicare supplemental health and prescription drug coverage.

That's a matter of fact. In case of Medicare-eligible individuals aged over 65 you can enroll in Medigap for free and it is guaranteed for a limited period of time. It also doesn't allow them to view the medical information of the person or their history. You should be able to change your Medigap plan at any time, but you may not need medical insurance. It may be difficult for you to get canceled or your premium could increase based on your condition. In most states, medical insurance for people younger than 65 doesn't guarantee a definitive release. If this patient qualifies they will be given medical insurance with significantly higher premium increases. Get a Medigap Quote Join Medigap.

I don't think. Medigap will pay a fixed amount based on your income. It's good news for people with good earnings, while bad news for fixed incomes.

The premium is reduced in many forms. This guide provides general recommendations for saving money.

They also have limits on out-of-pocket spending, but include physician networks, which means that you will pay more if you see a provider out-of-network. Medicare Advantage plans may charge a premium in addition to the Part B monthly premium. For free assistance with understanding your options for supplemental coverage, contact your local SHIP. View all questions about Medigap Topics Medigap Related Questions Can I get information about Medigap policies on the Medicare Plan Finder? I have Medigap Plan C.

If the amount is greater than your monthly payment from Social Security, or you don't get monthly payments, you'll get a separate bill from another federal agency. This agency may be the Centers for Medicare & Medicaid Services or the Railroad Retirement Board. How Social Security Determines You Have a Higher Premium We use the most recent federal tax return the IRS provides to us.

We will not sell your personal information. A licensed sales representative may contact you regarding Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans. Ask a Question Here Subscribe Notify of Label First name* Last name (Not published)* Email (Not published)* Senior65 is a small but energetic company. We will respond to your request as soon as possible.

About Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans. Note: We cannot answer specific medicare claim information. 0 Comments Inline Feedbacks View all comments Load More Comments Leave a comment Looking for a quote? Senior65 is appointed to sell plans by carriers including: Check your Medicare Deadline Enroll without penalties in Medigap.

You can find more information about the Medigap plans available in your state by contacting your state's health insurance department or your SHIP. Another option could be to enroll in a Medicare Advantage plan. Medicare Advantage plans provide all benefits covered under Medicare Part A and Part B, but often have lower cost-sharing requirements than traditional Medicare.

Refer to Medicare glossary for more details. . What's a premium, deductible, coinsurance, or copayment? Part A (Hospital Insurance) costs Part A costs: What you pay in 2022: Premium $0 for most people (because they or a spouse paid Medicare taxes long enough while working - generally at least 10 years). If you get Medicare earlier than age 65, you won't pay a Part A premium.

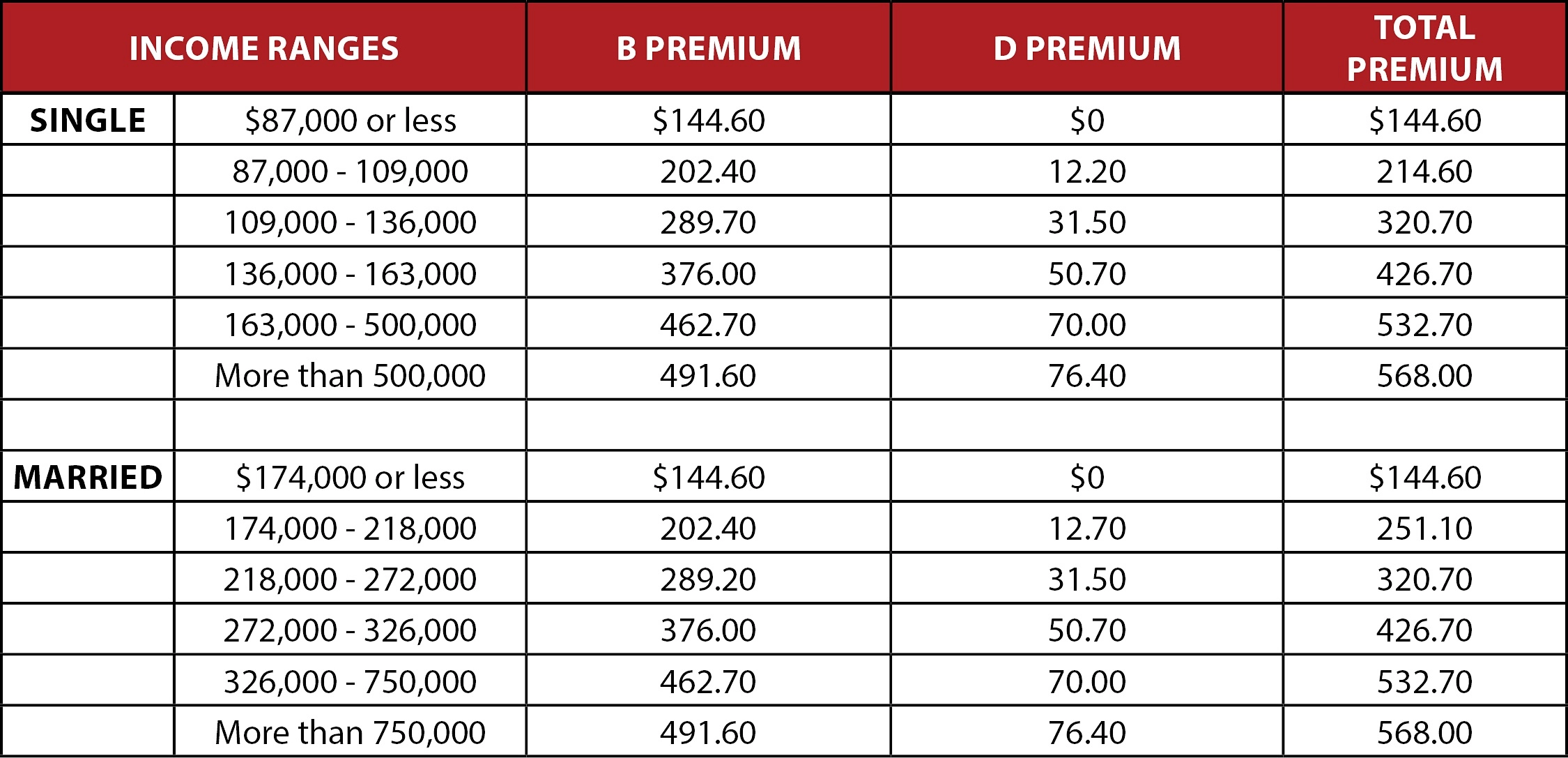

How Social Security Determines You Have a Higher Premium We use the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your “modified adjusted gross income” (MAGI). Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage.

The premiums are calculated from the age of the person buying the Medigap insurance plan ("evidencing"). Premium rates will be higher if people buy at the younger age, but not lowered with age. In fact the premium may increase due to an increase in inflation, but that doesn't mean you're old.

Medicare beneficiaries must pay an increase of $176k in premiums. The maximum is 88,000 for the individual and $176k for the marriage. You pay according to your adjusted gross income from recent federal income tax returns.

For income adjustments for 2019, use your earliest 2019 federal income tax return. The general data on these forms was obtained by filing 2018 tax returns for the tax year 2017. The IRS may provide the data for tax returns filed by the taxpayer in 2017.

We explain the IRMAA process below. The IRRAA will charge individuals with incomes over 911,000 in 2021 and couples who earn over $182,000. The yearly limit for 2022 is expected at approximately $97,000.