Medicare Supplement Insurance Plan or Medigap — is an alternative plan that can be purchased for most Americans and is not available elsewhere. Terry Turner. Terry Turner is Senior Financial Writer and Financial Wellness Facilitator. Terry Turner is a veteran journalist and covers government spending on Social Security programs, Medicare and other federal programs. As a financial wellness coach, he holds certification from the National Health Educator Association and from the Foundation for Financial Wellness. Read More Matthew Mauney Matthew Mauney Financial Editors.

Can I still be covered by a Medicare Supplement Plan? Medicare Parts A & B, or Original Medicare may not cover all your health care expenses. Find ways in Wisconsin that a Medicare supplement plan provides coverage for your coverage.

Wisconsin's health-saving Medicare Supplement plans are quite different from typical letter plan available throughout America. This state offers the basic plan and the option to use riders. A state law mandates that Medigap insurers provide supplemental benefits as an additional protection. The Wisconsin Medigap Guide is available here. How does cheapest insurance plan exist in Wisconsin?

In general, you'll get a great deal on Medicare Supplement insurance if you purchase a plan once you qualify and have Parts A and B. Medigap Open enrollment starts on the day after your 65th year. A company cannot ask a physician to approve a patient's payment for the same period. To apply to MEDICAP plans, contact a medical insurance company to check if your account is open for new enrollment. Fill out your application for a plan and decide when it should begin.

Most common types of Medigap plan options exist in Wisconsin, though the most common is Plan A. There is no enrollment for Plan M. Only about half of people choose Plan H.

The Wisconsin Medicare Supplement is very different from typical letter plans in many states. The program in these states includes basic plans which have the option to ride. State law requires Medigap insurers to provide special benefit to the premium coverage.

There are several disadvantages to using Medigap plans. Have difficulty navigating a variety of plans. No prescription insurance.

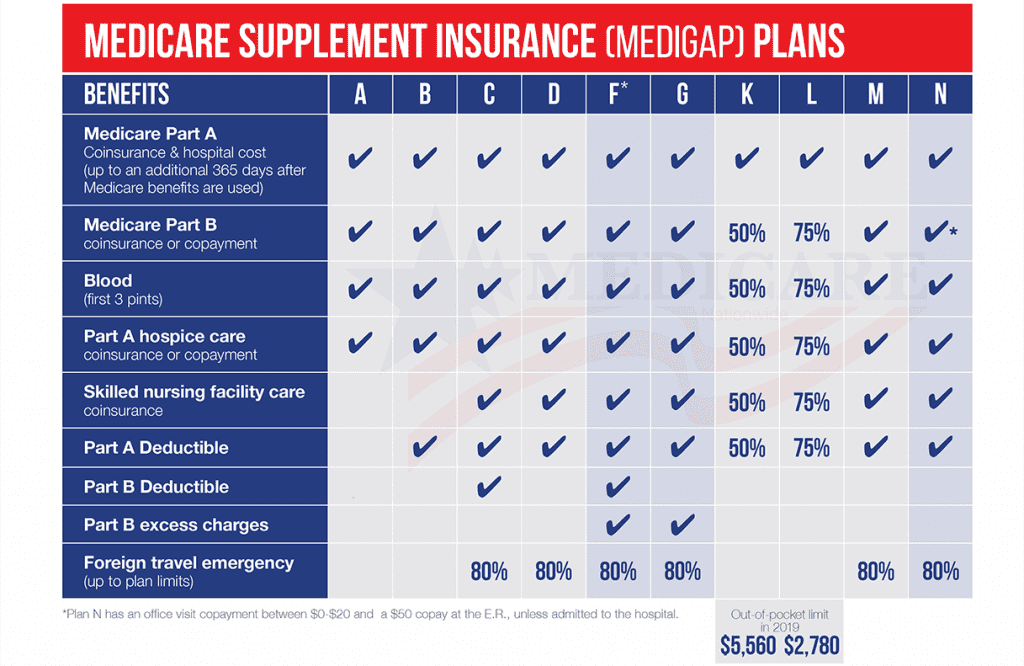

Plan A generally carries higher premium rates than plan A because the insurance is more comprehensive. However, you may save money by using plan n for a higher cost than plan g, depending on your specific medical requirements. Medigap policies cost differently depending on the state.

If you're not eligible for an MSP, you might still qualify for Extra Help with your prescription drug costs. Beneficiaries eligible for an MSP are always entitled to Extra Help . Wisconsin's State Health Insurance Program (SHIP) is through the Wisconsin Department of Health Services .

Read More Updated: August 12, 2022 4 min read time This page features 5 Cited Research Articles Fact Checked Fact Checked A licensed insurance professional reviewed this page for accuracy and compliance with the CMS Medicare Communications and Marketing Guidelines (MCMGs) and Medicare Advantage (MA/MAPD) and/or Medicare Prescription Drug Plans (PDP) carriers' guidelines.

Other options include: Medicare Advantage: Medicare Advantage plans provide Medicare benefits through a private health insurance plan. Medicare Advantage, or Medicare Part C, usually includes benefits like vision and prescription drug coverage .

Subscribe Now Call Now Get My Free Open Enrollment Guide Close Home > Medicare > Supplement Insurance > Compare Plans > Wisconsin Medigap in Wisconsin Medicare supplemental insurance — or Medigap — plans in Wisconsin are different from the standardized choices of Medigap plans available in most other states.

This website is not connected with the federal government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area.

One of the most important decisions you have to make is what type of Medicare coverage to enroll in. There are multiple factors to consider. It can be easy to make the wrong choice, a choice you may not be able to undo.

Shop Plans Need help finding the right plan? Talk to a licensed agent through ChooseHealthy ®4 EyeMed vision care program 4 Hearing Care Solutions hearing program 4 Base plans offer unlimited preventive coverage 5 Optional foreign travel emergency coverage up to $100,000 6 Optional dental coverage (requires a premium) Services available to every customer To make our Medicare supplement insurance plans even better for you, we offer additional services 7 you can use at no extra cost.

Are in your initial open enrollment period and are guaranteed the opportunity to join a plan regardless of your health condition. Can afford the monthly premiums Don't want a Medicare Advantage Plan No, if you: Want a Medicare Advantage Plan with zero or low monthly premiums Don't mind following the rules and restrictions of a Medicare Advantage Plan to get your healthcare services and drugs.

Part A: skilled nursing facility coinsurance 175 days per lifetime in addition to Medicare's benefit of inpatient mental health coverage 40 home health care Health care services and supplies a doctor decides you may get in your home under a plan of care established by your doctor.

If you and your spouse both want Medicare supplement coverage, you will have to buy separate policies. However, WPS offers a 7% household discount when two or more individuals who reside together in the same dwelling have WPS Medicare supplement coverage. A dwelling is defined as a single home, condominium unit, or apartment unit within an apartment complex.