Part B and Part C of Original Medicare provide supplemental health care coverage to Medicare enrolling citizens without paying for medical care. In Medicare the coverage is limited. Get free quotes Find the most affordable Medicare plan in the region Many elderly people enroll in a Medicare Supplement (Medigap). Getting a comprehensive plan is a must to ensure you receive the greatest coverage possible.

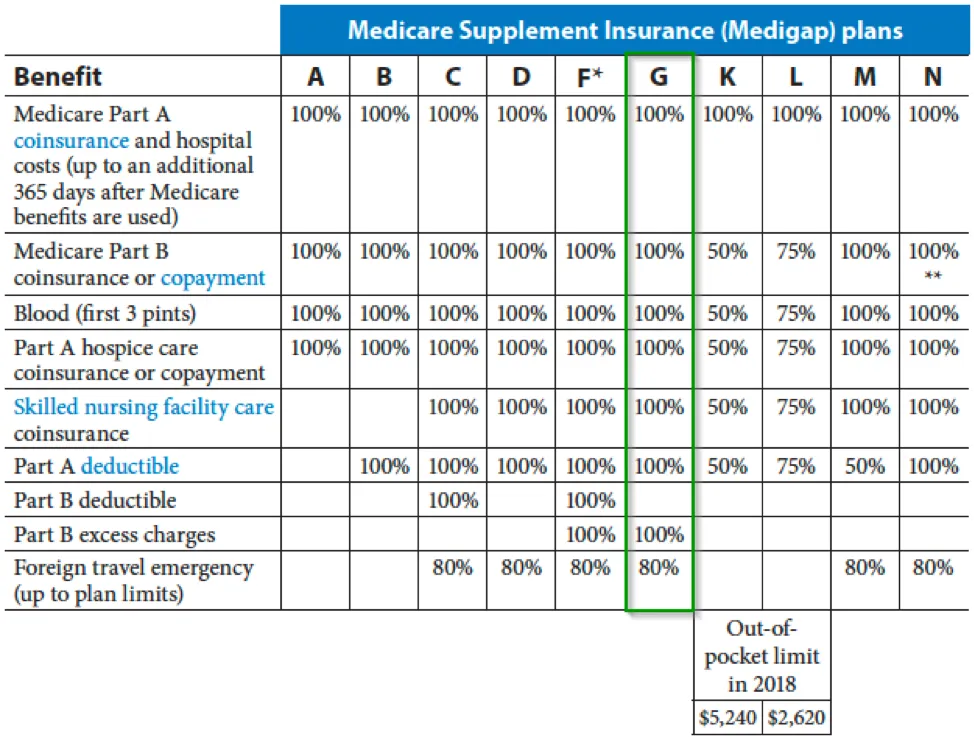

Medigap plans are sold by private insurance companies and are designed to assist you with out-of-pocket costs (e.g., deductibles, copays and coinsurance) not covered by Parts A and B.

All Medicaid insurance policies must comply with federal and state law designed for your protection and must be clearly marked as "Medicaid Supplement Insurance" Insurance companies sell only standard policies that are usually identified in the state alphabetically by their names. Each policy provides similar basic benefits, but some of them offer additional advantages to give you the choice to meet your needs. The Medicaid policy is different for Massachusetts, Minnesota, and Wisconsin. Every insurer decides the Medigap policy they want to sell, but some states may have their own rules on the coverage that they will be able to sell in the future. Companies selling Medigap policies.

Exceeding fees: $6620 in 2020; $3310 in 2022. Plans F and G offer high deductible plans for most Americans. The plan will cover the cost of the supplemental insurance coverage (co-payments, and the deductible) until the 2020 deductible amount is $2990. (Plans C and F do not apply to new beneficiaries of Medicare on or after 1 January 2020). **The Medigap plans will be automatically canceled once the amount meets its deductible for the first year after you exceed the monthly deductible and meet your deductible.

As of January 1, 2020 Medigap plan sales for new Medicare patients do NOT cover Part B deductibles. Since then the Plan C and F are no longer available to new Medicare users. Unless you have gotten a plan that is covered under either of those plans prior to January 1 2020, you can keep your plan. When the Medicare enrollment period ends January 1, 2019, you can purchase either plan.

Medigap is not a perfect solution for everyone. A particular Medigram policy may work for you when the coverage you need is tailored for you and comes with premium rates that match your budget. Medicare Plan F is the best known health care program for seniors. All Medicaid-administered beneficiaries receive the benefit under Plan F2. Plans F provide the best in standardized costs in the health care system. Basically Plan F includes all standardized benefits offered through Medigap. Average Plan F premiums for 2020 are $76.25 per month. Medigap Plan G has a high popularity rate and has quickly gotten popular. Plan G enrollment rose 38 percent last year.

Medicare supplements are paid by the private insurance firms. It is also possible the plans availability or premiums can vary depending on the provider. A Medicare Supplement Insurance Plan will cost a maximum of $22816 monthly per year by 2022. The average cost varies considerably between different Medigap Plan options. Various types of Medigap offer standardized benefit combinations and plans which are less likely to attract higher premiums than others. Your age, gender, smoking habits, health, the area of your residence, and the time you apply for Medigap will all affect the average costs of Medigap plans closest to you.

Medicare Advantage and Prescription Drug Plans are offered by a Medicare Advantage organization and/or Part D plan sponsor with a Medicare contract. The Initial Enrollment Period is a limited window of time when you can enroll in Original Medicare (Part A and/or Part B) when you are first eligible. After you are enrolled in Medicare Part A and Part B, you can select other coverage options like a Medigap (Medicare Supplement) plan from approved private insurers.

Medicare Supplement Plan G provides a way to reduce your healthcare expenses and pay a minimum of 10% of your total Medicare Part A costs. Then, Medicare covers your health insurance expenses for 99%. The 2020 Medicare deductible will be $233. Consequently your annual medical expenses are $233, less than the premium you pay. Due to these low upfront expenses, Medigap Plan G has positioned itself as the best Medicare Plan to be launched by 2022. Because of a new enrollment law, Medicare Supplement plan G becomes one of the most popular options. Medicare Supplement Plan G may help you if you are:

In the absence of traditional health plans where the policy varies among providers, Medicare Supplement plans have standardized benefits for every letter of the plan in all companies. The UnitedHealthcare Medicare Supplement G Plan is identical in coverage to Plan G offered by aetna. Rates vary, however, because the Medicare Supplemental provider has different pricing structures. It is crucial to consider these factors together with the financial strengths and history of rate hikes by each provider. Some companies offer low rates and can increase their prices faster as you get older.

Until 2022 Medicare Supplements are priced at around $63 monthly. The cost range is particularly broad due to the variety of plans and prices factors including age and geographic proximity. Some people on Supplement Plans may pay just under $100 monthly, while many may pay over $500.

Most of the population prefers to use Medigas plan G of UnitedHealthCare, which costs around $159 per month. Provides comprehensive insurance from an experienced company. All Supplement plans include standard benefits and can help protect against your deductible.

Plan g is the most common Medigap plan. Approximately 49% of Medicare Supplement enrollees chose the plan due to its comprehensive services. Plans G currently have 22% of the market, so it is a popular option for newly admitted Medicare beneficiaries.

Medicare Supplement plan F is the simplest Medicare Supplement plan and regarded as a good Medicare Supplement plan. The option guarantees 100% coverage if Medicare covers your portion of the cost. Medicare Part A and Part B deductibles and Part B coinsurance. You won't be liable for more than the cost of any healthcare service provided by Medicare under the Supplement plan. The plan also covers certain emergency travel to other countries. Some Medicare patients don't even have Medicare. You must ensure that you meet the criteria of eligibility.

It is a budget-oriented program. But that adds more costs. Part B of your Medicare Supplement plan covers 80% of coinsurance. In other words, Medicare Part B plans are liable for Medicare Part B deducted costs and co-payments. The amount is a minimum amount for a patient to receive care. Medicare supplemental plan N offers an exceptional solution for those who don t frequently visit the doctor or seek medical emergency assistance. Get Free quotes Get the cheapest Medicare coverage for your area.

In this example, your best Medicare supplement plan should provide you with a balanced budget. Policies with fewer deductible coverage typically carry more premiums per year. Plan g is ideal mainly for those that have very minimal medical needs and can pay around 90 a month. Having a good sense of calmness may help you avoid medical expenses. In most cases a lower-cost Supplement Plan may provide you with a lower-priced health care option that will reduce the annual cost of health care.

Plan N is good for people seeking protection similar to Plan G, but with much lower costs. There are no Medicare Part B excitement costs covered under Plan N. This is an additional expense that your doctor may be required to incur if your insurance provider doesn't accept Medicare's approved payment. If you are not satisfied with Medicare's reimbursement program, you should consult with your healthcare provider to make sure your plan is accepted. Compared to Plan A, you would have incurred $152 / month in savings of $38.

If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles). This website is not connected with the federal government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area.