What's important about the plan: The plan G covers the entire Medicare Part A and B coverage except the Part B deductible. Premium prices can vary greatly according to location. The cost of cigarettes also differ a lot according to your age or how much vape you smoke. If your Medicare eligibility is met you may be eligible for Plan G. Medicare Supplemental Plan G, also known as medspa Plan G, is the supplemental insurance that has become more popular in recent years. With Medigap plan F being phased away in 2024, Plan G has become the preferred choice for many.

Medicare Supplement Plans G are the most comprehensive Medicare Supplement (medigap) program available for Medicare beneficiaries. The coverage has become more popular over the past few years. Get an estimate Find the most inexpensive Medicare Plans in your local area It's the most popular Medicare Supplement plan currently in use. Medigap plans G will reduce your Medicare payment from the cost of your coverage. These programs are available to many Medicare recipients all over the United States.

Medigap is among 10 Medicare Supplement Insurance Plans. Medigap plans provide coverage for certain expenses, excluding coinsurance. Plan G is the best available Medicare Medicap plan available. Premiums for Medigap Plan G are set by the private health insurance companies that sell it, even though the plans are regulated by the government.

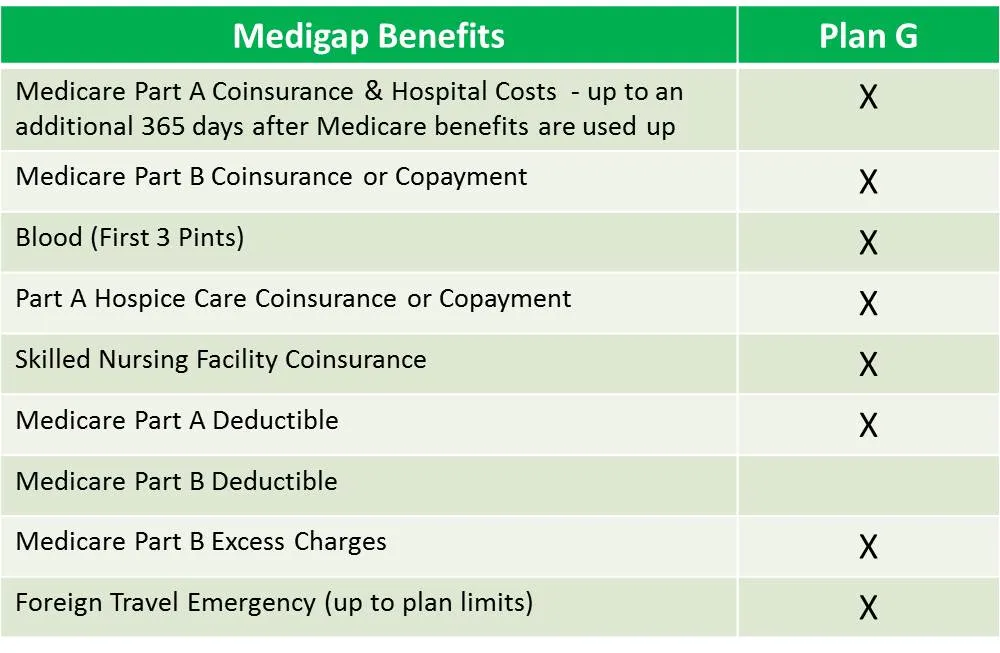

Medigap Benefits Plan A Plan B Plan C Plan D Plan F Plan G Plan K Plan L Plan M Plan N Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. rules will vary with each state as well as the Medicare Supplement insurance company. Residents in these states can take advantage of this exception when the cost of premiums increases each year.

Plans G do not have premiums as they are priced between $100 and $200. Your annual premium will vary depending on the location and zipcode you are in, your age, smoking status and much more. Compare Medicare options with an insurance brokerage. Three states have different Medigap policies than the 10 standard plans. They are Wisconsin, Minnesota and Massachusetts. Residents may also make an alternative plan similar to plan G policies in their state. Since they could be adding riders to a policy to create a plan G, premiums may vary by individual. $233 is billed annually as part of the plan's Part B deductibility in 2022.

Plan F is an industry standard for Medigap policies. This program covers the largest gap in health coverage. Plans G have similar protection with one exception: Plans G does not have Part B deductibles which will be $233 in 2022. Although most Medicare beneficiaries are paying part B, deductible plans are cheaper to administer than Plan F when they consider each premium. Plan G will cover most of Medicare Part B and Part C coverage, with no additional Part A deductibles and. This will make you pay no extra cost to cover services after paying a deductible. Plan G, similar to Medicare, includes an “excess charge”.

There is an additional 90 days available for the 742 daily rate. This is a life-time reserve day for which you can use across different benefit periods (each of which takes place in an emergency medical care unit). You must have 60 days between your stay to use Life-time Reserve. The amounts apply for each "benefit period" which is the time you enter an institution of health care (SNF) and ends after a stay at this place for fewer than 60 days in a row. Medicare typically doesn't pay Part A and B services in the United Kingdom. Medicare may occasionally provide inpatient hospital services out of the United States under certain conditions.

It is illegal for a government employee to enroll into Medicare Supplement plans when disabled. Despite this, several states require insurance firms to offer Medigap plans to all people who have less than 55 - 75. Sometimes these carriers may give you Medicare Supplement Plans. Medicare Supplement Plans A is one option most people should consider. Medicare Supplement Plans offer only basic benefits. Despite these difficulties some insurers recognize the significance of wide availability of plans for disabled patients and will allow these people to enroll in the Medicare Supplement Plan G. Ask a free estimate.

Costs of Medicare supplemental plans G vary depending upon many factors such as location and the age of the individual smokers or their smoking habits. Medigap Plan G is currently priced around $100-300. Get a free quote. Find your local best Medicare coverage and save money. Medicare Supplement monthly fees are generally more expensive in areas that are more expensive to live in. If you like Medicare Supplemental Plan G and can't afford it, then your options may change. Unlike Medicare Supplements, the HMO G plans offer the same benefits for an affordable monthly rate and lower premiums.

Medicare plans G, also known as Medicare plans G, have been increasing in importance for several different reasons. The G program covers the gap between Medicare and its members with the exception of Part C deductibles each year. It will cost about $63 in 2021. In truth you may get more benefits from Plan F than Plan G. When you buy insurance from Boomer Benefits, we usually find a Supplement Plan G that saves more than 50%. It's your pocket money if not. Second, there's excellent reporting. This cover covers the cost of hospital visits.

Frank is a diabetic on the Medicare Supplemental Plan G. His primary care physician visits his endocrinologist twice per year to refill his prescriptions. In January, he made his first medical appointment in one year. The specialist charges Medicare, which covers 80 percent of the deductible, which Frank has paid out. He pays the rest of the money. Frank has covered himself in a way that offers free lancets, glucone strips and glucose tests. Medicare will cover all the costs associated with these insulin supplements.

Medicare supplemental program G provides proportional coverage for any health care you receive under the Original Medicare plan, except for deductibles. It also helps to provide hospital services like the first 3 pint of blood, skilled nursing facility services, and hospice services. In addition, they cover ambulatory medical services such as x-rays, ambulances, surgery etc. So Plan G covers the coverage gap with Original Medicare. All Plan G products must offer you coverage exactly as they are provided.

Plan G is a Medicare supplemental health plan offered exclusively to people disabled and under age 55. Plan G is an important Medicare supplement plan available to purchase. Plan G are Supplemental policies which mean that they are not your primary coverage but they cover most of the gaps that exist with Medicare policies. Part B benefits cover your medical needs. Until Medicare pays, Plan G will provide coverage for the remainder of the cost. Plans G covers some of the costs incurred in your Medicare policy. The maximum amount deductible under Medicare Part C is $15556.

The government offers 10 standard Medicare Supplement insurance plans to help you reduce your health costs under Original Medicare Part A and B. Medicare does not cover all medical procedures or treatments, thus leaving a gap in coverage this policy can fill. In case of Medigap policies you should use any doctor or hospital in the United States that accepts Medicare. All medical providers need to participate and accept new customers under Medicare. Most physicians in the USA have original Medicare. Retirements.

The only costs that Original Medicare doesn't cover in the Medicare supplemental plans are the Part B deductibles. You will be required to meet this deductible prior to receiving your Medigap benefits. In addition, Medicare Supplement Plan G does not cover services like dental, vision, hearing and prescription drugs. Medigap Plans G only cover original Medicare coverage. So this will be paid only if Medicare pays. If the Medicare program pays their portion of the insurance, the insurance company can't provide it to you. Imagine you want these additional benefits.

Medicare Supplement Plan G provides secondary coverage to Original Medicare Part A and B. Medicare originally offers no medical coverage in all respect of patients. A Medicare supplement plan will provide you with a way to pay off your expenses in a less than perfect way. Ten Medicare Supplement plans have been approved for people who qualify. Medicare offers two high-deductible plans. Each program has letters A to N. All of the lettered Medicare supplement plans offer varying health benefits as a monthly supplement for seniors who have a Medicare deductible.

A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services.