Medicare Advantage is an integrated replacement of Original Medicare. Medicare Advantage plans are offered to people who can receive Medicare. One in five Medicare patients has Medicare benefits. MA plans include health maintenance organizations, preferred provider organizations, private fee-for-service plans, and Special Needs Plans.

Medicare benefits programs offer many private insurance options over Medicare. However, Medicare Advantage has its advantages.

While certain health care plans are flexible in plan design and offer better care, others have less provider options, additional costs and lifestyle challenges.

The Medicare Advantage program is an insurance-backed insurance plan which offers many benefits and disadvantages as you learn about Medicare and its benefits for your family and friends.

We provide independent product reviews. We never bet on any payment made through our advertising partners. See how the company reviews our advertisements and read the advertiser disclosures.

A Medicare Advantage plan may seem attractive. Typically Medicare Part A is combined with Medicare Part B medical coverage and most often Medicare Part D prescription coverage.

This plan provides Medicare-related services and includes coverage for vision, hearing and dental. These services are supplied to the public through Medicare-regulated companies.

The Medicare Advantage Plan serves as an integrated replacement for original Medicare. These policies are available to customers through private providers who work for Medicare and offer Part A and Part B services, and sometimes they are also Part D (prescription).

Most plans provide coverage that Original Medicare does not include. You must be registered with Medicare Part A or Part B before enrolling in a Medicare benefit plan.

Q1Medicare.com is a Medicare education website that provides comprehensive Medicare plan information. Most Medicare benefits have yearly limitations on your medical expenses called maximum deductibles. If you have reached your maximum amount you will not pay any fees.

Each plan has a different limit, and the limit changes yearly, which will affect how a plan is purchased in the future. It is not surprising how much of the difference between MOOPs is usually the difference between deductible and deductible premiums.

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services.

The Medicare Advantage plan or Medicare Part C provides Medicare Part A hospitalization insurance coverage for the health-care system.

In general, Medicare Advantage Plans usually also include pharmacotherapy prescriptions and may have other benefits besides Medicare allowing for savings on dental treatment and vision care. Medicare Advantage Plans have a yearly limit on your out-of-pocket costs for medical services.

Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage (Part D).

Costs can quickly accumulate in one year when someone is sick. The Medicare Advantage plan might have no premium in the beginning, but the upfront costs are likely to be lower than the anticipated savings.

The best candidate for Medicare Advantage should be healthy and well-balanced, says Mary Ashkar, senior advocate for the Center for Medicare Advocacy. Those people have problems when they are sick. Second.

The Centers for Medicare & Medicaid Services (CMS) uses a Five-Star Rating System to measure the quality of care provided by Medicare Advantage and Part D plans.

If you are over 55 and you have no Social Security entitlement, you can apply for supplemental Medicare. Part A and Part B will not automatically take effect.

If you receive Social Security benefits already, you will automatically receive Medicare Part A and Part B if your eligibility has changed. Medicare covers a variety of health care services.

Medicare Advantage plans typically cover some of the gaps in original Medicare and offer no premium from any company.

This option may offer a reasonable alternative to patients currently unwell with a severe medical condition or medical needs. Patients often have difficulty switching plans.

Comparison Medicare Advantage Plans involves understanding health insurance needs and considering what the individual plans offer.

Those who have chronic medical conditions who need to continue relying on a particular doctor may want health insurance. Depending where you live you might be able to find out how to reduce your prescription drug costs by using some of these plans.

Medicare Advantage plan may confuse Medicare Supplement Insurance with Medigap. Generally the two policies are available to the public, but their coverage of their expenses vary.

Medigap coverage covers “the gaps” in Original Medicare by covering 80% of covered charges. If you are in medical need all your medical expenses can be included in your insurance policy. You've also got the ability to pay monthly premiums.

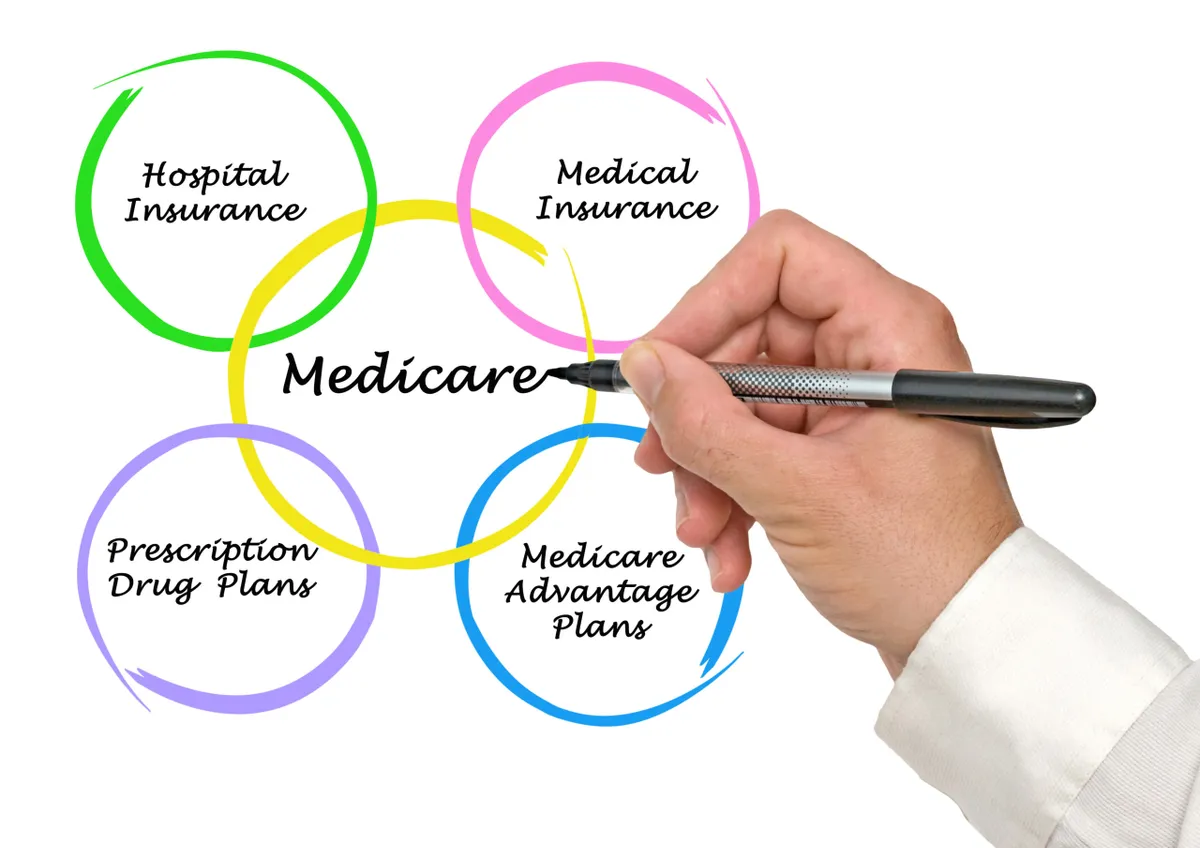

Medicare is a medical program that covers Part A (hospital insurance) and Part A ( medical insurance ). If you need help with expenses, you can buy additional medical care called Medigap (or Medicare Supplement).

This coverage is provided by private insurance companies and covers everything Medicare does not cover such as insurance premiums, deductibles and co-payments when a patient goes overseas.

The best Medigap policy is Plan F, which covers a total of copayments and deductibles. Unfortunately plan F is currently unavailable to new Medicare patients.

Medicare Advantage plans use network providers to limit your options. If you leave your local network your care is not considered covered or may be significantly less expensive unless you stay within their network.

Depending on Medicare's Original Payment Programs, you are typically able to use a medical provider who accepts Medicare assignments.

However, it's often more expensive to pay. The monthly premium for Part B is required. Nonetheless, you can still receive fewer costs from Medicare Advantage plans than from Medigap programs.

Key Takeaways A Medicare Advantage (MA) Plan, known as Medicare Part C, provides Part A and B benefits, and sometimes Part D (prescription drugs), and other benefits. All Medicare Advantage providers must accept Medicare-eligible enrollees.

Most Medicare Advantage Plans include drug coverage (Part D). In most cases, you'll need to use health care providers who participate in the plan's network.

Some Medicare Advantage Plans do not offer the premiums. Medicare Advantage Plans have an additional maximum cost per visit limit on covered services.

While Medicare Advantage is an affordable option if you have an active health plan, you have to pay for all expenses.

If you decide to quit Medicare and decide it is not for you, then you have the right to use Medicare Advantage for your medical insurance coverage, if you have already switched to the Medicare Advantage plan for the first time.

In addition, you can opt-out of your Medicare Advantage plans during a free enrollment period, or if you are eligible. Medicare Advantage, or Medicare Part C, is a type of hospital and medical insurance provided by private companies instead of the federal government.