Most of Medicare's coverage of blood pressure monitors is limited but not always. Medicare Advantage does not usually include blood pressure monitoring, but some MA policies offer prescription drug coverage as well as medical and hospital services. Part B of Original Medicare may pay for blood glucose monitoring in patients who are in the midst of an inpatient kidney transplant. In other words, the Medicare plan does not usually provide supplemental coverage for blood glucose monitoring. Certain Medicare-based Part C plans provide coverage for certain prescription drugs and prescription medications.

You can get blood pressure monitoring online if you are prescribed a blood pressure test. The cost to purchase blood pressure monitoring devices online or from health care providers should be reviewed carefully since original Medicare (part b and c) covers only the at-home monitor. Find out the best ways to monitor hypertension at home by following these simple steps: Buying a portable monitor is a must.

Medicare provides ambulatory blood pressure monitors that may be used at least once a year if requested by an expert physician. There's no regular “cuff†blood pressure monitor except in patients who have dialysis.

An at-home blood pressure monitor makes it much easier to keep tabs on your numbers and see your progress over time, without the headache and potential stress of going into a drugstore or your doctor's office. In these cases, physicians aim to attain more reliable readings using ABPM devices that take blood pressure readings multiple times over a 24-hour period at home.

Medicare usually does not provide for blood glucose monitoring but can provide supplemental care if a doctor considers it medically needed. Medicare Advantage offers patients with high blood pressure medications a stipend that pays for their medical expenses. Medicaid may be helping with blood pressure monitoring. The coverage depends on where the residence is located. Parts A and B are not applicable for blood pressure monitoring, although Part B might have coverage for certain conditions as medically required. Medicare is also offered through prescriptions that provide money that is available for items such as toothpaste, deodorant and blood pressure monitor.

Part B provides for Medicare to cover vascular blood - pressure monitoring as a standard medical device. The funds will cover 80% of all Medicare payments for blood pressure monitoring equipment after paying the deductible annually. Medicare Advantage replaces Part A or Part B on the original Medicare and will therefore offer the same level of reimbursement for blood pressure monitoring by Medicare. Some Medicare Advantage plans also provide coverage for other services than those provided by Part B. Century medicare insurance professionals can contact you.

A blood pressure reading that's over 130/80 is considered high. Even if just one of the numbers is over that level – the upper number or the lower number – the reading is still high.

A blood pressure meter or APMS is a device that measures and records blood pressure data during daylight hours and night. The device is equipped with a wristband and a recording device which is attached to a belt or a clothing belt. Wearing it can last up to 48 or 72 hours in your routine. You have to wear it while you are asleep. Blood pressure levels vary according to the hours at night, activities levels, emotions, and other factors. ABPMs help doctors monitor blood pressure at any point during the day.

This includes both standard blood pressure monitors (“cuffsâ€) or ambulatory blood pressure monitoring (ABPM) devices, for use at home by a patient.

Nearly half of Americans have high cholesterol, also called Silent Killer due to its higher rate of heart attack and stroke, which is a serious problem. The blood pressure problem is treatable. Here comes the blood pressure monitoring system. While Original Medicare does not normally provide a blood pressure monitor, certain Medicaid programs can cover them. Every state has a Medicaid program which was launched in 1965 along with Medicare for those who were facing a financial need due to their disability.

An ABPM is only covered by Medicare if your doctor determines that you have suspected white coat hypertension (high blood pressure induced by anxiety or stress from visiting a doctor's office or hospital). We recommend that you speak with your doctor directly to learn more about blood pressure monitors and whether or not they are recommended for your use.

Suppose a health care provider considers high blood pressure a medical condition necessary for the diagnosis of that condition. Part B covers the leasing of a pulmonary embolization catheter. A BPM monitors your blood pressure for 24 - 48 days to verify validity of an individual blood pressure measurement done by the physician. Part B usually covers blood pressure monitoring as one of the durable medical devices it covers during home dialysis. The blood test can be purchased from Medicare.

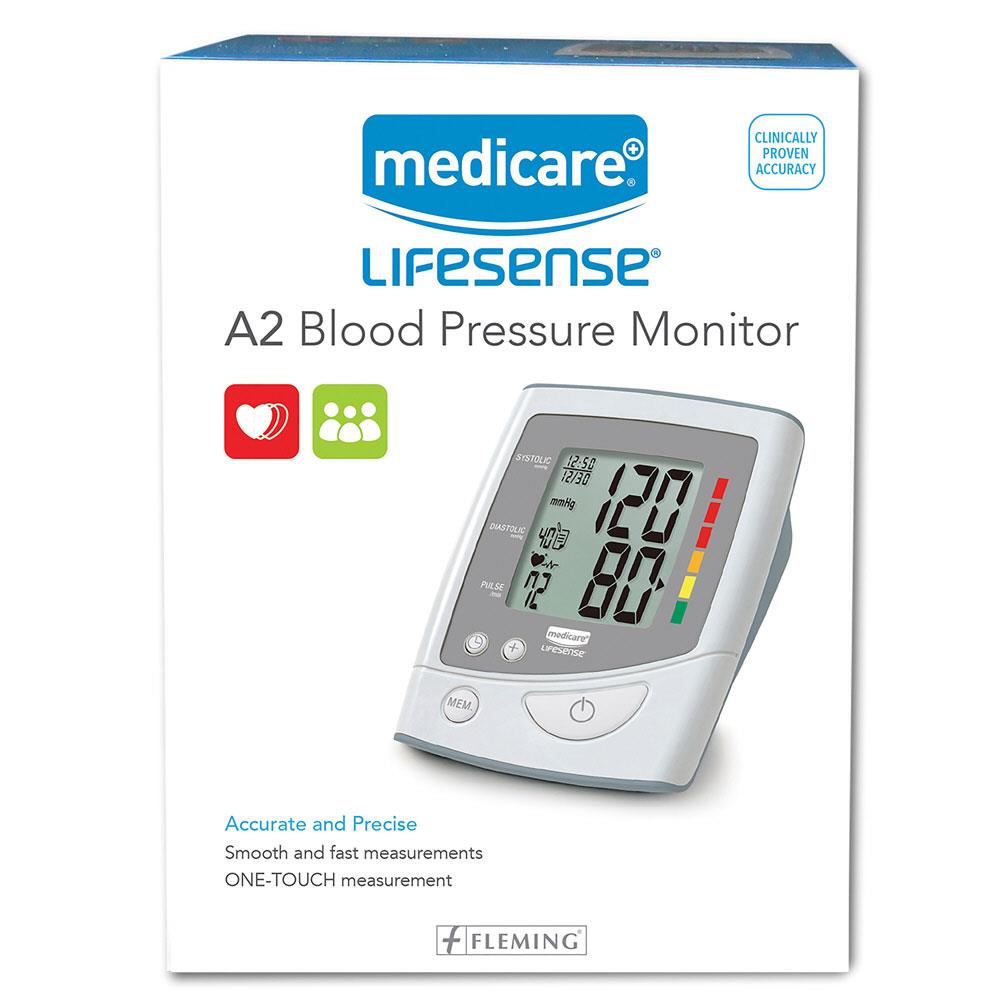

Medicare may provide coverage for a blood pressure monitor at home if you are receiving dialysis treatments at home. If this is the case, Medicare will provide a blood pressure cuff and a stethoscope to allow for blood pressure and heart rate monitoring during treatment. Medicare Coverage for Blood Pressure Monitors There are two main devices used to measure blood pressure: blood pressure cuffs and ambulatory blood pressure monitoring devices (ABPMs).

Generally Medicare Part B insurance can help pay deductibles for Blood Pressure Monitoring devices that measure your blood pressure over 24 hours. An ABCPM is deductible for patients with white coat hypertension. Please consult your doctor first if you have questions.

Even with a blood pressure monitoring service Medicare will cover you with additional out-of-pocket expenses which may include: It's unclear when Part B coinsurance is required every year.