Medicare's funding is based on tax payments in trust funds, beneficiaries' monthly premiums, and other funds approved by Congress. In 2019, a new report released Wednesday said Medicare spending had reached a record $776 million. This article discusses Medicare funding strategies. The article also describes the changing cost of Medicare. This article uses some terms that should make it easier for a person to choose a suitable plan.

Medicare provides coverage and reimbursement of healthcare services for people with a long-term illness who are 65 or older. This issue brief contains the latest historical and projection Medicare expenditure data released by the Boards of Medicare Trustees of the Centers for Medicare & Medicaid Services (CMS) Office of the Actuary, the 2019 Medicare horizon, and projected budgets for 2019.

CMS is the agency's primary monitoring agency for all program offerings by state. In 2017, Medicare provided health insurance to 57 million individuals. Overall expenditure was $855.5 million. These funds come from government funding for Medicare.

Income taxes paid on Social Security benefits Interest earned on the trust fund investments Medicare Part A premiums from people who aren't eligible for premium-free part A

Despite its disparate, Medicare has various funding mechanisms. Part A of Medicare pays 89 percent of its costs through the payroll tax system, which includes the hospital. Part B provides coverage for medical care out of home and provides the largest portion of the country's total revenue, 74. General revenue is revenue collected from taxes and other sources for government programs. Medicare Part D, an optional insurance plan covering drug costs, is also funded by 83 percent through general income. Medicare Part C – sometimes called Medicare Advantage – is funded under Medicare Part B.

Medicare Part B revenue comes from both general revenues and premiums paid by Medicare beneficiaries (the money goes into the Supplemental Medical Insurance (SMI) Trust Fund and is then used to cover Medicare expenses).

Part A receives most of the income through payroll taxes that amount to 2.9% of earnings and each employee and employer pay 14.5 percent. High-income workers have higher taxes, and self-employed individuals are taxed at 2.9% for each quarterly filing. Every worker must pay wages tax as required under FICA under the federal insurance contribution law (FICA). These taxes, also commonly termed Medicare taxes, are automatically deducted during the yearly payroll procedure based on payroll data. Medicare pays $341.7 million in 2020. Most of that funding is 89 percent sourced from payroll.

Most of Medicare's annual revenues come from revenues derived mostly from federal income taxes. Another 25% of Medicare Part B is funded by a monthly premium payment. Social Security borrowers pay primarily interest in Part B of the program. Part B enrollments pay an annual adjustment of their payment. In 2022, the average monthly cost for Medicare Part B is 177.00. These amounts are automatically deductible from Social Security payments. Enrolled persons earning over $91,000 annually pay higher rates.

Medicare pays private insurers administering the Medicare Advantage program an annual payment of one percent for the beneficiary who subscribes. This funding is taken from Medicare Parts A and B treasuries accounts and covers the cost of the Medicare Parts B and A service. It is typically over $1000 a month paid to insurance providers by enrolled beneficiaries to the advantage scheme. The federal government spends over $348 million annually for Part C funding. The program provides plans for a further amount to cover drug costs as well.

Almost 80% of Medicare D spending comes from general revenues. The state pays out 17% in funding from Medicare to dual qualified Medicare and Medicaid beneficiaries who have lower incomes or low incomes. Medicare Part D offers optional benefits that help beneficiaries with Medicare pay prescription drug premiums. Private insurers offer Part-D prescription drug policies in which beneficiaries pay premiums, deductibles, and bundled payments to cover prescriptions.

Each year, the U.S. Congress allocates a percentage of the total amount of SMI Trust funding to avoid funding problems. Contrary to other SMI trust funds, the HI Trust Fund does not earn any annual funding and also reflects a weaker economic condition, namely low wages while rising healthcare expenses or increasing enrollments. Medicare Part A expenditure exceeds Part A revenues thus causing a slow but certain deficit in resources. In 2022, the federal government said a $1 trillion fund was running out by 2026.

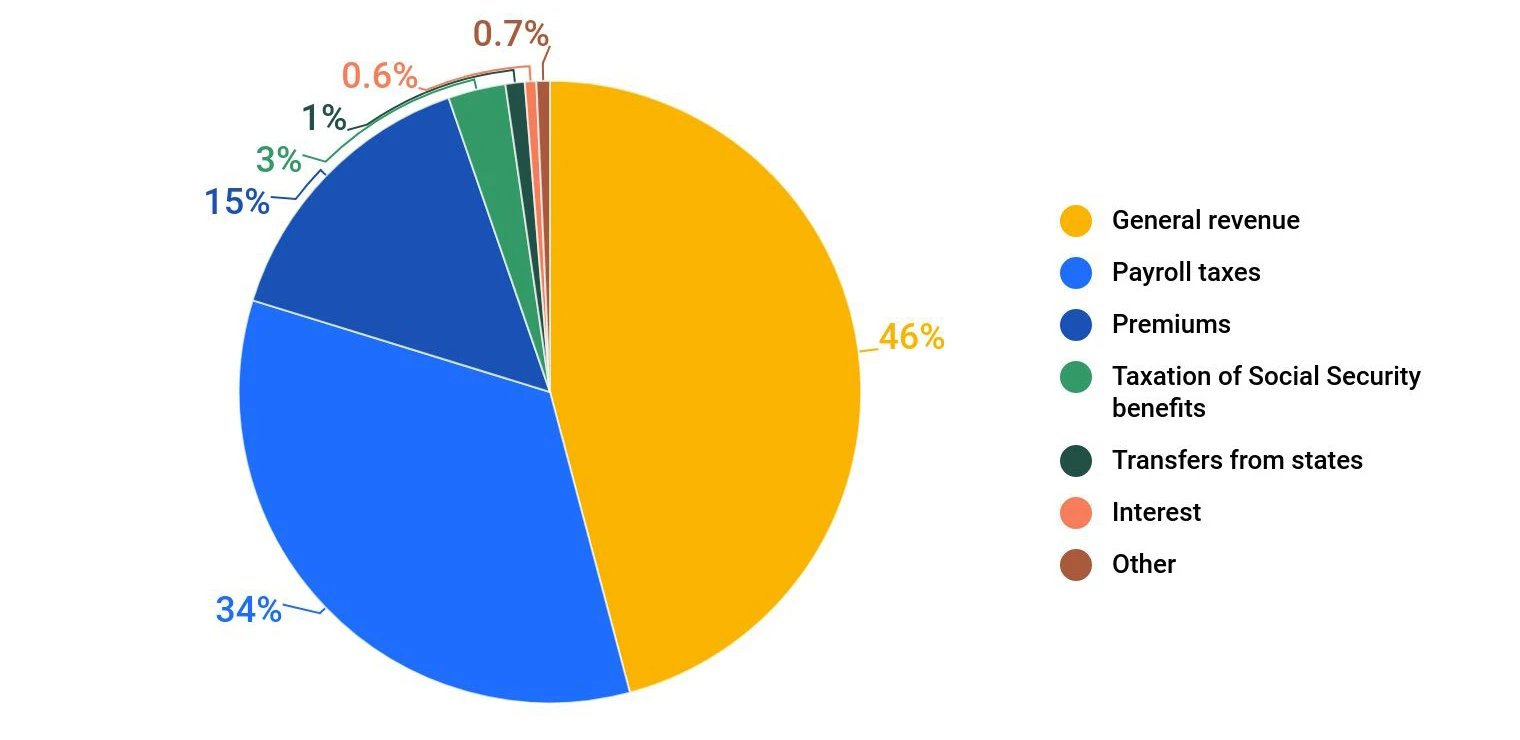

Medicare is supported in various forms: 46% comes from federal government revenues including taxes on income, 34% is Medicare payroll taxes and 15% comes from monthly payments from Medicare beneficiaries. Various funds include taxes on the Social Security benefits and earned interest.

Medicare is an alternative program that serves disparate populations. Medicare is largely funded by government funds. Medicaid provides Medicaid benefits for low-income residents and their families. The project is funded by state funds.

Medicare is a federal initiative and a large portion of Medicare money came by the federal government. The federal government provides an affordable benefits for enrollees in both Medicare and Medicaid.

The federal government is funded through two trust fund schemes that support Medicare Part A and Medicare Part B and D. A trust fund called Hospital Insurance Trust Fund provides money to provide part B services. The other trust fund known as the SMI Trust Fund helps cover Part B and C. Essentially Part A gets funding from the HI Trust Fund, and Medicare Part B and D is provided through SMI trust funds. The SMI trust funds are supported by the following sources to fund Part A.

Medicare Drug Coverage (Part D) Optional benefits for prescription drugs available to all people with Medicare for an additional charge. This coverage is offered by insurance companies and other private companies approved by Medicare.

The Centers for Medicare & Medicaid Services (CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the Department Of Health And Human Services(Hhs).

Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid. programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

If a Medicare beneficiary joins a Medicare Advantage plan, the plan provides part A (hospital insurance) and part B (medical insurance). Many plans offer extra coverage such as dental, hearing, vision, and prescription drug coverage.